Unit 18 The nation and the world economy

How the integration of national economies into a global system of trade and investment provides opportunities for mutual gains and conflicts over the distribution of the gains

- Globalization is a term referring to the integration of the world’s markets in goods and services, as well as flows of investment and people across national boundaries.

- Globalization has led to the prices of goods converging across countries, but much less so of wages.

- Nations tend to specialize in the production of the goods and services in which they are relatively low-cost producers, for example because of economies of scale, an abundance of the relevant resources or skills, or public policies.

- This specialization allows for mutual gains for the people of trading countries.

- Increased trade and specialization may benefit some groups within a country while harming others, for example, those producing goods that compete with imports.

- When evaluating government policy and international agreements, we may look at whether they fully exploit the mutual gains made possible, distribute those gains fairly, and reduce the economic insecurities involved in the globalization process.

In December 1899, the steamship Manila docked in Genoa, Italy, and offloaded her cargo of grain grown in India. The Suez Canal had opened 30 years earlier, slashing the cost of moving agricultural commodities from south Asia to European markets. Italian bakers and shoppers were delighted at the low prices. Italian farmers were not. After a couple of months in Genoa, the Manila headed west. She carried 69 people in steerage (the cheapest possible passage), who were abandoning their homeland in search of a livelihood in the US.

The low prices were made possible by a revolution in transportation and farming technology. As with the opening of the Suez Canal, the expansion of the railway system to the fields of North America, the Russian plain and northern India, and the development of steam-powered ships like the Manila, had cut the cost of transporting grain to distant markets. Across the vast plains of the American midwest, new strains of wheat, newly developed reapers and sowers, and improved drainage technologies had created a hi-tech, capital-intensive form of farming that was as productive as anywhere in the world.

- tariff

- A tax on a good imported into a country.

Across Europe, parliaments and state bodies struggled to adjust to the grain price shock. In France and Germany, farmers and their advocates prevailed. Despite the benefits of lower grain prices to families, and despite the protests of workers who consumed the grain, governments imposed tariffs to protect the incomes of farmers.

Denmark, among other countries, responded differently. Instead of protecting grain farmers from cheap imports, the government helped them to start dairy farming instead. Using cheap imported grain as an input, farmers responded to the incentives to produce milk, cheese, and other commodities that could not be transported cheaply over long distances. In turn, cheaper grain meant families could increase spending on these dairy products.

In Italy, the children of some farmers took up jobs in the booming textile industry, which was exporting to the rest of the world. Many bankrupted farmers made the trip to the US. They slept on the decks of empty freighters that were returning to the US to pick up grain for Europe. About 750,000 Europeans made this voyage each year during the decade after the Manila’s visit to Genoa. Some of their grandchildren would end up as American farmers, growing grain in Kansas.

In the European Union, the Common Agricultural Policy seeks to protect the agricultural sector for member countries. In the US, the most recent legislation supporting the sector is The Agricultural Act of 2014, known as ‘The Farm Bill’.

There were big winners and big losers from the grain price shock. Many of the changes made economic sense. For example, the world’s grain was now grown increasingly in places where it could be produced most efficiently. But tariffs designed to protect the farmers of Germany and France held back this reallocation, preventing owners and workers in other sectors of the economy from enjoying lower grain prices. This continues to this day—rich countries still commonly protect their agricultural sectors through subsidies.

- globalization

- A process by which the economies of the world become increasingly integrated by the freer flow across national boundaries of goods, investment, finance, and to a lesser extent, labour. The term is sometimes applied more broadly to include ideas, culture, and even the spread of epidemic diseases.

- offshoring

- The relocation of part of a firm’s activities outside of the national boundaries in which it operates. It can take place within a multinational company or may involve outsourcing production to other firms.

The battle line was not between rich and poor, or landlords and tenants, or employers and employees. The conflict was between the producers of different commodities. Those involved in manufacturing welcomed the expansion of trade with the US, while those farming grain did not.

Globalization is the word commonly used to describe our increasingly interconnected world. This term refers not only to the trade in grain and migration across national borders illustrated by the Manila, but also to non-economic aspects of international integration, such as the International Criminal Court, the flow of ideas across borders, or our increasingly similar taste in music.

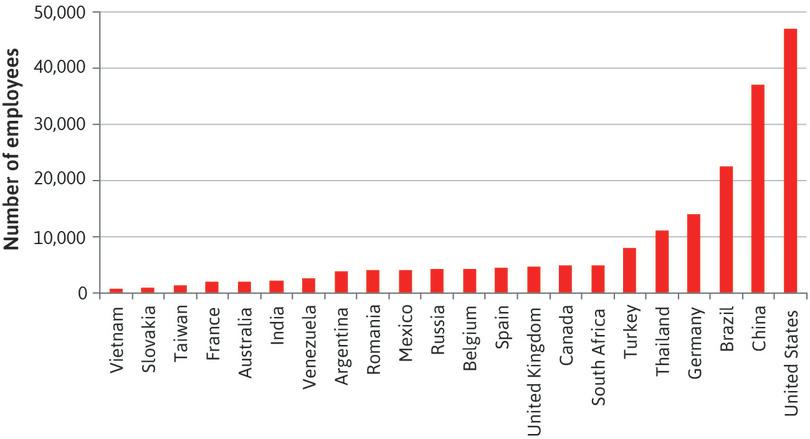

In Unit 6, we looked at firms like Apple that choose to produce their goods in other parts of the world where costs are lower. This offshoring is an important dimension of globalization, and it can involve outsourcing production to other companies, or it can take place within the boundaries of a multinational company. For example, Figure 18.1 shows that the Ford Motor Company operates offices or plants in 22 countries outside the US. The company started offshoring a year after it was founded, first in Canada in 1904, and began manufacturing in many other countries soon afterwards, for example in Australia (1925) and even the Soviet Union (1930). In 2016 this ‘American’ company had 201,000 employees, 144,000 of them located outside the US.

Ford Motor Company.

In the case of a multinational company, owners, managers and employees in many countries have become part of the same unified, transnational structure. This is because the costs of doing business within the company are lower than the costs of doing business with other companies. But, as we saw with the cotton market in Units 8 and 11, globalization not only involves the integration of firms in different countries; it involves the integration of markets themselves, bringing sellers and buyers in different countries closer together.

You have already learned the basic concepts that you need to understand the global economy:

- Exchange involves the possibility of mutual gains and also conflicts over how these gains will be distributed.

- The resulting outcomes may not be Pareto efficient (there may be technically feasible mutual gains that remain unrealized).

- The resulting distribution may seem unfair in the eyes of many.

- Well-designed government policies can improve the efficiency or fairness of the outcomes.

While this is true of any set of market exchanges, when goods, services, people, and financial assets cross national boundaries, governments have additional powers and policies that include:

- Imposition of tariffs: These are taxes on imports that effectively discriminate against goods produced in other countries.

- Immigration policies: Governments regulate the movement of people between nations in a way that would not be possible (or acceptable) within most nations.

- Capital controls: Limits on the ability of individuals or firms to transfer financial assets among countries.

- Monetary policies: They affect the exchange rate, and so alter the relative prices of imported and exported goods.

While national boundaries give governments additional policy tools, they also limit the reach of governments. Within a nation, governments generally succeed in protecting private property rights where these exist, and in enforcing contracts. Because there is no world government (and international agencies are often weak), enforcing contracts and protecting property rights globally is sometimes impossible.

This raises controversial questions about the fairness of the distribution of mutual gains from exchange. The conflicting interests sometimes coincide with national differences between poorer and richer economies. It is tempting, though often inaccurate as we will see, to consider these conflicts as ‘us’ at home versus ‘them’ abroad.

In this unit, we will consider three markets that became more integrated with globalization: international markets for goods and services (trade), international labour markets (migration), and international capital markets (international capital flows, which are flows of savings and investment).

18.1 Globalization and deglobalization in the long run

- merchandise trade

- Trade in tangible products that are physically shipped across borders.

The trade in goods, sometimes called merchandise trade, concerns tangible products that are physically shipped across borders by road, rail, water, or air. Trade of this sort has been happening for millennia, although the nature of the goods traded, and the distances over which they have been shipped, have changed dramatically. Trade in services is a more recent phenomenon, although it has also been occurring for centuries. Services that are commonly traded across borders are tourism, financial services, and legal advice. Many traded services make merchandise trade easier or cheaper—for example, shipping services, or insurance and financial services.

The UK became the leading provider of these services during the nineteenth century, when it was the most advanced industrial economy, the major naval and imperial power, and the most important trading nation. Nowadays, countries also export educational services (for example, people travel from all over the world to study in US or European universities), consulting services, and medical services. India has become a major exporter of software-related services. For example, the ebook for the CORE project was initially developed in Bangalore. We will study these service exports together with merchandise trade, since the same principles can help us to understand them.

How can we measure the extent of globalization in goods and services? One approach would simply be to measure the amount of trade in a country or region, or the world as a whole, over time. If it increased, we conclude that the country, region or the whole world was becoming more globalized. It is common to measure trends in the share of imports, exports, or total trade (imports plus exports) in GDP as an indicator of globalization, so as to take account of the growth of GDP as well as trade.

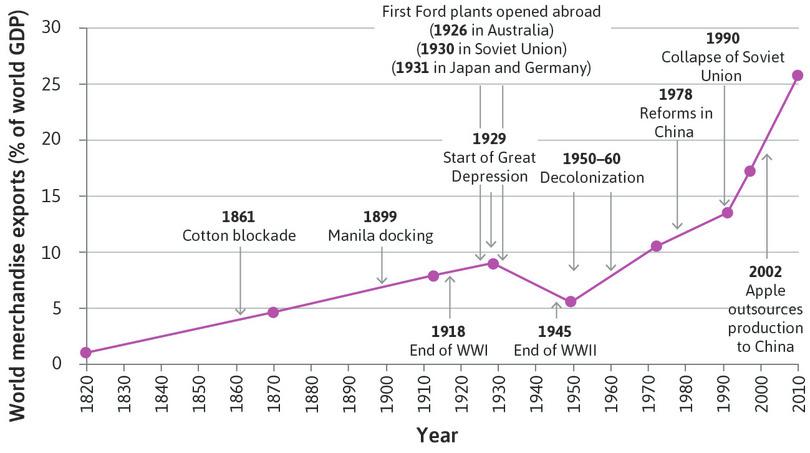

Figure 18.2 shows world merchandise exports (which excludes services), expressed as a share of world GDP, between 1820 and 2011. The share rose by a factor of 8 between 1820 and 1913, from 1% to 8%. In 1950, the share was lower (5.5%) but recovered rapidly during the prosperous postwar period. It reached 10.5% in 1973, 17% in 1998, and 26% in 2011. In the long run, the trend has clearly been upwards, with a sharp acceleration from the 1990s onwards. However, this trend was interrupted between 1914 and 1945, which included two world wars and the Great Depression.

World merchandise exports as a share of world GDP (1820–2011).

Figure 18.2 World merchandise exports as a share of world GDP (1820–2011).

(1) Appendix I in Angus Maddison. 1995. Monitoring the World Economy, 1820–1992. Washington, DC: Development Centre of the Organization for Economic Co-operation and Development; (2) Table F-5 in Angus Maddison. 2001. The World Economy: A Millennial Perspective (Development Centre Studies). Paris: Organization for Economic Co-operation and Development; (3) World Trade Organization. 2013. World Trade Report. Geneva: WTO; (4) International Monetary Fund. 2014. World Economic Outlook Database: October 2014.

- law of one price

- Holds when a good is traded at the same price across all buyers and sellers. If a good were sold at different prices in different places, a trader could buy it cheaply in one place and sell it at a higher price in another. See also: arbitrage.

- price gap

- A difference in the price of a good in the exporting country and the importing country. It includes transportation costs and trade taxes. When global markets are in competitive equilibrium, these differences will be entirely due to trade costs. See also: arbitrage.

A second method is to measure the additional costs associated with exporting goods relative to selling them domestically. When the costs of trading between countries fall, then in economic terms, the world has shrunk. It is as if countries were closer. In Unit 8, you learned about Alfred Marshall and his model of supply and demand. We saw that the law of one price holds in markets with many potential buyers and sellers, where all goods are identical and where buyers and sellers are aware of all trading opportunities. But this assumes that it is costless to take advantage of those trading opportunities. If, on the other hand, trading between markets in two countries is costly because of transport costs, trade barriers, or other factors, then there is no reason to suppose that prices will be the same in both.

