Unit 21 Innovation, information, and the networked economy

Innovations that enhance our wellbeing are a hallmark of capitalism. Making the most of human creativity and inventiveness is a public policy challenge

- Innovation depends on many factors: the state of knowledge, individual creativity, public policy, economic institutions, and social norms.

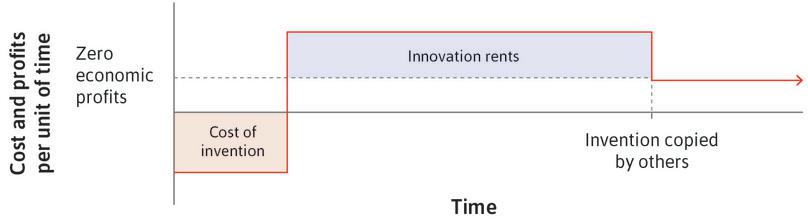

- Individuals or companies who introduce socially beneficial innovations are rewarded with profits above the opportunity cost of capital, referred to as innovation rents.

- Innovation rents are eventually competed away by imitators who spread the new knowledge by using it.

- The production and use of new knowledge is unusual in three ways: knowledge is a non-rival good, producing new knowledge is initially costly, but once produced it can be distributed and used for free, and innovations generally become more useful as more people use them.

- Innovating firms often have little immediate competition and can profit by setting prices far above the marginal costs of production, which disadvantages consumers.

- But innovating firms still cannot capture all of the benefits their innovations generate, so may invest too little in innovation.

- Public policy therefore seeks to spread socially beneficial innovations, while at the same time providing adequate rewards for those producing innovations.