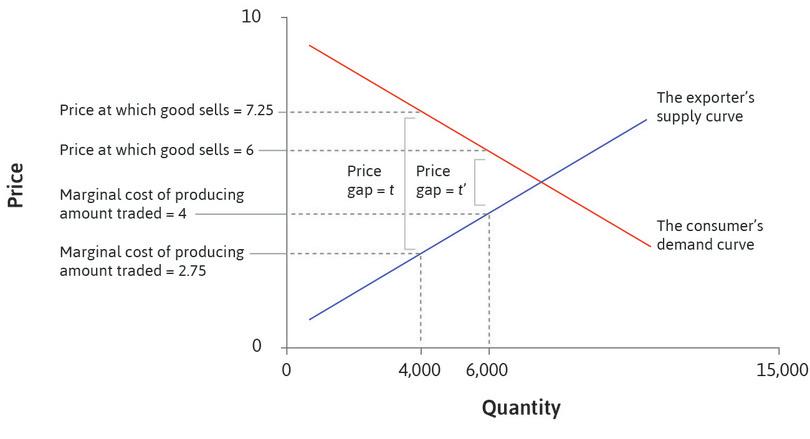

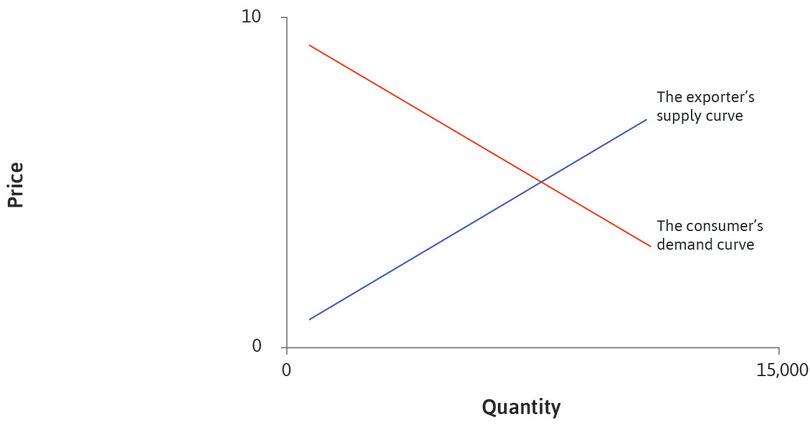

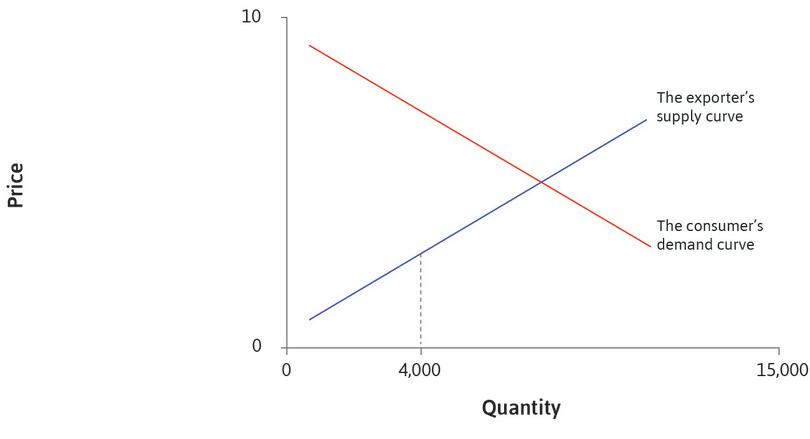

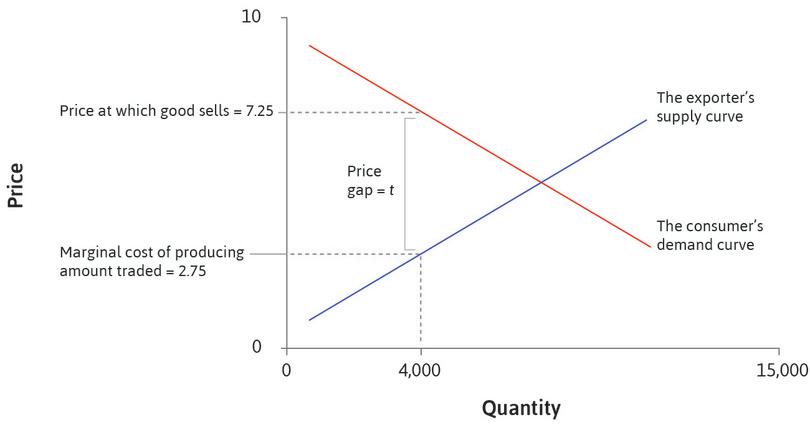

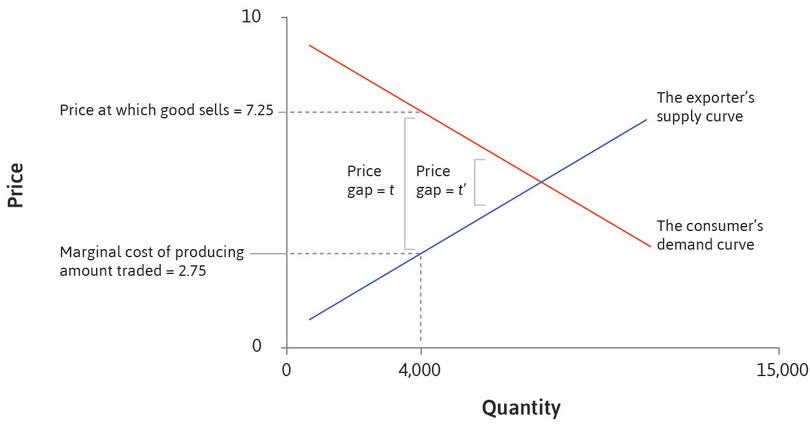

Consider the market for a good that is produced in (and exported from) one country and consumed in (and imported into) another. Let’s use the example of Japan exporting cars to the US. To keep the analysis straightforward, imagine that these are the two only countries in the world, that the Japanese do not consume cars, and that the US does not produce any cars itself. This means that everything that is produced is traded. The blue line in Figure 18.3 represents the supply curve in Japan: it is an upward-sloping function of the price in Japan. The red line represents the demand curve in the US. It is a downward-sloping function of the price in that country.

Let t be the cost of shipping a car from Japan to the US, including all transportation costs, trade taxes and so on. If the market is competitive, then the total cost of obtaining a car in the US will be the cost of buying it in Japan, plus the trade cost t. t is a measure of the price gap between cars in Japan and cars in the US. Follow the analysis in Figure 18.3 to see how changes in trade costs are reflected in price gaps.

- In the right circumstances, globalization can benefit both exporting producers and importing consumers.

- It does so by bringing them closer together, and it leads to an increase in both the supply of exports and the demand for imports.

- arbitrage

- The practice of buying a good at a low price in a market to sell it at a higher price in another. Traders engaging in arbitrage take advantage of the price difference for the same good between two countries or regions. As long as the trade costs are lower than the price gap, they make a profit. See also: price gap.

The concept of arbitrage explains why the price gap should tend to equal the sum of all trade costs. By buying at a low price in export markets and selling at a higher price in import markets, traders can make a profit as long as the price gap is higher than the total costs of trade. When traders engage in arbitrage in this fashion, they lower the supply of the good in the export market, driving up its price, and they increase the supply of the good in the import market, lowering its price. Both of these effects cause the price gap to decline. This should continue until price gaps have been driven down to the trade cost, and further arbitrage is unprofitable. A high price gap reflects a world in which trade is expensive and globalization is limited. A low price gap, on the other hand, reflects a much more globalized world in which trade is cheap.

This means we can learn about globalization from data on prices:

- Globalization should lead to falling import prices: But if we observe falling import prices, this does not necessarily mean that globalization is occurring. The demand for the good in question may simply have declined (or the supply may have increased).

- Globalization should also lead to rising export prices: But rising export prices do not necessarily imply globalization. Demand for the good in question may simply be rising (or the supply may have declined).

- Declining price gaps between importing and exporting countries are a much surer sign of globalization: This is particularly true if we can also observe rising trade volumes.

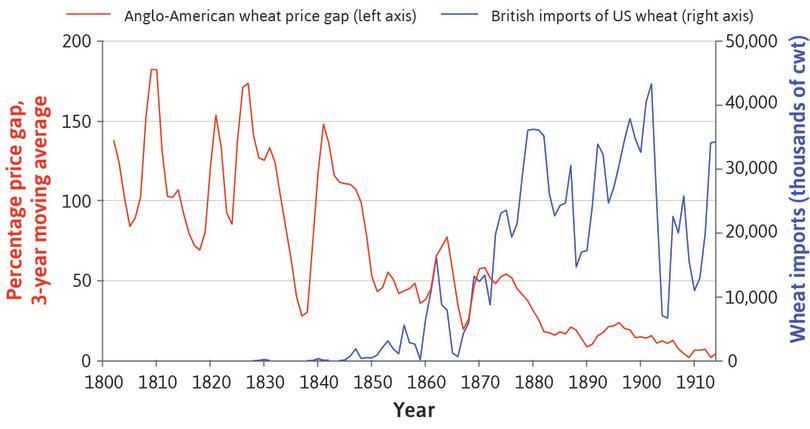

For example, Figure 18.4 shows unmistakable evidence of declining transatlantic trade costs during the nineteenth century. The wheat price gap between the UK and the US (expressed as a percentage) fluctuated wildly before 1840 or so, around a roughly constant trend. It then started to decline at about the same time that shipping costs started to fall, a result of the introduction of steamships on long-distance routes. The price gap had almost vanished by 1914. At the same time, the volume of wheat shipped across the Atlantic rose dramatically.

Figure 3 in Kevin H. O’Rourke and Jeffrey G. Williamson. 2005. ‘From Malthus to Ohlin: Trade, Industrialization and distribution since 1500’. Journal of Economic Growth 10 (1) (March): pp. 5–34.

The transatlantic trade in wheat is not an isolated example. International price gaps fell sharply on many routes and for many commodities between 1815 and 1914, the first epoch of modern globalization.

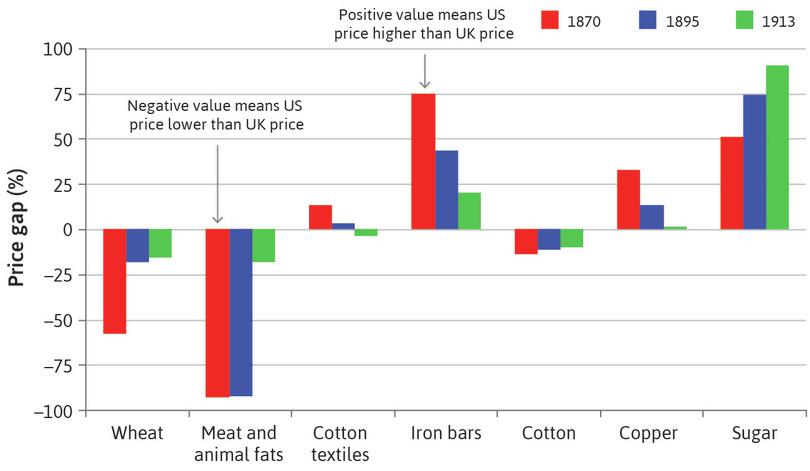

Figure 18.5 gives ‘American-Anglo’ price gaps (the reverse of Figure 18.4) for a variety of commodities between 1870 and 1913. For agricultural commodities such as wheat and animal products, British prices were higher than American ones, so the price gaps are the percentage by which the British price exceeded the American price. In the case of industrial commodities such as cotton textiles or iron bars, American prices were higher than British ones, so the price gaps quoted are the percentage by which prices in Boston or Philadelphia exceeded prices in Manchester or London. In nearly all cases price gaps fell (sugar is the outstanding exception), indicating that transatlantic commodity markets were becoming better integrated. Much like the dramatic reduction in grain prices in Genoa after the opening of the Suez Canal, which we discussed in the introduction to this unit, price gaps between the US and the UK reduced over time because of a revolution in transportation and improvements in farming and production technology. This is hardly an isolated example. There exists evidence of similar convergence for Liverpool-Bombay cotton, London-Calcutta jute, and London-Rangoon rice prices.

Commodity price gaps between the US and UK (1870–1913).

Figure 18.5 Commodity price gaps between the US and UK (1870–1913).

Table 2 in Kevin O’Rourke and Jeffrey G. Williamson. 1994. ‘Late Nineteenth-Century Anglo-American Factor-Price Convergence: Were Heckscher and Ohlin Right?’ The Journal of Economic History 54 (04) (December): pp. 892–916.

Railways were probably even more important than steamships in integrating global commodity markets. Without them, it would have been prohibitively expensive to ship grain and other goods to and from the interior of continents and coastal seaports. Where price gaps fell less sharply during the late nineteenth century, this was often because of tariffs—taxes on imports—which were rising in several countries for reasons that we will discuss later, and which counteracted the effects of declining transport costs.

- protectionist policy

- Measures taken by a government to limit trade; in particular, to reduce the amount of imports in the economy. These are designed to protect local industries from external competition. They can take different forms, such as taxes on imported goods or import quotas.

- quota

- A limit imposed by the government on the volume of imports allowed to enter the economy during a specific period of time.

Transatlantic shipments of wheat fell after 1914, and price gaps rose, suggesting a rise in trade costs and therefore deglobalization. International price gaps rose during the interwar period for many agricultural commodities, because governments raised tariffs in response to unemployment and economic insecurity. When a country undertakes protectionist policies, its government is taking steps to limit trade, in particular by reducing the amount of imports coming into the economy. This is often done to protect domestic industries against foreign competition (hence protectionism), but it also means consumers have to pay more for imports. Protectionist measures include taxes to raise the domestic price of imports (a tariff) and quantitative restrictions on imports (a quota).

The post-1945 period was one of ‘reglobalization’, which began slowly but then accelerated, especially after 1990. Agricultural markets were largely protected for much of the period, and there is no reason to suppose that international price gaps for agricultural commodities fell sharply. The markets for industrial goods and components, on the other hand, were liberalized, and several studies have found evidence of declining international price gaps in the late twentieth century.

Economists have measured trade costs indirectly, by looking at trade between pairs of countries. This shows the long-term changes in impediments to trade, and can separate the effects of distance between the countries from national policies of those countries. If trade between Germany and France, for example, increased from one year to the next, but it did not increase between these two countries and their other trading partners at the same time, we can interpret this as an indirect measure of declining trade costs for this pair of countries.

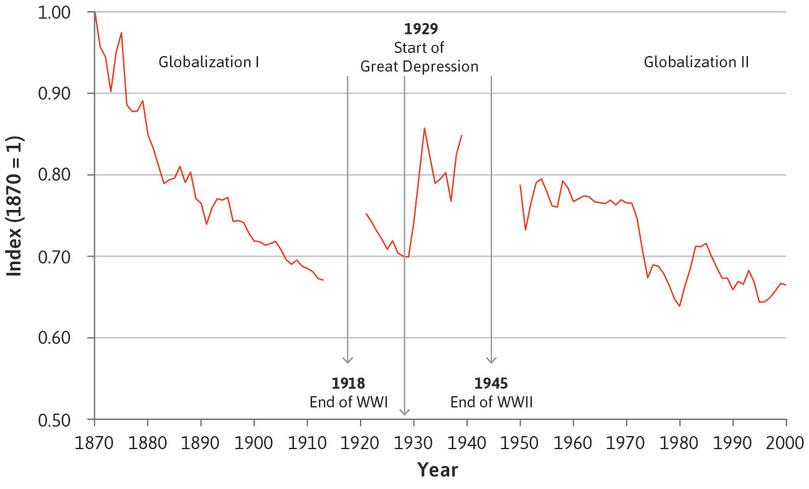

If we sum total trade costs each year for all major economies, we have an indicator of the process of globalization. Figures 18.6 and 18.7 do this for the period 1870 to 2000.

David S. Jacks, Christopher M. Meissner, and Dennis Novy. 2011. ‘Trade Booms, Trade Busts, and Trade Costs’. Journal of International Economics 83 (2) (March): pp. 185–201. Note: Presented as an index, with 1870 = 1.

Trade costs declined substantially from 1870 to 1913, reflecting declining transport costs and reductions in tariffs. Trade costs then rose in the interwar period because of rising tariffs. This was particularly the case following the onset of the Great Depression in 1929: countries attempted to solve unemployment problems by discouraging imports.

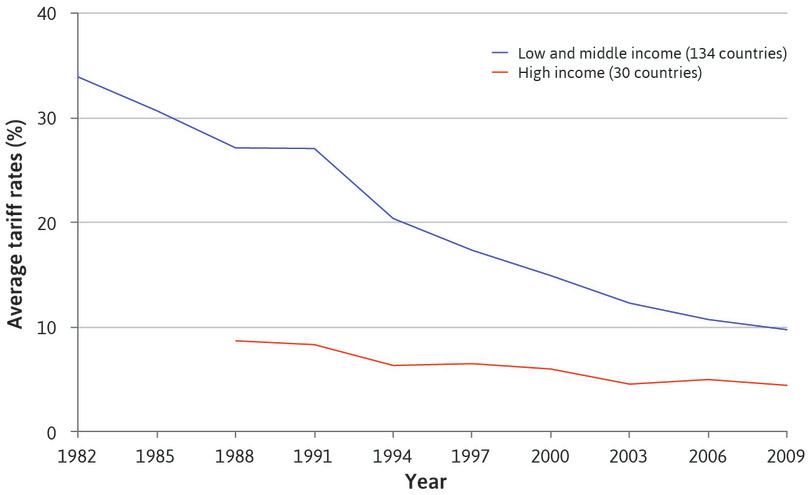

From 1970, trade costs started to fall worldwide again as countries began to reliberalize trade, and transport technologies improved. Tariffs tend to be higher in low-income countries than in rich countries, in part because alternative methods of raising government revenue such as the income tax are difficult to administer in developing countries. As Figure 18.7 shows, however, most countries have reduced their tariffs in recent decades.

- Globalization I and II

- Two separate periods of increasing global economic integration: the first extended from before 1870 until the outbreak of the First World War in 1914, and the second extended from the end of the Second World War into the twenty-first century. See also: globalization.

The price evidence therefore suggests interrupted commodity market integration over the past 150 years. Nineteenth century integration was briefly reversed, followed by reintegration after the Second World War. We call these two periods of integration Globalization I and Globalization II.

The World Bank. 2011. ‘Data on Trade and Import Barriers’. Note: 3-year centred moving average.

Exercise 18.1 Price gaps that did and didn’t fall

Figure 18.5 shows the price gap of different commodities between the US and UK over time. Can you think of a reason why price gaps for meat and animal fats such as butter did not start to fall until 1895? Propose an explanation for the smaller price gaps and the more rapid fall for copper as compared with iron ore. What might account for the increase in the price gap for sugar?

Exercise 18.2 Learning more about tariffs

Download the World Bank data set, ‘Trends in average MFN applied tariff rates in developing and industrial countries, 1981–2010’. This data was used to produce Figure 18.7.

- Choose one country from each income category (code 1 to 4) and plot the evolution of tariffs in these four countries. Use your plots to describe how tariffs in your chosen countries have changed over time.

- Evidence from other studies suggests that on average, tariffs tend to be higher in lower-income countries than in high-income countries, but that most countries have reduced tariffs substantially in recent decades. Do your plots support this claim? Suggest an explanation for some of the observed differences between your chosen countries (if any). (As a starting point you may want to consider your chosen countries’ membership of global trade agreements such as GATT/WTO or the EU, and also whether the country has followed the structural adjustment programs of the IMF).

Question 18.1 Choose the correct answer(s)

Figure 18.3 depicts the supply curve in the exporting country and the demand curve in the importing country in a market for a traded good. Assume that the good is produced exclusively in the exporting country and consumed exclusively in the importing country.

Based on this information, which of the following statements is correct?

- The price received by the producers is the price paid minus the trade costs. At quantity 4,000, this is 2.75.

- The price paid by the consumers at quantity 6,000 is 6.

- Due to arbitrage, the price difference must represent trade costs.

- The causality is the other way round. If the trade costs were 2, the quantity traded would be 6,000.

Question 18.2 Choose the correct answer(s)

Figure 18.6 is a graph of an index that represents trade costs. A higher index represents higher trade costs and less globalization. Based on this information, which of the following statements are correct?

- There is a period between the two World Wars when the trade costs seem to have increased.

- After 1929 countries sought to protect their economies by placing tariffs on imports.

- There is a downward trend in the impediments to trade index after the Second World War.

- We see an overall downward trend in trade costs, with the notable exception of the interwar period.

18.2 Globalization and investment

As in commodity markets, in international capital markets there is a similar pattern of nineteenth century globalization, followed by a brief episode of interwar deglobalization, and late twentieth century reglobalization.

If countries existed in isolation, they would have to finance their investment needs using their own savings. If this were the case, they could not spend more than they earned in a year, and all their income would have to be spent domestically. Domestic expenditure would have to equal domestic income. In reality, we see lending and borrowing across borders, between individuals, financial institutions, companies, and governments. To keep the language simple, let’s talk about countries lending to or borrowing from other countries, bearing in mind the fact that these countries are not actors themselves but are made up of many individuals, companies, and institutions. A country can spend more than it earns by borrowing from abroad. Similarly a country can decide not to use its savings to finance domestic investment, and instead lend it abroad and earn a return on these foreign loans. In this case, its savings will exceed domestic investment, or (equivalently) its income will be higher than its expenditure.

Balance of payments account (BP)

Records all payment transactions between the home country and the rest of the world and is divided into two parts: the current account and the capital and financial account.

If there is a current account surplus, this is a source of foreign exchange and it is either used to purchase foreign assets such as factories (FDI) or financial assets (recorded as a private net capital outflow) or it adds to the home country’s official foreign exchange reserves. As a consequence, the home country’s wealth rises. The opposite is the case for a current account deficit.

We use the balance of payments accounts to track lending and borrowing abroad. We first need to explain how lending and borrowing abroad is related to international trade in goods and services. This is because imports represent payments from the domestic economy to the rest of the world, while exports represent payments from the rest of the world to the domestic economy. The balance of payments records the sources and uses of foreign exchange. If the records of transactions were complete, the balance would sum to zero because the source and use of each dollar crossing an international border could be accounted for (in reality, an entry called ‘errors and omissions’ is added to the balance of payments accounts to make it sum to zero).

To see how the balance of payments accounts work, think first about an economy where the only international payments are due to trade. If the home country imports more than it exports, then its residents are making more international payments than they are receiving. For example, a country buying a higher value of imports from the US than it receives from selling its exports to the US needs to get hold of the US dollars—by borrowing from the US or the rest of the world—to cover the difference.

Conversely, if the home country is exporting more than it is importing, then its nationals must be lending to their trading partners so they can pay for the exports. These loans are a use of foreign exchange for the home country, and a source of foreign exchange for its trade partners.

Thus a trade deficit will imply that the country is borrowing, while a trade surplus implies it is lending (which is equivalent to saving, as we saw in Unit 10).

- foreign portfolio investment

- The acquisition of bonds or shares in a foreign country where the holdings of the foreign assets are not sufficiently great to give the owner substantial control over the owned entity. Foreign direct investment (FDI), by contrast, entails ownership and substantial control over the owned assets. See also: foreign direct investment.

- foreign direct investment (FDI)

- Ownership and substantial control over assets in a foreign country. See also: foreign portfolio investment.

There are other reasons that people in one country make payments to people in another. The most important is the purchase of assets in another country. If a US company purchases shares in a company in China, it is making a payment for a Chinese asset. This implies a payment from the US to China. This is a use of foreign exchange called foreign portfolio investment. Similarly, if a US company purchases a factory in China, this is a use of foreign exchange called foreign direct investment (FDI).

- remittances

- Money sent home by international migrant workers to their families or others in the migrants’ home country. In countries which either supply or receive large numbers of migrant workers, this is an important international capital flow.

In subsequent years, however, the US company will receive dividends from its portfolio investment or profits from its direct investment, which will be sent back (‘repatriated’) to the US company. These repatriated profits are payments from China to the US. They are recorded in the US balance of payments as a source of foreign exchange.

Other important international payments include money sent home by migrant workers to their families (called remittances) and official aid flows, mostly from the governments of rich to poor countries.

Current account (CA)

The sum of all payments made to a country minus all payments made by the country.

Since the current account includes all international payments, it also tells us directly whether a country is borrowing or lending:

- CA deficit: This means the country is borrowing—it has to do so to cover the excess payments it is making to the rest of the world.

- CA surplus: This means the country is lending (saving) to allow other countries to send it the excess payments.

All of these international payments are tracked in the balance of payments accounts, and the net value of these payments is called the current account (CA)—so the CA is the sum of all payments made to a country minus all payments made by the country. A country might have a trade deficit—that is, import more than it is exporting—but still have a current account surplus if it is receiving more than enough income from its foreign investments, remittances or foreign aid to pay the difference. In this case it will not need to borrow. For simplicity we ignore remittances and international aid and assume that the current account is equal to exports (X) minus imports (M) plus net earnings from assets owned abroad.

- current account deficit

- The excess of the value of a country’s imports over the combined value of its exports plus its net earnings from assets abroad. See also: current account, current account surplus.

- current account surplus

- The excess of the combined value of its exports and net earnings from assets abroad over the value of its imports. See also: current account, current account deficit.

- net capital flows

- The borrowing and lending tracked by the current account. See also: current account, current account deficit, current account surplus.

The borrowing and lending tracked by the current account are known as net capital flows. In this context, capital refers to money that is being lent and borrowed, rather than capital goods. A country that is borrowing (has a CA deficit) is receiving net capital flows—it is borrowing cash in order to cover its CA deficit. This cash will have to be paid back in the future, so capital inflows also represent rising foreign debt for the country. If the borrowed money is used for productive investments though, the investment can help generate the income needed to repay the debt. Thus, when a country wants to invest more than it can afford using its own savings, borrowing from abroad can be used to finance the extra investment.

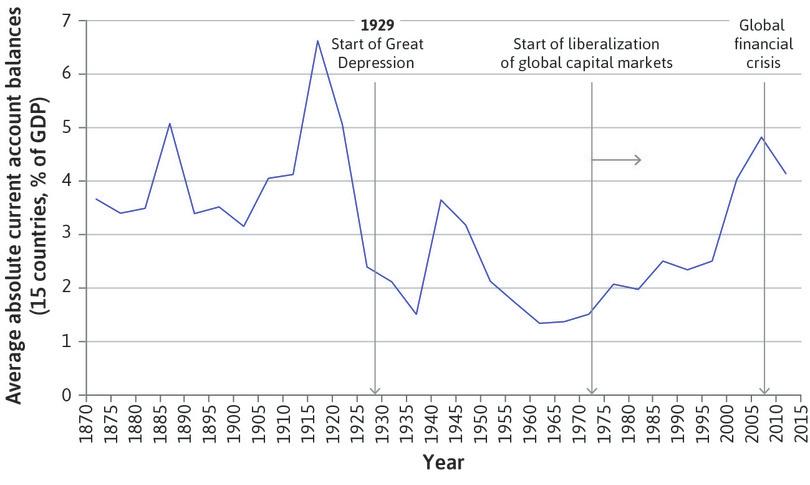

Historically, increased trade tends to lead to larger CA imbalances. That is, when countries trade more, they also tend to borrow and lend more. The measure shown in Figure 18.8 is the sum of the absolute values of the current account balances of 15 countries from 1870 to 2014. We add up the absolute value of the current accounts to capture both borrowing and lending across countries.

(1) Figure 2.2 from Maurice Obstfeld and Alan M. Taylor. 2005. Global Capital Markets: Integration, Crisis, and Growth (Japan–US Center UFJ Bank Monographs on International Financial Markets). Cambridge: Cambridge University Press; (2) International Monetary Fund. 2014. World Economic Outlook Database: October 2014. Note: The data shown in the figure is the average absolute current account balance (as a percentage of GDP) for 15 countries in five-year blocks (from 1870–74 through to 2010–14). The countries in the sample are Argentina, Australia, Canada, Denmark, Finland, France, Germany, Italy, Japan, Netherlands, Norway, Spain, Sweden, UK, US. Data for 2014 is an IMF estimate.

As with commodity trade (Figure 18.6), the volume of capital flows in Figure 18.8 reflects a pattern of interrupted globalization. During the late nineteenth century there were huge capital flows from northwest Europe where there were current account surpluses—the UK especially, but also France and Germany—which financed investment in railways and infrastructure in countries such as Argentina, Australia, Canada, and the US. These were all countries with abundant and underexploited natural resources, especially land, but railways had to be extended into the interior in order to exploit these resources, and the land had to be settled with immigrants. In Europe, the countries that succeeded in attracting foreign investment during this period, such as Russia and Sweden, were also relatively resource-abundant. The investments made a healthy return, since they increased the productive capacity of the borrowing countries, who were able to pay back the loans with interest based on the increased incomes that they enjoyed as a result.

In the interwar period these capital flows fell sharply—especially after the beginning of the Great Depression in 1929, which had led many countries to impose strict limits on the movement of capital across frontiers. These limits on capital flows meant that countries had to keep their current account deficits and surpluses relatively low— they prevented the capital inflows that would be required to finance large current account deficits. Unlike international trade, which resumed growth soon after the end of the Second World War, capital controls persisted for longer and only started to be relaxed in the 1970s and 1980s. Since then capital flows have increased sharply, although not yet to their dizzying heights of the early twentieth century.

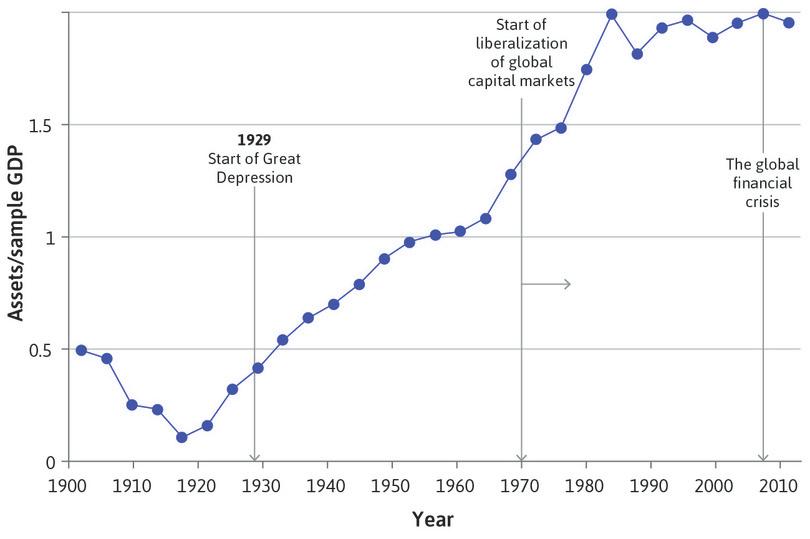

Figure 18.9 shows how international asset holdings evolved during the twentieth century. The pattern is U-shaped. For the rich countries that dominated international lending, the share of foreign assets divided by GDP was high in the early part of the century, but collapsed in the 1930s. After 1945, New York took over from London as the global financial centre and the US eclipsed Britain as the dominant international asset holder.