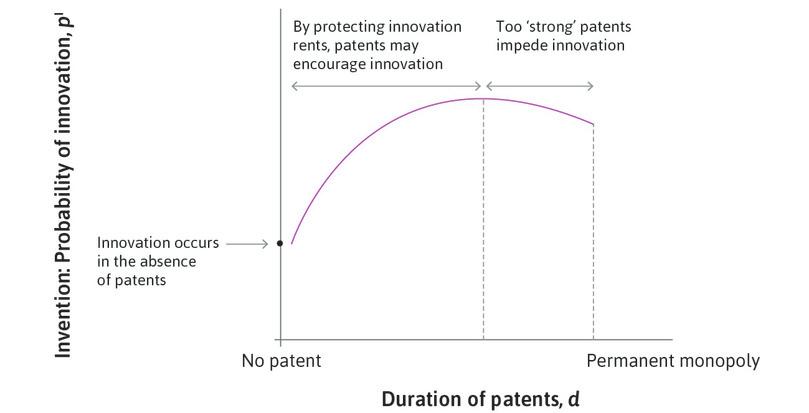

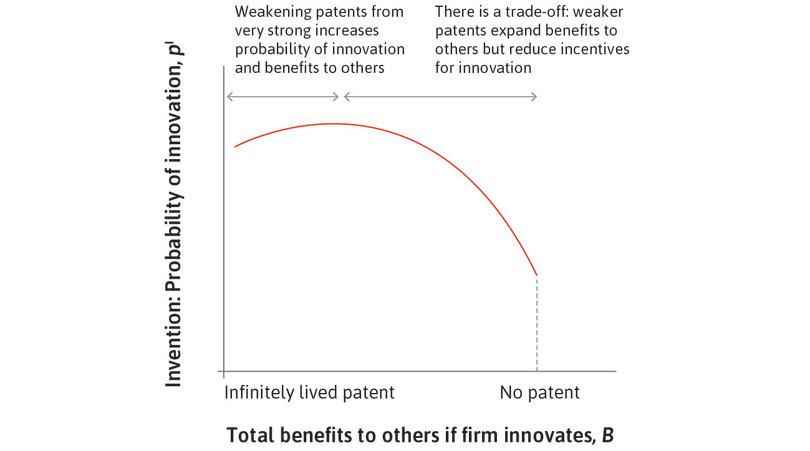

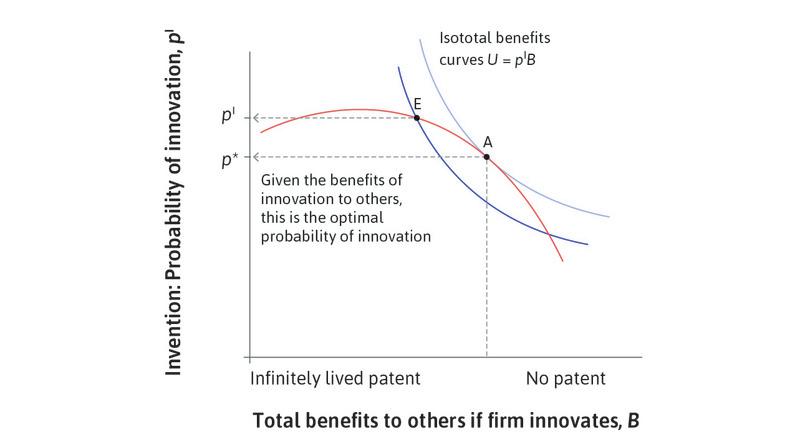

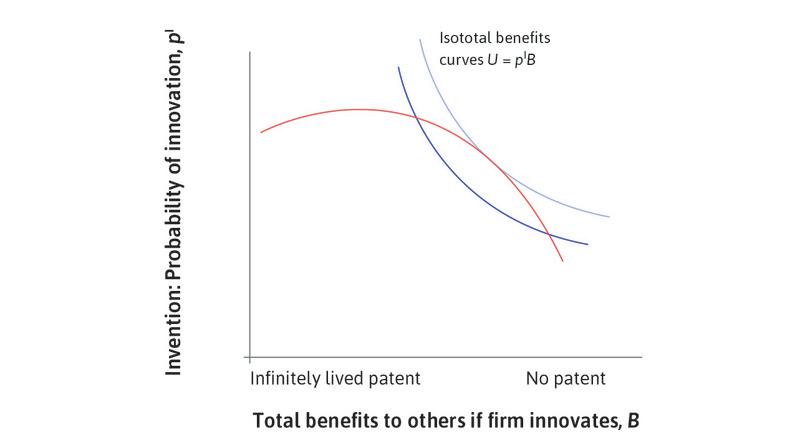

- Given this trade-off, intellectual property rights can be either ‘too strong’, preventing new innovations from spreading, or ‘too weak’, providing innovation rents that are too small to sufficiently reward innovators.

- Digital technologies support ‘two-sided markets’ like Facebook, eBay, and Airbnb, which match individuals who can mutually benefit from exchanges.

- These technologies have altered the nature of economic competition, but exhibit many of the same market failures observed in the production of knowledge.

Around the turn of the present century, South Africa had one of the highest rates of people living with HIV in the world: about 5 million South Africans, 1 in 10 of the population, were HIV positive. But in 1998, Bristol-Myers Squibb, Merck, and 37 other multinational pharmaceutical companies brought a lawsuit against the government of South Africa, seeking to prevent it from importing generic (non-brand name) drugs, other inexpensive antiretroviral drugs, and other AIDS treatments from around the world.

Street protests erupted in South Africa, and both the European Union and the World Health Organization announced their support for the South African government’s position. Al Gore, then US vice president, who had represented the interests of pharmaceutical companies in negotiations with South Africa, was confronted by AIDS activists chanting, ‘Gore’s greed kills!’ In September 1999, the US government—previously the drug companies’ strongest ally—said that it would not impose sanctions on poor countries that are affected by the HIV epidemic, even if US patent laws were broken, so long as the countries abided by international treaties governing intellectual property. The pharmaceutical giants pushed back, engaging an army of intellectual property rights lawyers to promote their case. They closed factories in South Africa and cancelled planned investments.

But three years later, with millions of dollars spent on litigation and with the even greater cost to their reputations, the companies backed down (even paying the South African government’s legal fees). Jean-Pierre Garnier, the chief executive officer of GlaxoSmithKline, telephoned Kofi Annan, secretary general of the United Nations, to ask him to help make a deal with President Thabo Mbeki of South Africa. ‘We’re not insensitive to public opinion. That is a factor in our decision-making,’ Garnier later explained.1 2

It was too late: the damage had already been done. ‘This has been a public relations disaster for the companies,’ commented Hemant Shah, an industry analyst. ‘The probability of any drug company suing a developing country on a life-saving medicine is now extremely low based on what they learned in South Africa.’

Of course, pharmaceutical company owners cannot sell an AIDS treatment at less than what it cost them to manufacture it and still stay in business. Moreover, few of the industry’s research projects lead to a marketable product (research in 2016 estimated the industry’s success rate as just over 4%). The sales of a successful product must therefore cover the costs of many failed projects because, of course, it is impossible to predict which research projects will succeed.

In this instance, the drug companies went to court in South Africa to protect their patents. In the pharmaceutical industry, the patent system gives the innovating company a time-limited monopoly that allows the company to charge a price much higher than the cost of producing the drug (sometimes by a factor of 10) during the years of patent protection. The prospect of high profits provides an incentive for companies to invest in risky research and development.

By creating a government-imposed monopoly, patent protection often conflicts with the equally important objective of making goods and services available at their marginal cost (recall from Unit 7 that a monopolist will set a price above the marginal cost). The high price—sufficient to cover the cost of research and development, including investments on failed projects—means that many of those who could benefit from access to the drug will not get it. This is an example of the deadweight efficiency losses resulting from monopoly pricing studied in Unit 7.

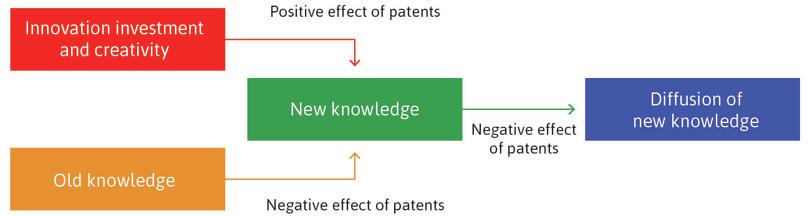

Conflicts between competing objectives—in this case, the production of new knowledge on the one hand and its rapid diffusion on the other—are unavoidable in the economy, and are particularly difficult to resolve when they concern innovation, as we will see.

But sometimes, new technologies allow for win-win outcomes.

Recall the problem of the fishermen and fish buyers of Kerala that we described at the beginning of Unit 11. On returning to port to sell their daily catch of sardines to fish dealers, fishermen often found that there was excess supply in the market. The result was higher prices for the consumer, on average, and lower incomes for the fishermen.3 4

- law of one price

- Holds when a good is traded at the same price across all buyers and sellers. If a good were sold at different prices in different places, a trader could buy it cheaply in one place and sell it at a higher price in another. See also: arbitrage.