(1) Figure 2.2 from Maurice Obstfeld and Alan M. Taylor. 2005. Global Capital Markets: Integration, Crisis, and Growth (Japan-US Center UFJ Bank Monographs on International Financial Markets). Cambridge: Cambridge University Press; (2) Lane, Philip R., and Gian-Maria Milesi-Ferretti. 2007.‘Europe and Global Imbalances’. IMF Working Papers 07 (144). The series shows the ratio of international assets to the GDP of the sample of countries in each year.

To measure price gaps in international capital markets, we need prices of identical financial assets in different countries. Where researchers have been able to locate such prices, they have found that the late nineteenth century saw significant globalization in capital flows.

For most of the nineteenth century, if a would-be arbitrageur in New York (or London) wished to act on a price gap between New York and London, the speed at which information travelled limited his opportunities (we tracked the speed at which information travelled over the past 1,000 years in Unit 1). Information about price gaps travelled on ships that crossed the Atlantic. By the time the arbitrageur learned of the price gap, the information was already several days out of date. To act on it, he had to send written instructions to his agent in the other city to buy or sell. These instructions travelled by ship too. It took a large price gap, therefore, to create speculation, since prices may have changed by the time the orders made it across the Atlantic.

In 1866, investors in London and New York (and their agents) could, for the first time, communicate with each other on the same day. They were using the first transatlantic telegraph cable, running from Ireland to Newfoundland in Canada. Once the cable was installed, investors could act immediately when they heard of a potential arbitrage opportunity, and price gaps immediately collapsed.

In most countries, residents and companies do the majority of investment. One dimension of globalization is the foreign direct investment (FDI) mentioned earlier by companies abroad, including subsidiaries. Unlike the use of savings to buy foreign bonds or shares in a foreign company (portfolio investment), the intention of FDI is to exercise control over the use of resources in the foreign company.

Figure 18.10 shows the destination of investments by US companies when they invested directly in other companies abroad between 2001 and 2012. Perhaps surprisingly, when US firms chose to produce outside the US, they mostly went to countries in Europe; and in Europe, largely to countries in which wages were higher than in the US. The Netherlands, Germany, and the UK alone received more US investment than Asia and Africa combined. In this respect the location of Ford plants around the world shown in Figure 18.1 is not typical, because Ford has far more employees in China, Brazil, Thailand, and South Africa combined than in Germany, UK, Canada, Belgium, and France combined.

Foreign direct investment: Investment by US firms in other countries according to whether wages are lower or higher than in the US (2001–2012).

Figure 18.10 Foreign direct investment: Investment by US firms in other countries according to whether wages are lower or higher than in the US (2001–2012).

United Nations Conference on Trade and Development. 2014. Bilateral FDI Statistics. Note: Data is for US FDI flows abroad. The countries shown to have manufacturing wages higher than the US are those that are classified by the US BLS International Labor Comparisons as having higher hourly compensation in manufacturing than the US on average over the 2005–09 period.

Exercise 18.3 International capital flows: Does capital flow from richer to poorer countries?

- China has enjoyed a period of rapid development over recent decades. Using data from FRED, plot China’s current account balance over the period 1998–2012, and describe how it has evolved since the late 1990s (Hint: search for ‘total current account balance for China’). Make sure to highlight whether it is a CA surplus or deficit.

- On the same graph, plot the current account balance of the US over the same time period, and compare it with China’s current account balance (you can also find the data for the US at FRED by searching for ‘total current account balance for United States’).

- What does your graph suggest about capital flows between richer and poorer countries? Read the 2007 article ‘The paradox of capital’ by Eswar Prasad, Raghuram Rajan and Arvind Subramanian, who are IMF economists. Explain what is meant by ‘capital flowing uphill’ and whether or not it is a paradox.

- Look at Figure 18.8 and note that international capital flows (as measured by average absolute current account balances as a proportion of GDP) in the first decades of the twenty-first century are similar to those of the late nineteenth century. Using the discussion of capital flows in this section and in the article from question 3, was capital ‘flowing uphill’ during Globalization I or Globalization II? Why, or why not?

Question 18.3 Choose the correct answer(s)

Which of the following statements regarding current accounts is correct, ceteris paribus?

- An increase in the trade surplus means a larger export–import gap. The country would then be receiving more international payments, resulting in an increase in its current account.

- A country with historically high FDI may have high dividend receipts from these investments. Given a zero trade balance, when the net investment earnings are positive the current account would be in surplus.

- Remittance is where migrant nationals send money back to their families at home. This would increase the home country’s current account.

- Aid money sent abroad directly reduces a country’s current account. In the longer run however, it may help stimulate new export markets.

18.3 Globalization and migration

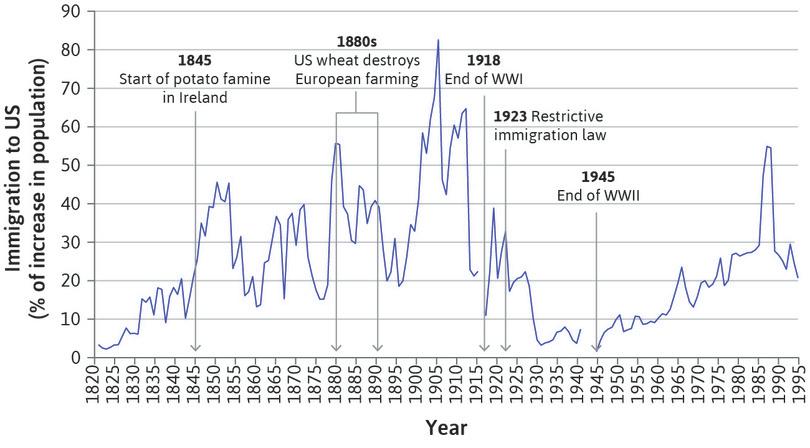

In the late nineteenth century, declining transport costs and rising wages made passage to America affordable for millions. Since then, labour migration is probably the dimension of globalization along which international economic integration has advanced the least. Indeed, labour into and out of some countries is less mobile internationally today than it was in 1913. Figure 18.11 plots immigration into the US as a percentage of the increase in the US population. During the late nineteenth and early twentieth century immigrants accounted for more than half of the increase in the US population, their numbers more than equalling the number of births minus the number of deaths. Restrictive legislation curbed immigration between the world wars. Although the contribution of immigrants to the growth in population has been rising again since the Second World War, it has not matched the growth before 1914. The low figures from the mid-1940s to the 1970s can in part also be explained by the relatively high birth rate in the US over this period.

Immigration into the US as a percentage of the change in US population (1820–1998).

Figure 18.11 Immigration into the US as a percentage of the change in US population (1820–1998).

Susan B. Carter, Michael R. Haines, Richard Sutch, and Scott Sigmund Gartner (editors). 2006. Historical Statistics of the United States: Earliest Times to the Present. New York: Cambridge University Press.

There were relatively few institutional barriers to immigration in the late nineteenth century. Today, migrants without appropriate documentation may be deported or imprisoned. This meant that when Europe was experiencing its population boom, as death rates fell sharply and birth rates fell only with a lag, it was able to ship its surplus population to what the fifteenth-century explorer Amerigo Vespucci had named the ‘New World’ in America. Today’s lower-income countries are not so fortunate. Immigration barriers were already in place during the late nineteenth century, but they became much stricter during and after the First World War, and rich countries retain strict immigration barriers to this day.

Thus the movement of goods and finance between countries is easier, and greater in magnitude, than the movement of people. Sending your money or your goods to some distant economy is much easier than sending yourself. You might have to learn an entirely new language or culture, not to mention leaving behind family and your home community. This is one reason why, for labour, there is nothing equivalent to the reduction in price gaps for goods that we discussed above. There is no tendency of wages in different countries around the world to become more similar.

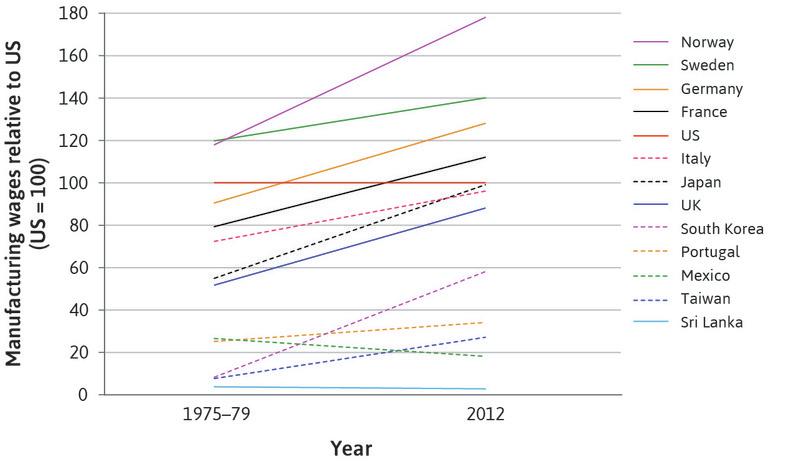

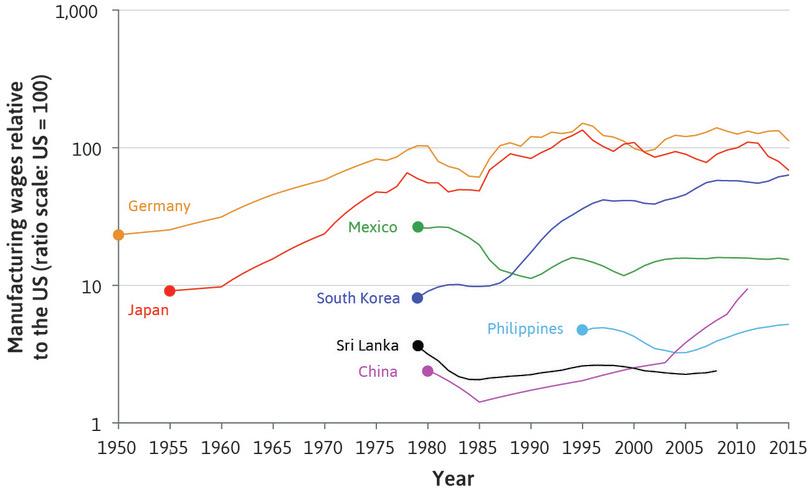

Figure 18.12 shows the trends in wages paid to manufacturing workers expressed as a ratio of the wages of US manufacturing workers. It indicates, for example, that in the late 1970s, workers in Finland were paid 80% of the wage of US workers but, by 2012, they were paid more than 20% more.

Manufacturing wages relative to the US (1975–79 and 2012).

Figure 18.12 Manufacturing wages relative to the US (1975–79 and 2012).

US Bureau of Labor Statistics. 2015. International Labor Comparisons. Note: (1) Data is for hourly compensation costs in manufacturing, which includes total hourly direct pay (pre-tax), employer social insurance expenditures, and labour-related taxes. National currency data converted into US dollars at the average daily exchange rate for the reference year; (2) Graph of Sri Lanka shows most recent available data, for the year 2008.

There are three developments that we can see in Figure 18.12:

- Like France, many other European countries caught up with the US in manufacturing wages, in some cases surpassing them by more than 40% (Norway and Sweden).

- Wages in South Korea and Japan rapidly converged towards the US wage level.

- A number of low-wage countries (for example, Sri Lanka) remained far behind, some falling even further behind (Mexico).

In conclusion, there was a dramatic increase in the integration of the world economy during the nineteenth century, which was marked by increasing volumes of trade and corresponding reduction in price gaps, as well as the movement of capital. This was followed by a brief period of deglobalization during the Great Depression and the Second World War, and renewed globalization afterwards, especially since the 1990s. These three waves of globalization, deglobalization, and reglobalization are equivalent to those in Figure 18.4.

Trade costs and barriers to the mobility of capital and labour fell in the nineteenth century, largely as a result of steam-driven transportation technologies. They rose again in the interwar period, largely due to government intervention—taxes and other barriers to trade, capital controls and immigration restrictions—and fell again in the late twentieth century, as a result of more liberal policies and technological change. National boundaries, however, have continued to be important barriers to the global integration of labour markets.

Question 18.4 Choose the correct answer(s)

Figure 18.11 depicts the level of immigration into the US as a percentage of the change in the US population.

Based on this information, which of the following statements is correct?

- Since immigration accounted for over half the increase in US population, the number of new immigrants must have exceeded the difference between births and deaths.

- There was a sharp rise in the immigration level for a short period after the First World War. Even if this were not the case, remember that we must be cautious before inferring causality from a time series graph such as this—many other factors influence the level of migration.

- Since the restrictive immigration law in 1923, the level of immigration has not recovered to the levels seen before it, suggesting that national boundaries continue to be barriers to the global integration of labour markets.

- With restricted migration, this is not true. Whilst wages in the manufacturing sector in many European countries, as well as Japan, have converged (and in many cases overtaken) the level in the US since 1975, wages in Mexico have actually fallen relative to the US.

18.4 Specialization and the gains from trade among nations

The result of this process of global economic integration means that today virtually all nations are part of a global economy characterized by:

- Specialization: Particular locations specialize in the production of distinct goods.

- International trade: These goods are then exchanged with other locations specializing in other goods.

- specialization

- This takes place when a country or some other entity produces a more narrow range of goods and services than it consumes, acquiring the goods and services that it does not produce by trade.

Specialization entails trade because by producing a narrower range of goods and services than you use, you must engage in trade to acquire the ones you do not produce. International trade is the outcome of specialization among countries.

Machine tools (such as precision-cutting tools) produced in southern Germany are used in the production of computers in coastal south China running software produced in Bangalore and California. These are then flown on aircraft produced near Seattle in the US to be sold to users throughout the world. Producers of these commodities put food on their table grown in the Canada or Ukraine and wear shirts made in Mauritius.

As these examples show, trade and specialization are two sides of the same process. Each provides the conditions necessary for the other. In the absence of trade, machine tool workers in Stuttgart could not eat bread made from grain grown in Ukraine or Canada and wear clothes made in Mauritius. If they had to provide for themselves, many of them would be farmers or clothing workers. In the absence of specialization, there would be little to trade.

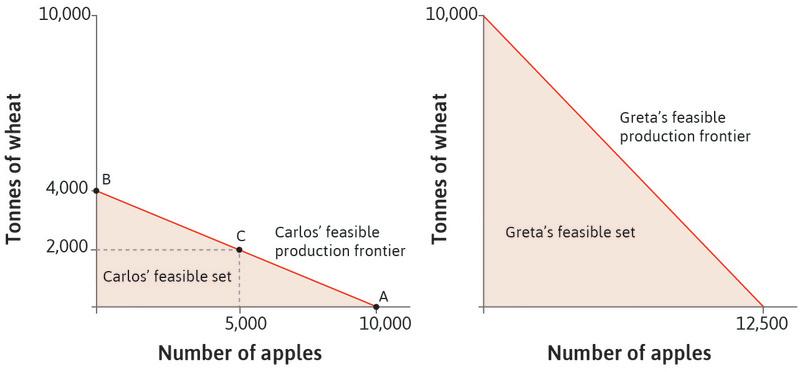

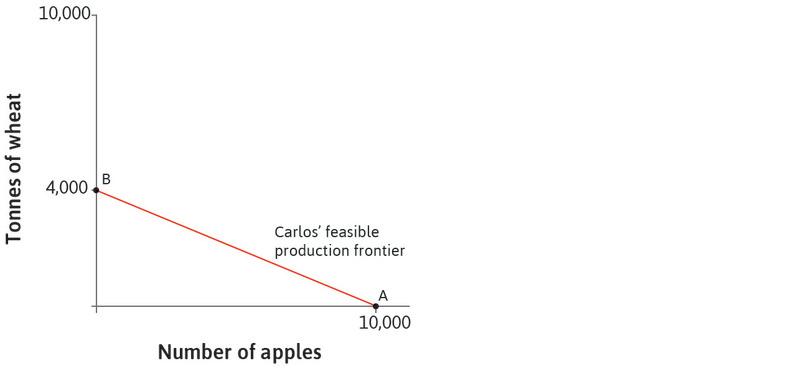

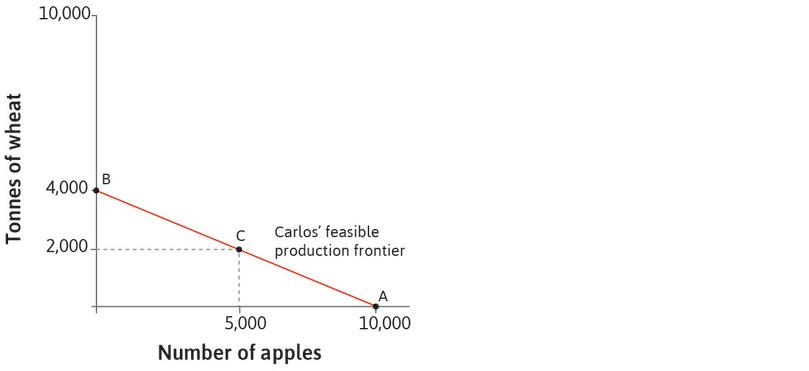

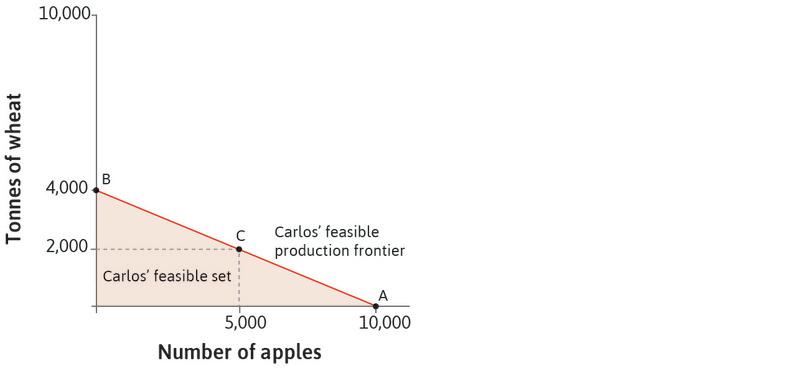

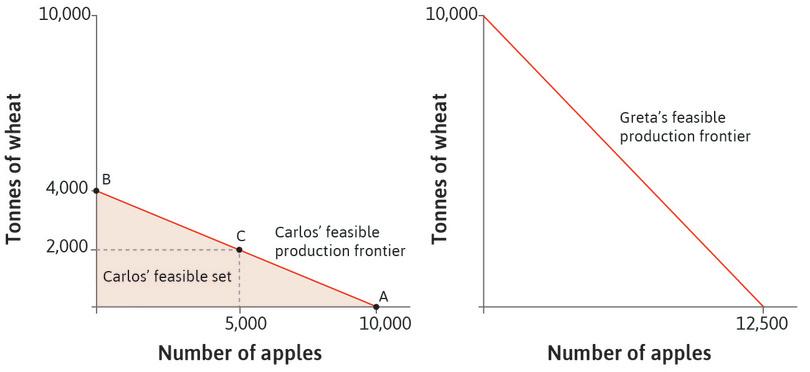

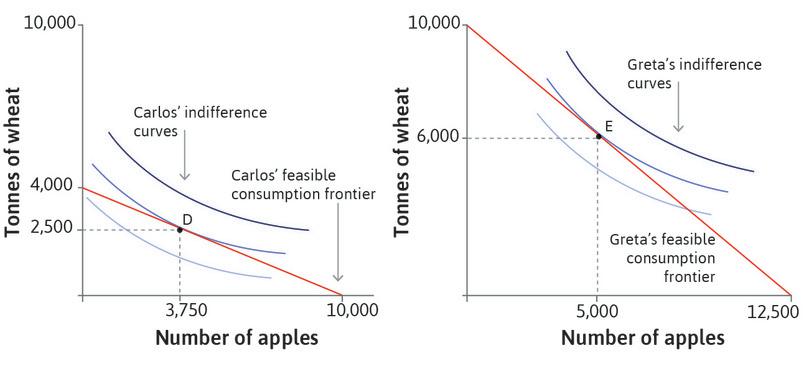

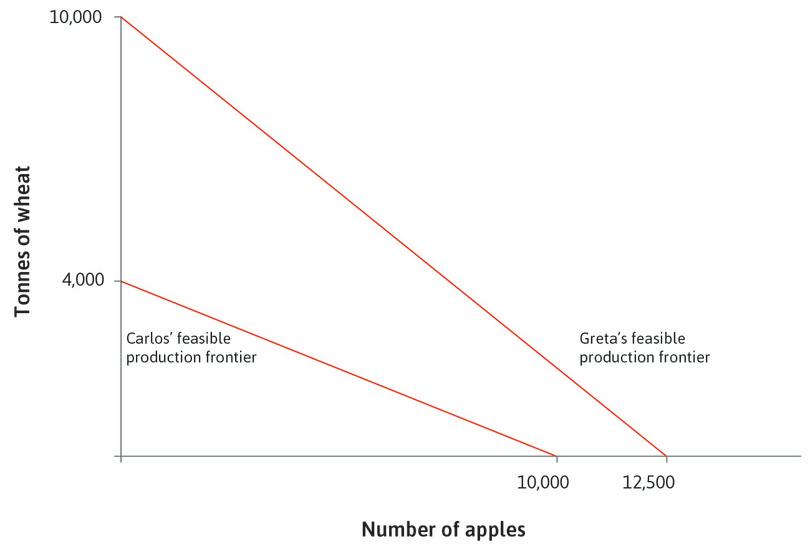

In Section 1.8, you met Greta and Carlos, who each wanted to consume both apples and wheat. With their own land and labour they each could have produced both crops, and been entirely self-sufficient. But they found that they could be better off by specializing; Carlos producing only apples and Greta producing only wheat.

- comparative advantage

- A person or country has comparative advantage in the production of a particular good, if the cost of producing an additional unit of that good relative to the cost of producing another good is lower than another person or country’s cost to produce the same two goods. See also: absolute advantage.

The two were better off by specializing because their land differed in what it was best at producing. While Carlos could produce 50 times as many apples as tonnes of wheat on his land if he produced just one crop, Greta could only produce 25 times as many apples as tonnes of wheat (again, if she produced just one or the other). Although Greta could produce more of either crop than could Carlos, Carlos had a comparative advantage in producing apples (in terms of productivity, he was less inferior to her in producing that crop compared to the other). Make sure you understand the term comparative advantage and Figures 1.9a and b before going on.

We are going to use the same reasoning to explain why entire countries specialize in some goods and services, and some in others.

For Greta and Carlos, the reason for specialization was that they had different land. In the same way, the natural resources and climate of countries differ. It would be very costly to produce bananas in Germany given the climate, and this is one of the reasons why Germans make their living doing other things. But there are many other reasons for specialization.

- economies of scale

- These occur when doubling all of the inputs to a production process more than doubles the output. The shape of a firm’s long-run average cost curve depends both on returns to scale in production and the effect of scale on the prices it pays for its inputs. Also known as: increasing returns to scale. See also: diseconomies of scale.

Suppose instead that Greta and Carlos had identical plots of land and the same set of skills. They are equally adept at growing either wheat or apples, but the production of both apples and wheat is subject to economies of scale. This would mean, for example, that doubling the amount of land and their own time devoted to the production of, say, apples would more than double the quantity of apples produced. Whether or not this is a reasonable assumption depends on the production technology of each good.

So we will replace Figure 1.9a, which showed the case of specialization based on factor endowments, with Figure 18.13. In the table in this figure, you see that if 25 hectares (and a proportional amount of either Greta’s or Carlos’ labour is devoted to the production of apples), 625 apples will be produced. If the land devoted to apple production is doubled to 50 (with half of labour time still applied to its production) apple production increases by a factor of four, to 2,500.

| Area of land used in production (hectares) | 1 | 25 | 50 | 75 | 100 |

|---|---|---|---|---|---|

| Wheat (tonnes) | 0.1 | 62.5 | 250 | 562.5 | 1,000 |

| Apples | 1 | 625 | 2,500 | 5,625 | 10,000 |

Economies of scale in the production of wheat and apples. Note that the entries in the ‘Apples’ row are just the square of the amount of land devoted to the production of apples, and the ‘Wheat’ row is just one-tenth of the number of apples produced in each column.

Figure 18.13 Economies of scale in the production of wheat and apples. Note that the entries in the ‘Apples’ row are just the square of the amount of land devoted to the production of apples, and the ‘Wheat’ row is just one-tenth of the number of apples produced in each column.

Imagine the two working as self-sufficient farmers, each with 100 hectares, dividing their land and labour equally between the two crops. They would each have 250 tonnes of wheat and 2,500 apples to consume.

But if either one of them were to specialize in wheat and the other in apples and then share the resulting crops equally, they could have four times as much wheat and apples as they would have in the absence of specialization. The important point here is that it doesn’t matter who specializes in what. The advantage of specialization does not come from any difference between the endowments (skills, land) of Greta and Carlos but instead from the fact that people each producing a lot of one thing may be more efficient than them producing lesser amounts of many things.

We’ll get back to Carlos and Greta in the next section, but what do the examples featuring them tell us about global integration and trade between nations? For example, why do southern Germans specialize in producing machine tools, high-end automobiles and other manufactured goods, while the southern coast of China is the world centre of manufacturing computers that run on US-produced software, while Mauritians produce shirts, and the residents of Alberta, Canada grow grain? There are two kinds of answers:

- Economies of scale, agglomeration, and other positive feedbacks: The production of aircraft is subject to extraordinary economies of scale. The Boeing Plant in Everett, Washington is the largest building in the world (over 13 million cubic metres in volume). Writing computer code is not subject to economies of scale, but good software is produced in areas in which a very large number of people are working on similar tasks, sharing information and innovating.

- Differences between regions: Alberta has an appropriate climate and soil for growing grain. The production of clothing requires a lot of labour but not an extensive amount of capital goods, fitting the availability of these factors of production in Mauritius. German apprenticeship training schemes support the high level of skills needed for the machine tool industry.

The distinctive aspect of the first source of specialization is its accidental quality. Why Everett, Washington rather than Osaka, Japan? Why is Bangalore a software hub, and not Singapore or Sydney?

Economies of agglomeration

The cost reductions that firms may enjoy when they are located close to other firms in the same or related industries.

Don’t confuse this with economies of scale or economies of scope, which apply to a single firm as it grows.

To explain specialization we often need to draw on both types of explanation. German machine tool production, for example, benefits not only from the high level of skill of the German workforce but also from economies of co-location, called economies of agglomeration. Firms also share information and develop common industry standards for components, and they stimulate research in the region, from which they benefit.

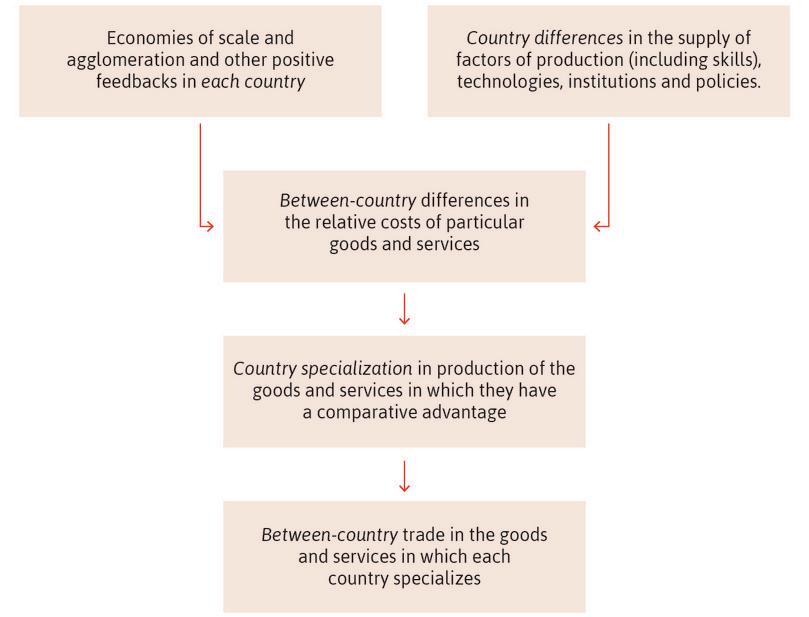

Figure 18.14 summarizes our explanation of specialization and trade.

Exercise 18.4 Assess some country production specialization patterns

Choose a few goods and services not discussed in this unit (for example, wine, automobiles, professional services such as accounting and auditing, consumer electronics, bicycles, or fashion goods). Use Figure 18.14, along with what you know or can research about your chosen products, to provide an explanation of country specialization patterns.