When the fishermen got mobile phones, they would phone the many coastal fish markets from out at sea, and pick the one where the prices that day were highest. The mobile phone made it possible to implement the law of one price in Keralan fish markets, to the benefit of fishermen and consumers. It was not entirely win-win, however. The mobile phones greatly increased the competition among the dealers who were the intermediaries between fishermen and buyers, because a fisherman could bargain for higher prices before choosing which market to enter. The dealers were the losers from this innovation.

But the mobile phone had much weaker effects in other parts of the world, such as Uttar Pradesh and Rajasthan in India, where the lack of roads and storage facilities prevented farmers from profiting from information on price differences. A small farmer in Allahabad remarked that price information that he could get on his phone was not worth much to him because there were ‘no roads to go there’. In this case the innovation was of little use, because of a lack of public investment in the necessary infrastructure.

Similarly, when mobile phones came to Niger, in West Africa, farmers lacked the means to transport their cowpeas and other crops to alternative markets, and so traders who transported the goods took much of the benefit. The fishermen did not face this problem because the boats used to catch the fish were also a means of transport, allowing them to choose among markets.

In this unit, we will show how economic concepts can make sense of the South African government’s policies to make AIDS treatments more widely available, the conflict that the policies caused, and the contrasting impact of the mobile phone on fishermen in Kerala and farmers in other Indian states.

To understand innovation, you will have to forget about the image of an eccentric inventor, working alone, creating a ‘better mousetrap,’ and getting rich as a reward for the public benefit of his inspiration. Innovation is not a one-off event set off by a spark of genius. Instead:

- Innovation is a process: It is a fundamental source of change in our life that itself is constantly undergoing change.

- Innovation is also systemic: It connects networks of users, private firms, individuals, and government bodies.

We discuss innovation as a process and as a system in the next two sections.

Exercise 21.1 Patents and innovation in the pharmaceutical industry

- According to Scherer in the ‘Economist in action’ video, what are the key features of the pharmaceutical market that differentiate it from other markets?

- According to the video, what prevented the same drug from being made available in both high and low-income countries, and how was this issue resolved?

21.1 The innovation process: Invention and diffusion

- innovation

- The process of invention and diffusion considered as a whole.

- invention

- The development of new methods of production and new products.

- diffusion

- The spread of the invention throughout the economy. See also: diffusion gap.

- process innovation

- An innovation that allows a good or service to be produced at lower cost than its competitors.

- product innovation

- An innovation that produces a new good or service at a cost that will attract buyers.

- innovation rents

- Profits in excess of the opportunity cost of capital that an innovator gets by introducing a new technology, organizational form, or marketing strategy. Also known as: Schumpeterian rents.

We begin with a few new terms. We use the word innovation to refer to both the development of new methods of production and new products (invention) and the spread of the invention throughout the economy (diffusion). An innovating firm can produce a good or service at a cost lower than its competitors, or a new good at a cost that will attract buyers. The first is called a process innovation and the second is called a product innovation.

Invention and innovation

The descriptive term invention is sometimes reserved for major breakthroughs, but we use it to refer to:

Radical innovation

Radical innovation introduces a brand new technology or idea that had not been previously available. The invention of incandescent lighting (producing light by running electricity through a filament) was a major advance over light made by burning oil or kerosene. The MP3 format allowed music to be compressed in a manner that enabled easy storage on hard drives and transmission over the Internet, offering a vastly different way to store music than CD or vinyl.

Incremental innovation

This improves an existing product or process cumulatively. After Edison and Swan patented their designs for the incandescent electric light bulb in 1880 and started working together in 1883, all subsequent improvements in the filament that generates the light were incremental innovations in lighting. You have already learned about the incremental improvement of the spinning jenny, one of the major inventions of the Industrial Revolution, which began with just eight spindles and eventually operated hundreds.5 6

Many of the concepts that are useful for the study of innovation have already been introduced in earlier units. They are listed in Figure 21.1, and you will encounter them again throughout this unit. Before going on, make sure you understand these concepts.

| Concepts | Previously in Units |

|---|---|

| Innovation rents | 1, 2 |

| External effects and public goods | 4, 12 |

| Strategic interactions | 4, 5, 6 |

| Property rights, including IPR | 1, 2, 5, 12 |

| Economies of scale | 7 |

| Complements and substitutes | 7, 16 |

| Mutual gains and conflicts over their distribution | 5 |

| Creative destruction | 2, 16 |

| Institutions and social norms | 4, 5, 16 |

Concepts relevant to innovation that you have studied.

Figure 21.1 Concepts relevant to innovation that you have studied.