18.5 Specialization, factor endowments, and trade between countries

In this section, we look in more detail at trade specialization based on factor endowments, extending the analysis in Section 1.8. We show how trade between the people of different nations—specialized in the production of different things—can result in mutual gains, and also in conflicts over how these gains are distributed.

- absolute advantage

- A person or country has this in the production of a good if the inputs it uses to produce this good are less than in some other person or country. See also: comparative advantage.

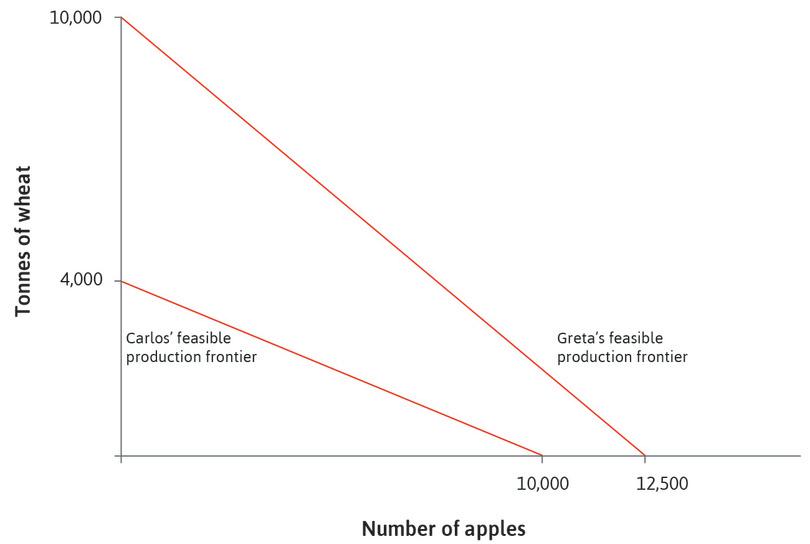

Imagine Greta lives on Wheat Island and Carlos lives on Apple Island. The land on each island can be used for growing both wheat and apples, and they consume both wheat and apples in order to survive. For the example in this section, we will use the numbers shown in Figure 18.15, and assume that Greta and Carlos each have 100 hectares of land. We have already seen that Greta is lucky. Wheat Island has better soil for both crops. She has an absolute advantage in both crops. Although Carlos’ land is worse overall for producing both crops, his disadvantage is less, relative to Greta, in apples than in wheat.

| Production if 100% of time is spent on one good, per hectare of land | |

|---|---|

| Greta | 1,250 apples or 100 tonnes of wheat |

| Carlos | 1,000 apples or 40 tonnes of wheat |

Absolute and comparative advantage in the production of apples and wheat.

Figure 18.15 Absolute and comparative advantage in the production of apples and wheat.

Remember, even those who have an absolute advantage in nothing at all will specialize in the thing at which they are least bad, and get the other goods they consume by exchange. Similarly, people who are better at producing everything will specialize in the goods at which they are comparatively best, while importing other goods. Both Greta and Carlos can benefit from specialization and trade.

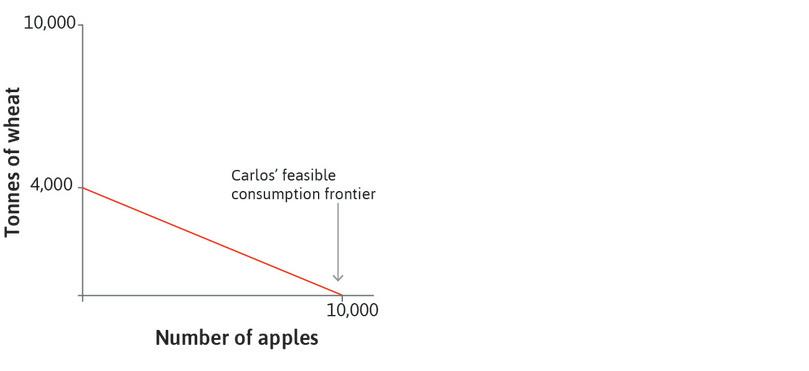

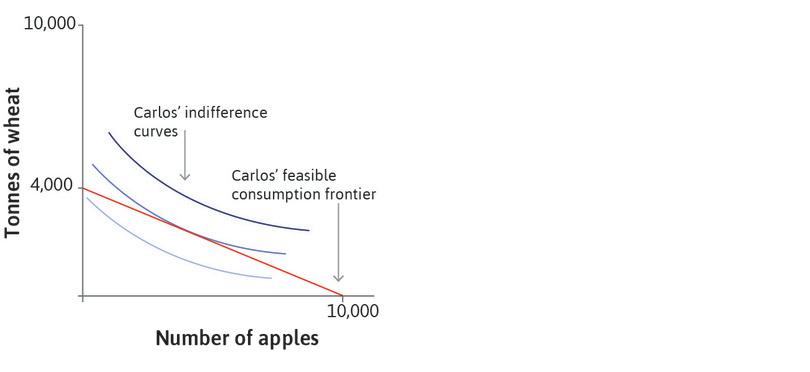

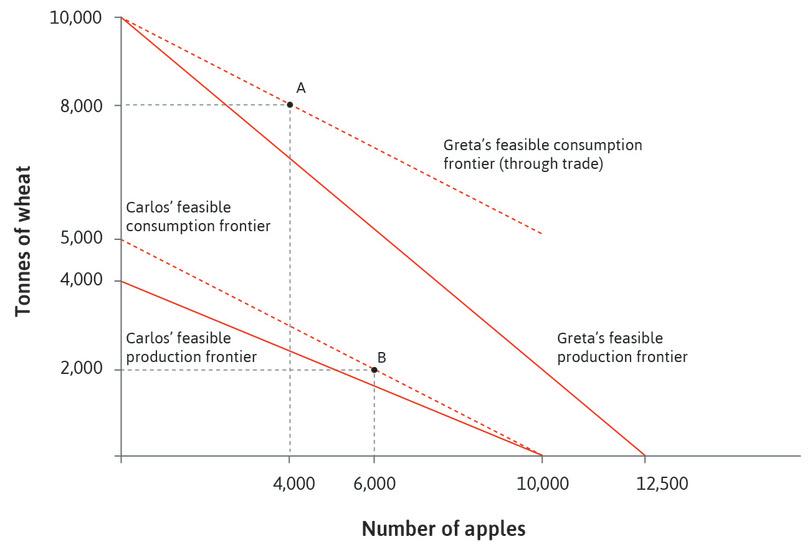

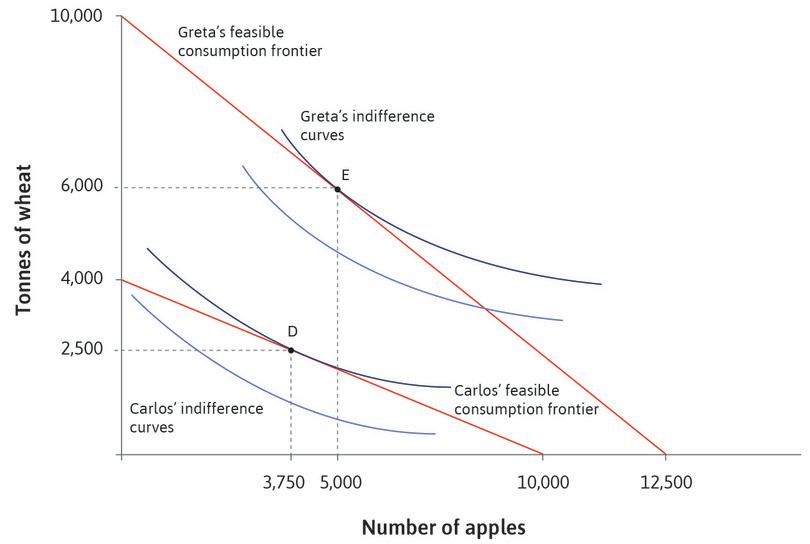

To see how this works, follow the analysis in Figure 18.16a.

Diversification in the absence of trade

In the absence of trade, Carlos and Greta do best by selecting a point on the highest indifference curve possible, given the constraint of their feasible production frontier. In our simple example, the feasible production frontier is also the feasible consumption frontier, because each person spends time producing only wheat and apples, and can consume only the amount they produce. Follow the analysis in Figure 18.16b to how Carlos and Greta make their production and consumption decisions.

Trade and specialization

What will happen when Greta and Carlos are able to trade? The decision to trade could be made for a number of reasons, such as the development of a new technology (maybe a boat) or the removal of barriers to trade (perhaps the end of a feud between the two islands). As we learnt in Unit 1, it is the relative, not the absolute, cost of producing the two goods that matters for mutually beneficial trade.

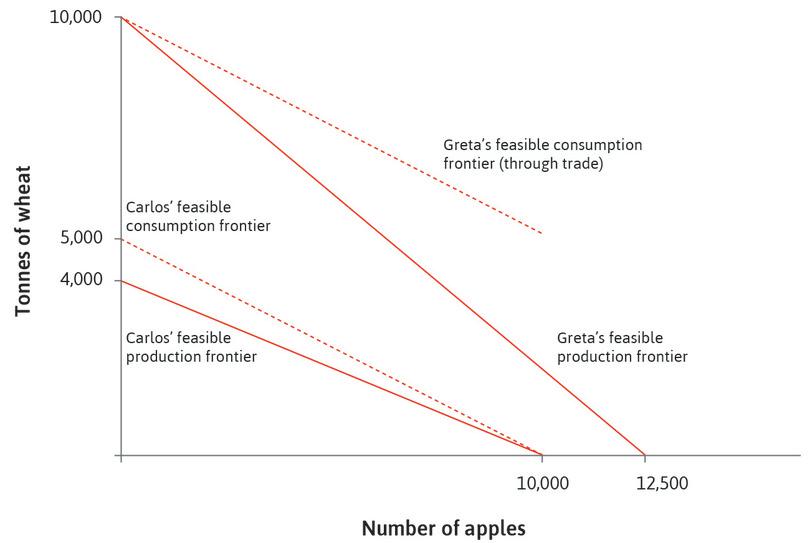

We will show that both Carlos and Greta gain when one island specializes in the production of wheat and the other specializes in the production of apples. Carlos can produce 4,000 tonnes of wheat a year, or 10,000 apples. In order to produce one more tonne of wheat, Carlos has to produce 2.5 fewer apples, so the marginal rate of transformation between tonnes of wheat and apples is 2.5. Since it takes the same amount of inputs (land and labour) to produce one tonne of wheat as it does to produce 2.5 apples, a tonne of wheat will cost the same as 2.5 apples. Thus the relative price of wheat to apples will be 2.5. The relative price is another way of referring to the marginal rate of transformation or the opportunity cost.

Greta is more productive in producing both goods. Greta can produce 10,000 tonnes of wheat in a year, or 12,500 apples. The relative price of wheat to apples on Wheat Island is therefore 1.25. Wheat Island therefore has a comparative advantage in producing wheat.

The relative price of apples is simply the inverse of the relative price of wheat, so if Wheat Island has a comparative advantage in producing wheat, then Apple Island will have a comparative advantage in producing apples. Figure 18.17 summarizes the key numbers from the example. The relative prices of the good for which each island has a comparative advantage are shown in bold.

| Apple Island (Carlos) | Wheat Island (Greta) | |

|---|---|---|

| Tonnes of wheat produced per year | 400 | 1,000 |

| Number of apples produced per year | 1,000 | 1,250 |

| Relative price of wheat | 1,000/400 = 2.5 | 1,250/1,000 = 1.25 |

| Relative price of apples | 400/1,000 = 0.4 | 1,000/1,250 = 0.8 |

An island has a comparative advantage in producing a good when it is relatively cheaper in their economy (in the absence of trade).

Figure 18.17 An island has a comparative advantage in producing a good when it is relatively cheaper in their economy (in the absence of trade).

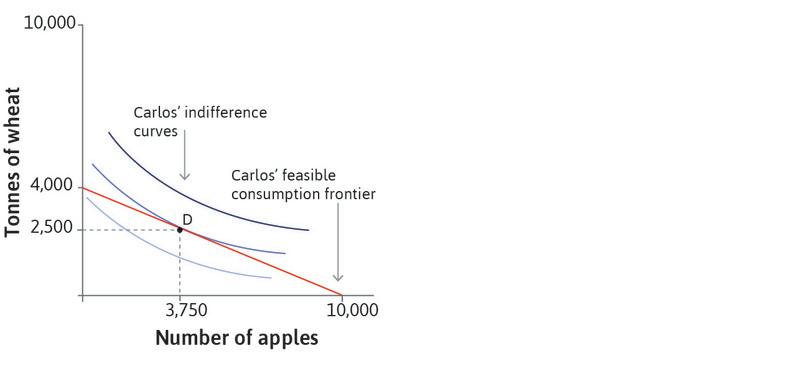

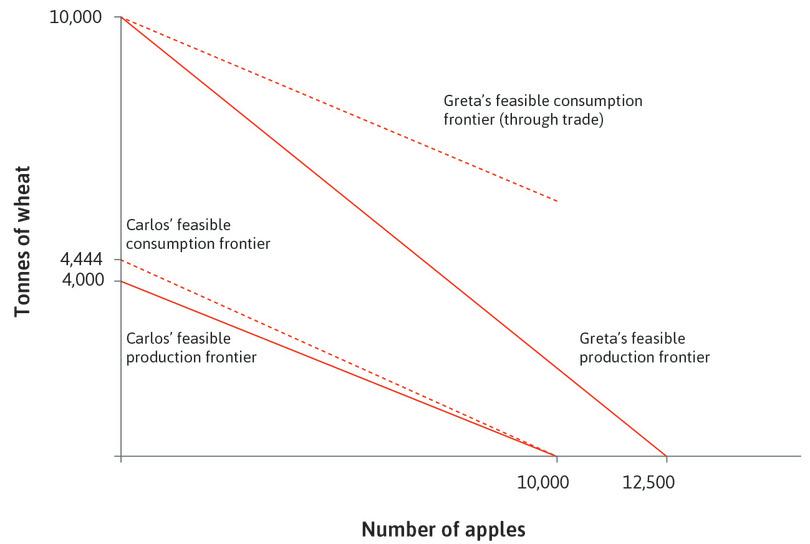

Gains from trade

When there is no trade (autarky, closed economies), the feasible production frontier is also the feasible consumption frontier. From Figure 18.16b, we can see that when the economies are closed, total production between the two countries is 2,500 + 6,000 = 8,500 tonnes of wheat and 3,750 + 5,000 = 8,750 apples. When countries fully specialize however, Greta is able to produce 10,000 tonnes of wheat and Carlos can produce 10,000 apples, so there is more of both goods overall. As long as they can trade, they can both consume more of each good and can, ideally, both be better off.