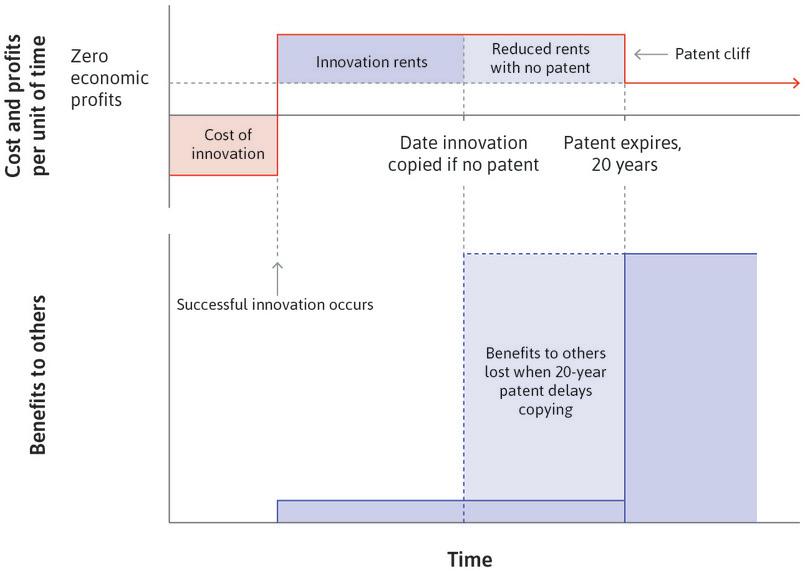

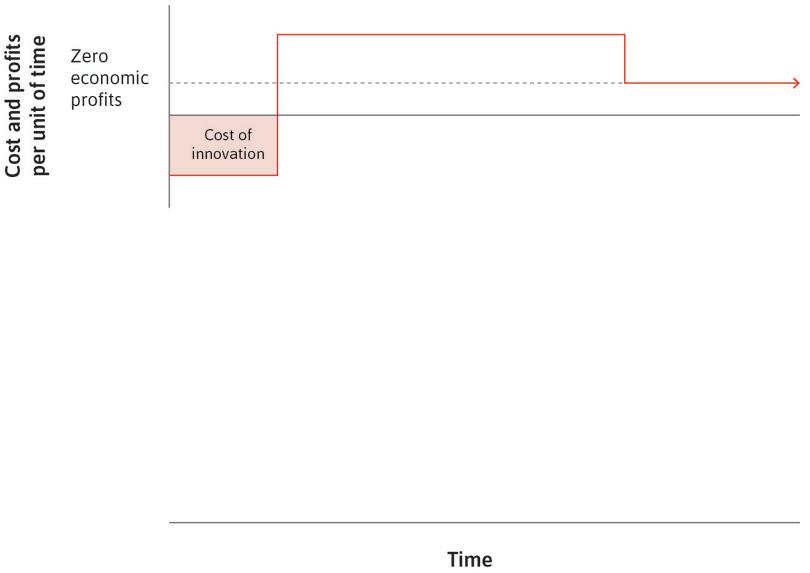

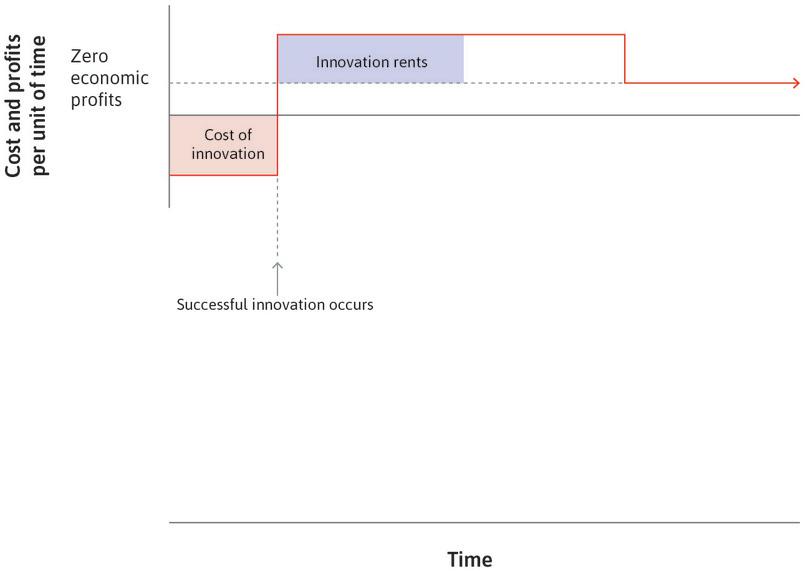

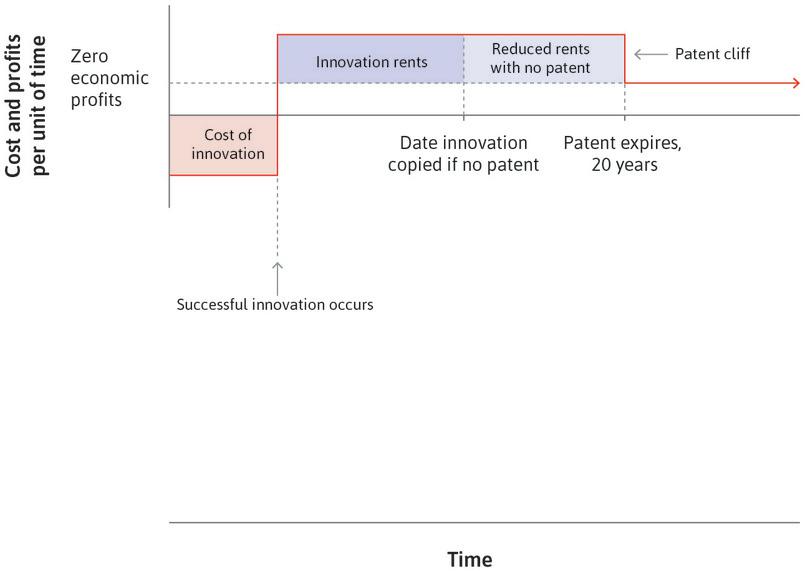

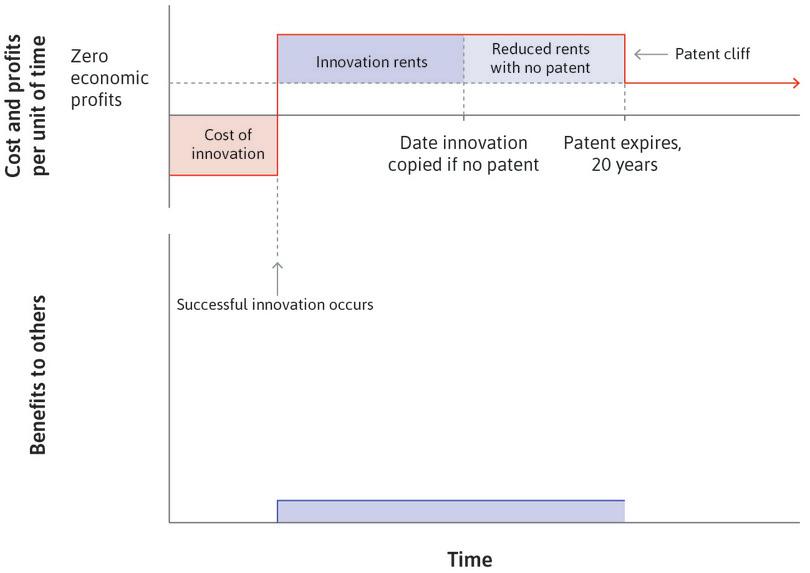

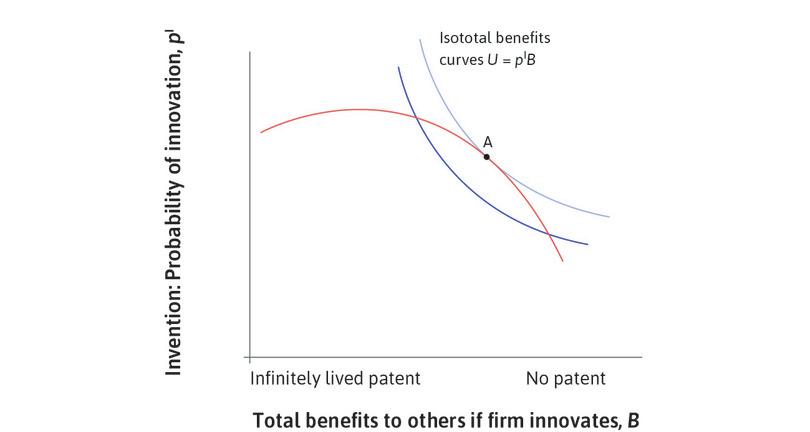

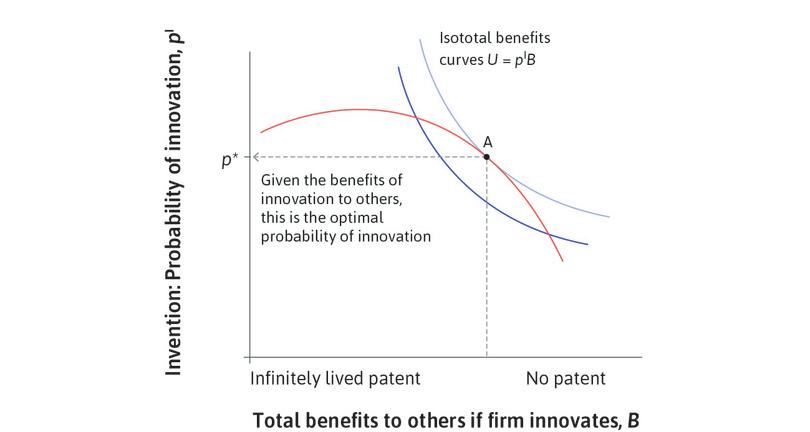

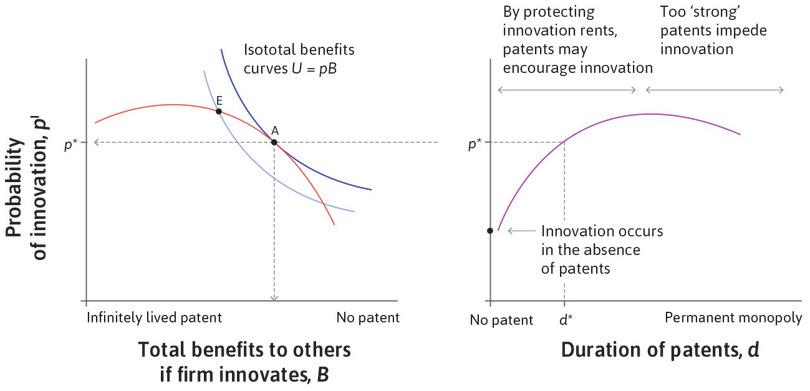

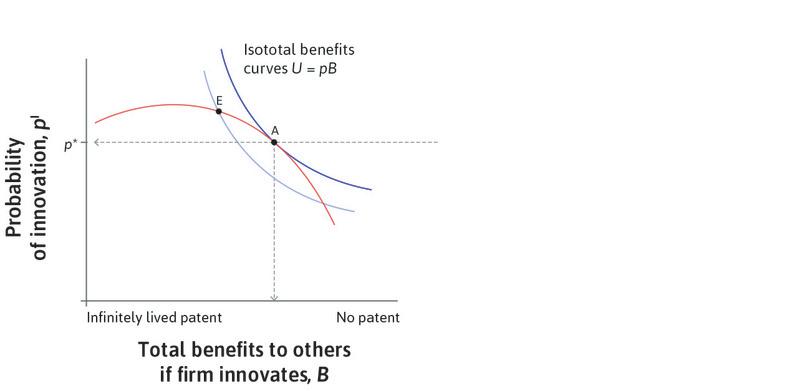

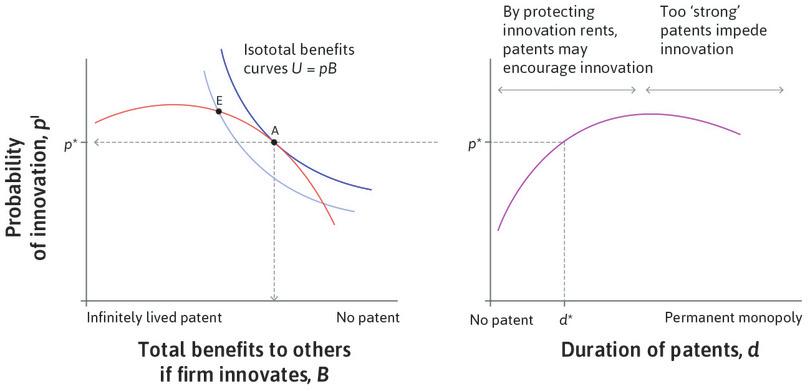

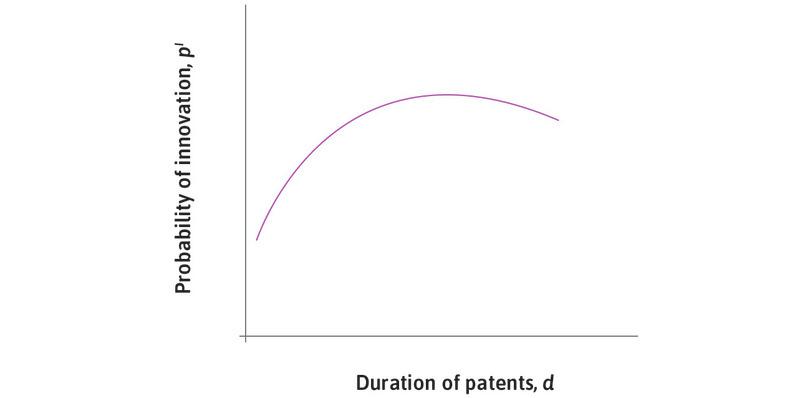

Recall from Unit 2 that at the going price, a company introducing a successful invention makes profits in excess of the profits that other firms make, termed innovation rents. In Figure 21.2, the research, development, and implementation costs of undertaking an innovation are shown along with the temporary innovation rents (profits above the opportunity cost of capital) from a successful invention.

Diffusion

The prospect of these innovation rents then induces others to try to copy the invention. If they are successful, the temporary rents of the innovator are eventually entirely competed away. The result of this copying process is that eventually the initial innovator will again earn profits that just cover the opportunity cost of capital, so economic profit returns to zero.

Latecomers are also eventually pushed to adopt the innovation, because the falling prices that result when the new methods become widely adopted typically mean that sticking with the old technology is a recipe for bankruptcy. A firm that does not innovate will make negative economic profits, meaning that its revenues fail to cover the opportunity cost of capital. This carrot-and-stick combination of the promise of rents from successful innovation and the threat of bankruptcy if firms fail to keep up with innovators has proved a powerful force in reducing the amount of labour required to produce goods and services, thereby raising our living standards.

- general-purpose technologies

- Technological advances that can be applied to many sectors, and spawn further innovations. Information and communications technology (ICT), and electricity are two common examples.

Although there have been inventions throughout human history, the acceleration of the innovation process started in England around 1750 (as we saw in Unit 2) with some key new technologies introduced in textiles, energy, and transportation. It did not end with the Industrial Revolution. Important new technologies with applications to many industries such as the steam engine, electricity, and transportation (canals, railroads, automobiles, airplanes) are called general-purpose technologies.

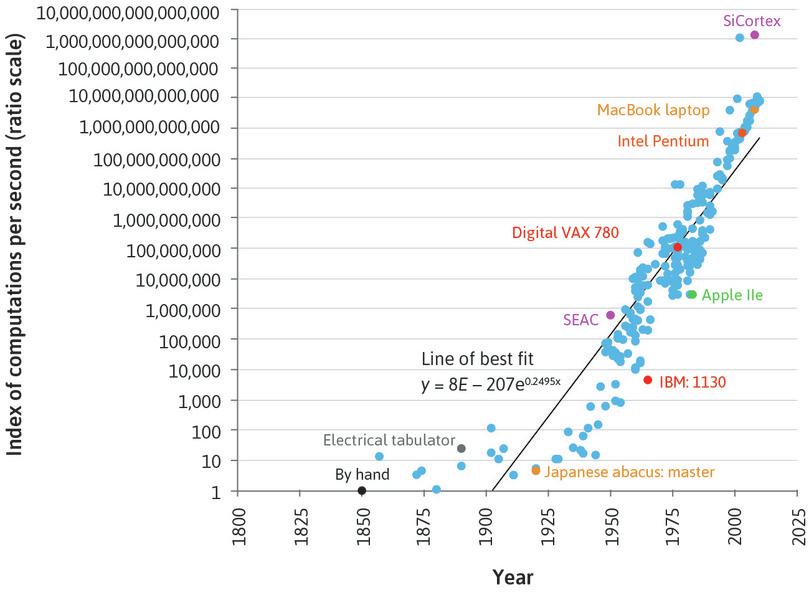

William Nordhaus, an economist whose analysis of the discount rate applied to environmental problems you read about in Unit 20, has estimated the speed of computation using an index that has a value of 1 for the speed of a computation done by hand (like dividing one number by another). For example, in 1920 a Japanese abacus master could perform computations 4.5 times faster than a mathematically competent person could do the same calculation by hand. This difference had probably been constant for many centuries, because the abacus is an ancient computational device.