If we assume that there are no trade costs, it is obvious that the relative price of wheat and apples is the same in each country when they trade. What will the new price be? From Carlos’ point of view, the supply of wheat has increased more than the supply of apples, so the price of wheat relative to apples will go down to something less than 2.5. Equally, from Greta’s point of view the supply of wheat has increased by less than the supply of apples, so the relative price of wheat will go up for her to something higher than 1.25. When trading, the prices will lie between the prices experienced by the two economies when they are closed.

To see what happens when they trade, work through the analysis in Figure 18.18.

Because both countries are now specializing in the good in which they have a comparative advantage, the new consumption frontiers are above their production frontiers. For each country, the two frontiers meet at the point at which they do not trade, which given full specialization, correspond to each axis. We can see that specialization and international trade have led to an increase in the size of the feasible consumption set for both countries. Note that through trade, Greta cannot consume more than the maximum amount of apples Carlos can produce (10,000), which is why her feasible consumption frontier does not extend beyond 10,000 apples.

If we look back to Figure 18.16b we can see that any expansion of their feasible sets makes it possible for both Carlos and Greta to reach a higher level of utility (a higher indifference curve), so trade has been mutually beneficial.

Specialization has enlarged the feasible consumption set of both in the same way that borrowing and investing increased the feasible consumption set of Marco in Unit 10. By investing, Marco specialized in having income in the future, which increased the total income he earned over all periods. Then, by borrowing, he imported some of his future income to the present so that he could consume in both periods.

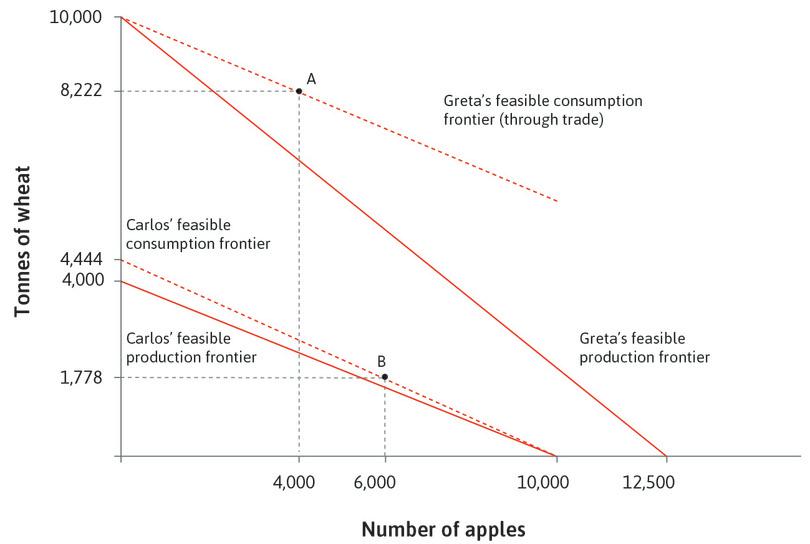

The relative price determines the extent to which trade increases the feasible set of each island. This, in turn, depends on how the price is determined. Suppose that Greta can unilaterally determine the price. To increase her gains from trade, Greta will choose a price that increases the amount of apples she receives for each tonne of wheat she sells to Carlos. Intuitively, Greta wants the good she produces to command a higher price. If we assume that she has chosen a price of wheat of 2.25, then how does this affect the expansion of the feasible sets? Follow the analysis in Figure 18.19 to find out.

- bargaining power

- The extent of a person’s advantage in securing a larger share of the economic rents made possible by an interaction.

Of course, if Greta could set any price she wished, she could have set an even higher price. If she set the price at 2.5 apples per tonne, she would eliminate Carlos’ gains from trade entirely. At this price Carlos would be equally well off if he produced his own wheat and would have no reason to engage in trade with Greta. When the people of a country are better able to influence the price in their favour, we say they have bargaining power.

Great economists David Ricardo

David Ricardo (1772–1823) developed the theory of comparative advantage. He was also the first economist to warn that a rapidly growing capitalist economy would confront the limits of its natural environment.

The son of a successful stockbroker and the third of 17 children, Ricardo grew up in London and eloped at the age of 21, which led to a long period of estrangement from his parents. He went on to build a huge fortune through trading in stocks before interesting himself in political economy. He entered parliament (by purchasing a seat, which then was possible) where, besides his contributions on economic questions, he favoured liberal social causes such as religious tolerance, freedom of speech, and opposition to slavery.1

Ricardo’s central contribution to economic theory was an analysis of the principles of production and distribution in a growing capitalist economy with a large agrarian sector. In An Essay on Profits, published in 1815, he developed the Ricardian model, which came to dominate British economic thought for much of the next 50 years. In this model, agricultural production relied on three inputs: labour, capital, and land. As production and population expanded, either existing land had to be farmed more intensively with greater doses of capital and labour, or less fertile plots had to be brought into production.

Drawing on ideas of diminishing returns, he explained how this would lead to a squeeze on profits and the eventual stagnation of the economy. Like Thomas Malthus, whose ideas we studied in Unit 2, he reasoned that wages could not be below subsistence. As farming expanded to less good land, the price of food and hence wages would have to increase. A result would be that profits (which Ricardo presumed would be invested) would fall. Rents (presumed to be spent on luxuries) would increase due to the growing scarcity of land. The result would be the eventual slowdown and stagnation of the economy.

Ricardo therefore advocated a repeal of tariffs on the import of grains (known as the Corn Laws), which his friend Malthus defended. Ricardo reasoned that if Britain could acquire more of its food from the US and elsewhere, then paying workers a subsistence wage would cost less to the employers, raising the rate of profit and investment. Importing grain rather than growing it in Britain would make land less scarce and therefore limit the landlord’s share of total output. The result, according to Ricardo, would be continued growth rather than stagnation.2

His greatest work, On the Principles of Political Economy and Taxation (published in 1817), introduced the labour theory of value, later used by Karl Marx. This theory holds that the value of goods is proportional to the amount of labour required, directly or indirectly, in their production. Wassily Leontief (1906–1999) devised a way that these values could be calculated (see ‘When economists disagree: Heckscher–Ohlin, and the Leontief Paradox’ later in this unit).

In Principles, Ricardo laid out the principle of comparative advantage, recognizing that two countries could trade to the mutual advantage of each, even if one of them was absolutely better at producing all goods.

Ricardo is not as famous an economist as Smith, Malthus, Mill, or Marx, but he is greatly respected for the theory of comparative advantage. In addition, his method of structuring thought using an abstract model as a guide to economic understanding makes him a very modern great economist.

Exercise 18.5 Comparative advantage

Suppose that there are only two countries in the world, Germany and Turkey, each with four workers. Within a given time period, each worker in Germany can produce three cars or two televisions, and each worker in Turkey can produce two cars or three televisions.

- Draw the feasible production frontier for each country, with televisions on the horizontal axis and cars on the vertical axis. In the absence of trade, what is the relative price of cars in each country?

- Suppose that, in the absence of trade, Germany consumes nine cars and two televisions while Turkey consumes two cars and nine televisions. Mark these consumption points as G and T, respectively. Draw the feasible consumption frontier for each country in the absence of trade. Comment on the relationship between the production and consumption frontiers you have drawn for each country.

- Now suppose Germany and Turkey start trading. What is the range of possible values for the world relative price of cars? If the world relative price of cars is PC/PTV = 1, in which good will each country specialize?

- Now use the world relative price given above to draw the feasible consumption frontier of each country in the figures you have drawn. Use these figures to explain whether or not each country gains from trade.

- What is the marginal rate of transformation between cars and televisions in each country? Explain the relationship between comparative advantage and the marginal rate of transformation between goods.

Exercise 18.6 Power and bargaining

Going back to our example of Carlos and Greta, assume that Greta has the power to set the relative price. Based on what you have learned in Unit 4 about how people play the ultimatum game, how do you think Carlos would react to a price offer of 2.4 apples per tonne of wheat?

Question 18.5 Choose the correct answer(s)

The following diagram shows Carlos’ and Greta’s feasible production frontiers and their utility-maximizing choices of consumption between wheat and apples under autarky (no trade).

Based on this information, which of the following statements is correct?

- Carlos will choose point D where he consumes 3,750 apples and 2,500 tonnes of wheat.

- This combination of goods lies within the feasible consumption frontier for Greta, but she is able to consume more of both good so would never choose this bundle.

- Greta has the absolute advantage in the production of both goods.

- It is entirely possible that with different shapes of indifference curves that Greta will choose to consume less of one of the goods than Carlos. For example, if her indifference curves were shallower (closer to being horizontal), she would consume fewer apples.

Question 18.6 Choose the correct answer(s)

Figure 18.18 depicts the feasible frontier and the consumption frontier of Carlos and Greta if they specialize and trade. The resulting relative price of wheat is assumed to be 2.

Let the resulting consumption be at A and B, respectively, for Greta and Carlos. Then which of the following statements is correct?

- The point is that they both specialize in the good with comparative advantage and trade. Therefore Carlos produces all the apples while Greta produces all the wheat.

- Those are their consumption choices as a result of trade. The two specialize and produce just one of the goods each.

- Given each person is fully specializing, to calculate the amount of each good that is traded we just need to look at their consumption of the goods that they do not produce themselves. These goods must have been traded.

- As a result of the trade they are both able to achieve a point on a higher indifference curve. Therefore they both benefit from the trade.

Question 18.7 Choose the correct answer(s)

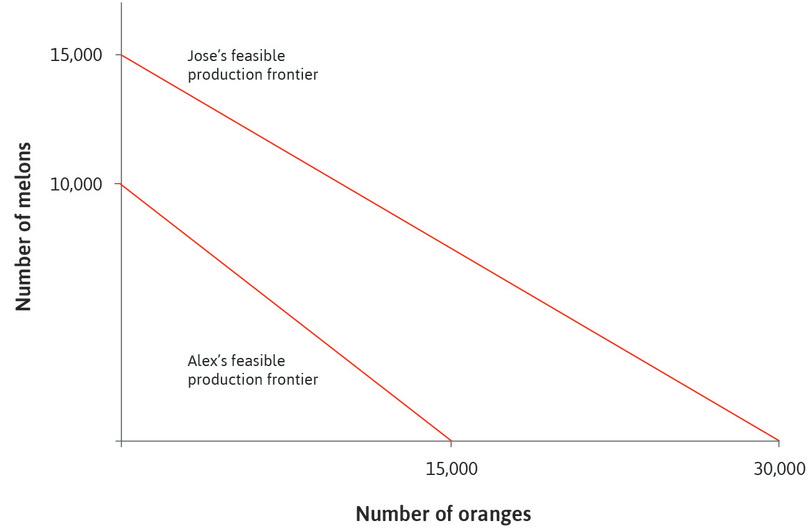

The following diagram shows Alex’s and Jose’s feasible production frontiers for oranges and melons.

Based on this information, which of the following statements are correct?

- Jose’s feasible production set includes Alex’s within it, so he has absolute advantage in both goods.

- Jose can produce twice as many oranges as melons. On the other hand, Alex can produce 1.5 times as many oranges as melons. Therefore Jose has the comparative advantage in the production of oranges.

- Visually comparing the slopes of the feasible production frontiers, we see that Jose has a comparative advantage in oranges and Alex in melons.

- The relative price after trade will depend on the bargaining power of the two, which may or may not be 1.75.

18.6 Winners and losers from trade and specialization

Carlos and Greta both benefit from trade, so why are imports and exports often controversial? Unlike our story, in the real world there are almost always winners and losers. The processes of specialization and exchange affect regions, industries, and household types differently. Had the bakers and shoppers of Genoa known that cheap grain was aboard the Manila they would have cheered her into port, while local farmers may have secretly prayed for a shipwreck.

Nations are composed of people with differing economic interests. They are not like our islands with only Greta and Carlos. Therefore, to understand these issues we need to go further than assuming a single individual or a set of identical individuals inhabits each nation.

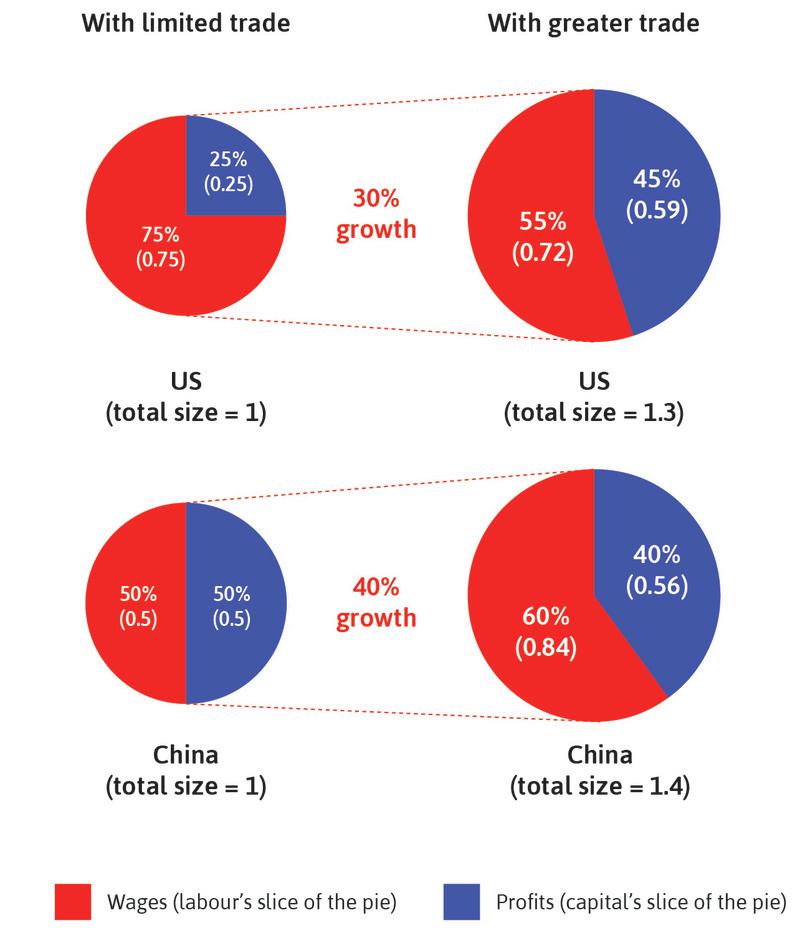

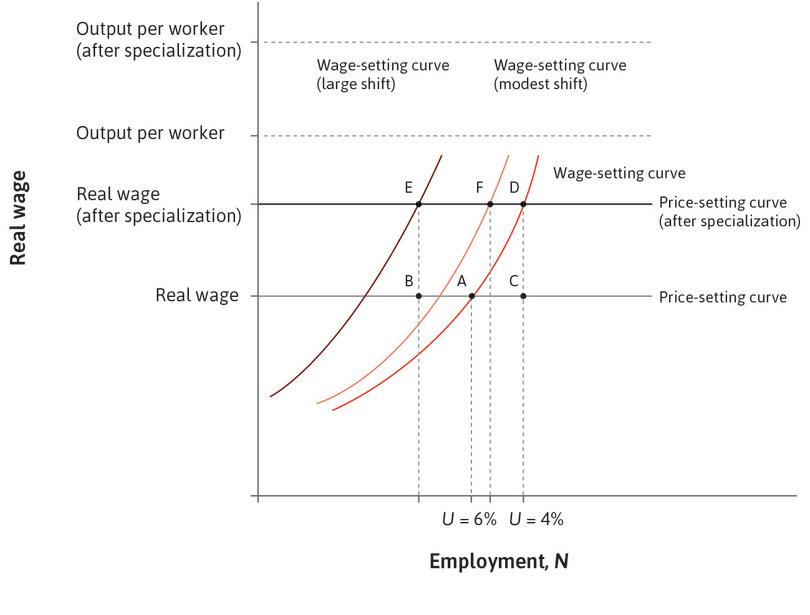

To think about winners and losers from trade, we begin with a model of two stylized countries, which we call the US and China, where specialization is based on factor endowments. The US is an advanced economy with a long tradition of manufacturing. China is less developed, but has become the world’s second-largest economy by exporting manufactured goods. Let us imagine, unrealistically, that the US and China produce only two goods, which are produced under constant returns to scale: passenger aircraft and consumer electronics (like games consoles, personal computers, and TVs). Furthermore, we assume (more realistically this time) that the US has an absolute advantage in producing both goods, and a comparative advantage in producing aircraft.