But sometime around 1940, computational speed takes off. The IBM 1130 introduced in 1965 was 4,520 times faster than hand computation (and as you can see, it was below the line of best fit through the data points from 1920).

Innovation in computing power: Index of computing speed. Particular examples are shown in colour and labelled.

Figure 21.3 Innovation in computing power: Index of computing speed. Particular examples are shown in colour and labelled.

William D. Nordhaus. 2007. ‘Two Centuries of Productivity Growth in Computing’. The Journal of Economic History 67 (01), Index updated to 2010.

- innovation system

- The relationships among private firms, governments, educational institutions, individual scientists, and other actors involved in the invention, modification, and diffusion of new technologies, and the way that these social interactions are governed by a combination of laws, policies, knowledge, and social norms in force.

The most recent entry in Figure 21.3, the SiCortex supercomputer, performs more than 1 billion computations per second. It is more than a quadrillion (count the zeros) times faster than you, and it is well above a line of best fit through the data points from 1920, so there is no indication that the process is slowing down.

But as the ‘When economists disagree’ box shows, engineers and economists disagree over whether improvements in computation or any other technology will continue at the pace given in Nordhaus’s chart, or instead will return to the modest pace of improvement that prevailed over most of human history.7

The stepped line in Figure 21.2 illustrated a simple theory of innovation and diffusion of technical progress. It clarifies how innovation rents, costs of innovation, and the copying of innovations are interrelated from the standpoint of a firm or individual that wants to develop a new product or process.

To understand this process, we need to know how inventions actually happen, how the costs and rents are decided, and when the process of copying takes place. To do this, we have to go beyond the point of view of the single firm in Figure 21.2 and think of innovation as the product of interactions among firms, the government, educational institutions, and many other players in the innovation system.

When economists disagree The end of the permanent technological revolution?

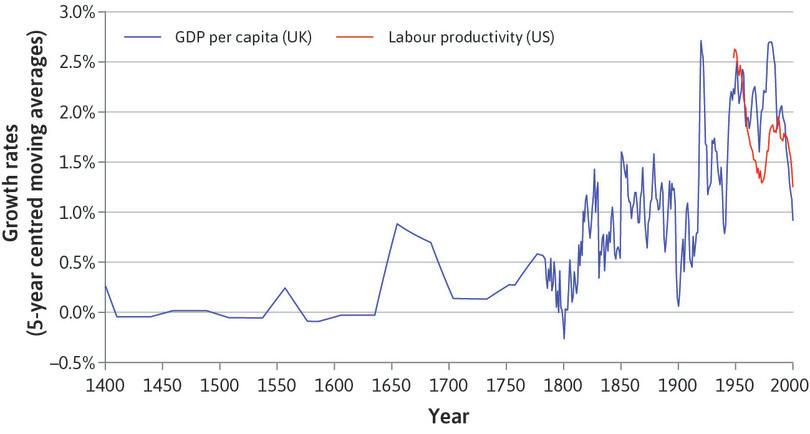

We began Unit 1 with the Industrial Revolution, the capitalist revolution, and history’s hockey sticks of rapid technological progress. In Unit 2, we explained how these advances translated into improvements in wellbeing. And we have just seen the dramatic (and possibly even accelerating) rate of technical advance in computation.

In Unit 16, we studied the long-run trend for the economy to produce more services relative to goods. If service productivity grows more slowly than manufacturing productivity, the shift from goods to services reduces overall productivity growth in the economy.

Will this limit the ability of technological progress to increase labour productivity at the rate that has occurred since the Industrial Revolution, and especially during the golden age of capitalism? It seems appropriate to begin this unit with the disagreement among economists about whether the ‘permanent’ technological revolution is ending.

The growth rate of productivity over the long run (1400–2013).

Figure 21.4 The growth rate of productivity over the long run (1400–2013).

Jutta Bolt and Jan Juiten van Zanden. 2013. ‘The First Update of the Maddison Project Re-Estimating Growth Before 1820’. Maddison-Project Working Paper WP-4, January; Stephen Broadberry. 2013. ‘Accounting for the Great Divergence’. London School of Economics and Political Science. The Conference Board. 2015. Total Economy Database.

Figure 21.4 shows the best available data on the advance of productivity of labour in the UK since 1400, and also for the US for the period in which the US has been the global technology leader. Robert Gordon, an economist who specializes in productivity and growth, has written extensively about productivity growth and its effects, particularly in the first chapter of his book The Rise and Fall of American Growth. He points to the downturn in the productivity growth rate series at the end of the period in the chart.

Gordon believes that the rapid growth era from the first half of the twentieth century is long gone, and slower growth lies ahead of us. In contrast, Erik Brynjolfsson and Andrew McAfee, both economists, advance the view that digital technology is opening up a ‘second machine age’. In a video broadcast by Swiss National Television and its second part, they explain their points of view.