We assume that aircraft production is capital-intensive and that capital is relatively abundant in the US. In contrast, China has a comparative advantage in consumer electronics production, which is more labour-intensive and China has an abundance of labour relative to capital. Given these assumptions, when the economies begin to trade with one another, the US will specialize in the production of aircraft, whereas China will specialize in the production of consumer electronics.

Opening trade between the US and China in aircraft and consumer electronics has the following effects:

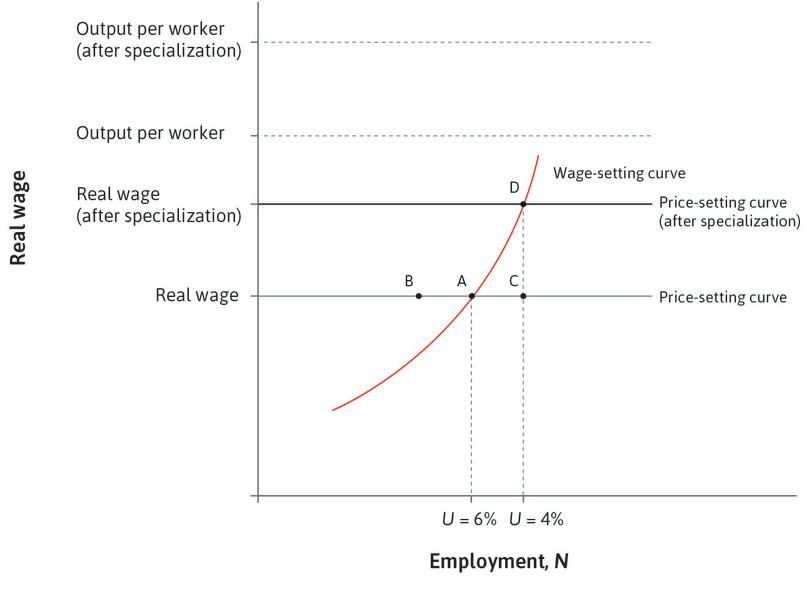

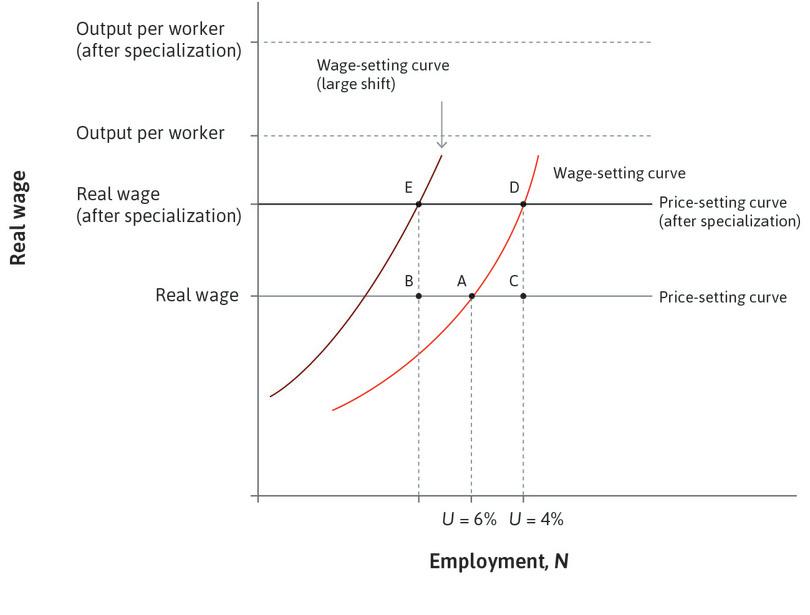

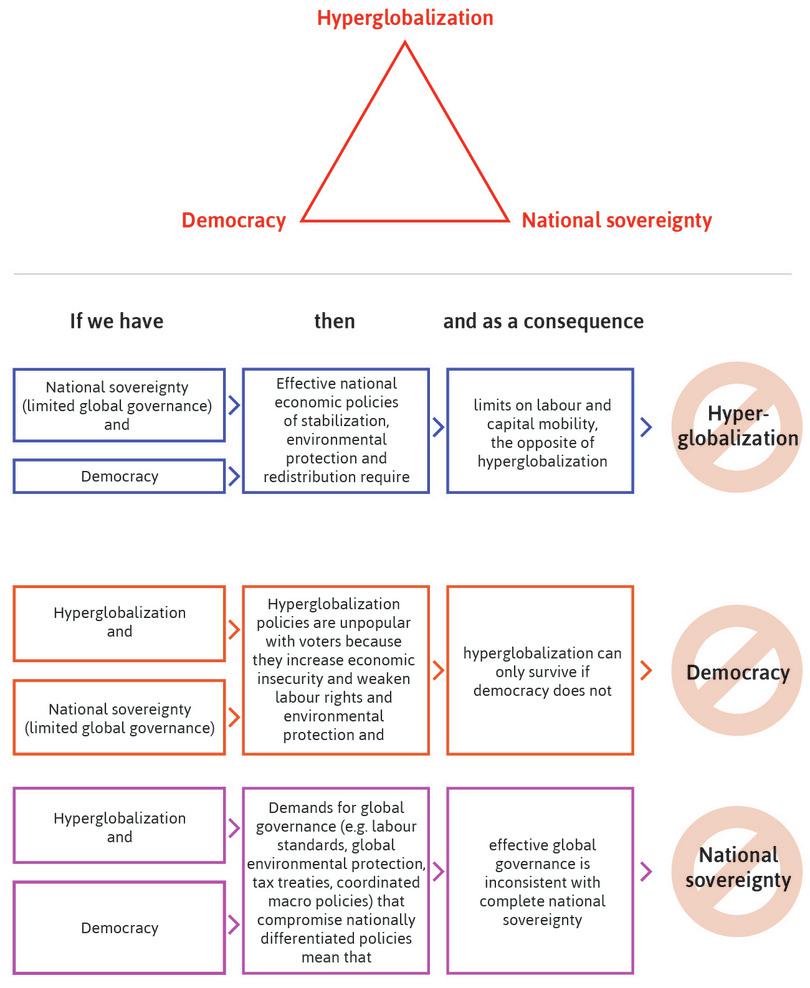

- It increases the consumption possibility set for both countries.

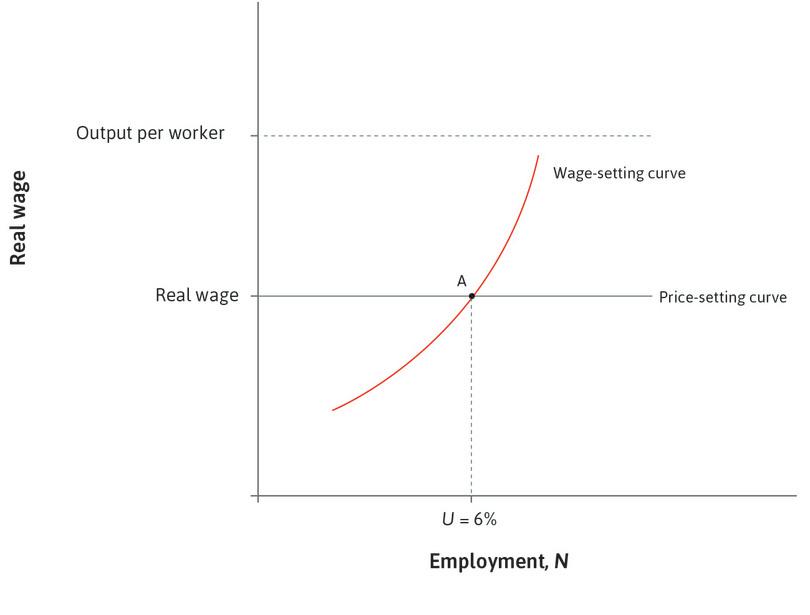

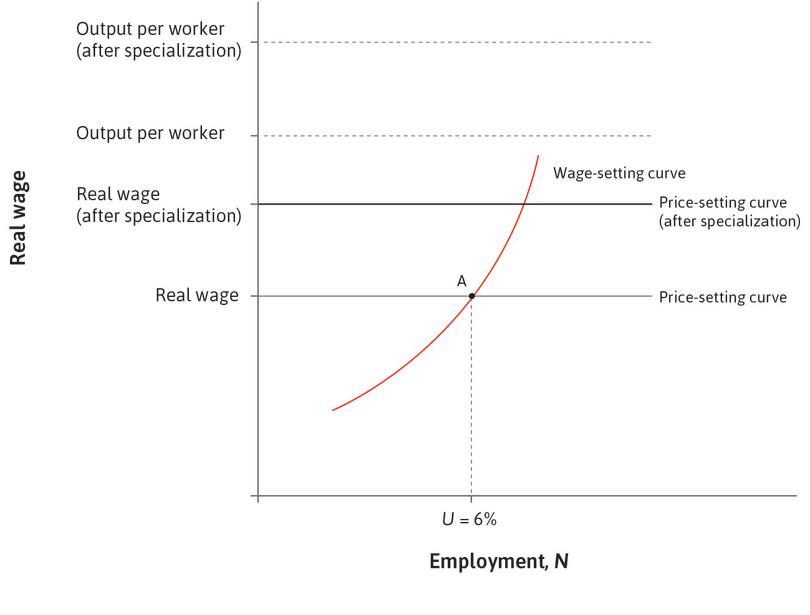

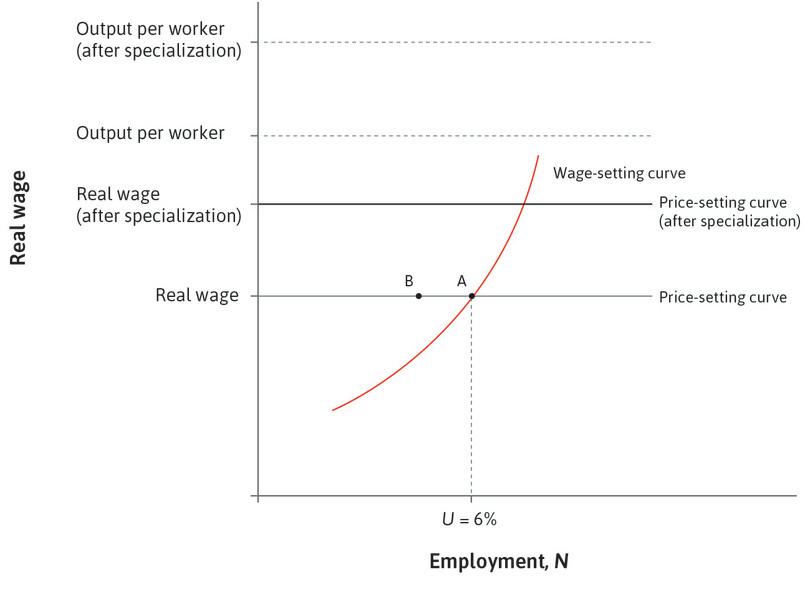

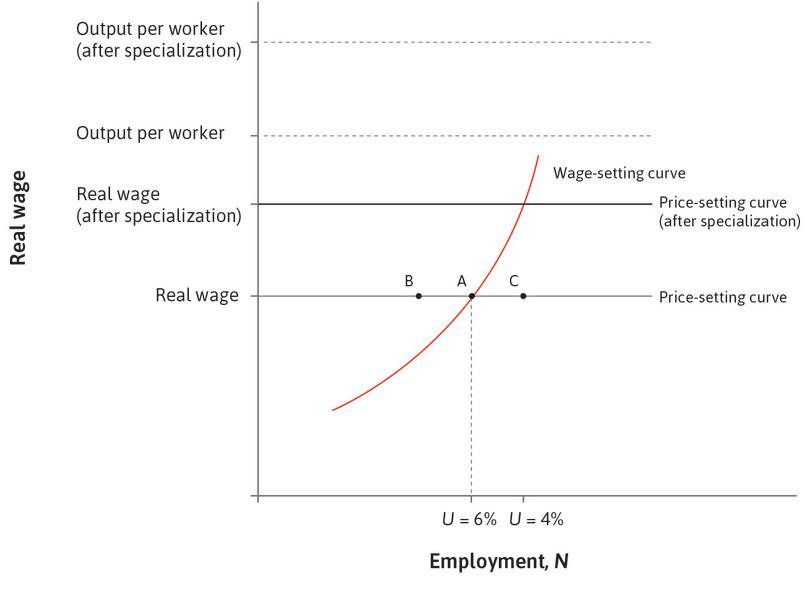

- Conflicts of interest emerge between the countries.