Exercise 21.2 The permanent technological revolution

Use all the sources above, as well as Thomas Edsall’s New York Times article ‘Boom or Gloom’ and Lee Koromvokis’ PBS Newshour article ‘Are the best days of the U.S. economy over?’, to answer the following questions:

- According to Gordon, Brynjolfsson, and McAfee, which other factors, apart from technological innovation, affect the rate of GDP per capita growth? Why might it take a long time for today’s innovations to affect the economy’s growth rate?

- How well do you think GDP per capita growth measures the effect of innovation? Suggest alternative ways to measure the effects of innovation.

- According to Brynjolfsson and McAfee, how will technological progress affect inequality? Use the data and models from Units 16 and 19 to discuss whether you agree with Brynjolfsson and McAfee’s analysis of the relationship between technological progress and inequality.

- In this unit, we discuss how policies and institutions can help the process of innovation. How can policies and institutions also help the economy adjust to the effects of innovation?

Question 21.1 Choose the correct answer(s)

Which of the following statements regarding innovation is correct?

- The spreading of invention, known as diffusion, is also part of innovation.

- This is process innovation.

- This is product innovation.

- This is the definition of innovation.

21.2 Innovation systems

Innovative activities are not spread evenly across the globe or even across a country. Think of the area now known as Silicon Valley in California, once a sleepy farming area centred on Santa Clara Valley. Silicon Valley got its nickname when high-growth firms in computing and semiconductor design moved in, later joined by innovators in biotech. In 2010, in a single US postal area (ZIP code 95054) in the centre of Silicon Valley, 20,000 patents were registered. Patent attorneys cluster in this part of Santa Clara. If this small area of 16.2 km² were a country, it would have ranked 17th in the world in patents in 2010.8

The outpouring of patents from Silicon Valley is a measure of its output of what is termed codified knowledge, meaning knowledge that can be written down. But much of the knowledge produced cannot be written down, or at least not exactly. This non-codifiable knowledge is termed tacit knowledge.

The difference between codified and tacit knowledge can be illustrated this way. A recipe for a cake can be written down, as it is codified knowledge, but being able to read the recipe and follow it exactly does not get you a reputation for being an outstanding cook; on the other hand, the tacit knowledge of an exceptional chef is not something that you can easily write in a book.

- codified knowledge

- Knowledge that can be written down in a form that would allow it to be understood by others and reproduced, such as the chemical formula for a drug. See also: tacit knowledge.

- tacit knowledge

- Knowledge made up of the judgments, know-how, and other skills of those participating in the innovation process. The type of knowledge that cannot be accurately written down. See also: codified knowledge.

The importance of tacit knowledge is demonstrated in the destruction and re-emergence of the German chemical industry. After the First World War and again after the Second World War, German chemical companies had their factories in Germany disassembled and their facilities in the US and UK expropriated. All that remained were key personnel.

Had all of the necessary knowledge to build a modern chemical industry been codified, there is no particular reason why Germany should have resumed its leadership in this field. Any country with a large scientific and engineering labour force could have created the industry using the available codified knowledge, more or less like the cook following a recipe. But using their know-how and experience (the tacit knowledge), German companies nevertheless managed to resume dominant positions in some markets.

Silicon Valley is as famous for its tacit knowledge as it is for its patented codified knowledge. The extraordinary concentration of innovative businesses in Silicon Valley reflects the importance of external effects and public goods in the production and application of new technologies. The two words ‘Silicon Valley’ no longer just refer to a place. They now represent a particular way that innovation gets done. Silicon Valley has become associated with an innovation system.

As well as the legal institutions that protect codifiable knowledge and that govern how easily holders of tacit knowledge can move between firms, an innovation system includes financial institutions such as venture capital funds, banks, or technology-oriented firms that will finance projects that seek to commercialize innovations.

Different countries provide quite different innovation systems that often co-evolve with industries in which they specialize. For example, radical innovation is more prevalent in the US, where labour can move easily between firms and venture capital is well developed, and incremental innovation is more prevalent in Germany, where ties of workers to firms are stronger and finance for innovation comes from retained profits and banks rather than from venture capital.

- non-compete contract

- A contract of employment containing a provision or agreement by which the worker cannot leave to work for a competitor. This may reduce the reservation option of the worker, lowering the wage that the employer needs to pay.

Even within the US, Silicon Valley was unusual. During the 1960s, Silicon Valley was a minor player in technology compared to the Route 128 concentration near Boston, Massachusetts, which benefited from proximity to Harvard and MIT. But Route 128 differed from Silicon Valley in important ways, including the use of non-compete contracts that prohibited anyone leaving one firm from taking up employment with a competing firm, as a way of protecting information that a firm produced:

- The state of Massachusetts enforced non-compete contracts: This limited inter-firm mobility and the information-sharing that resulted from it.

- The state of California took the opposite position: It outlawed non-compete contracts, saying that: ‘Every contract by which anyone is restrained from engaging in a lawful profession, trade, or business of any kind is … void.’ The resulting circulation of engineers among firms in Silicon Valley promoted the rapid diffusion of new knowledge among firms.

The Silicon Valley innovation system

Why is innovation concentrated in Silicon Valley? Institutions and incentives reinforce each other to produce a radical innovation cluster. The Silicon Valley model is one of highly mobile entrepreneurs, investors, and employees linked within a small geographical area, with support from government and educational institutions.9 10

The Silicon Valley system consists of:

- Innovating firms: Most innovation takes place in firms specializing in producing new methods or products (start-ups) rather than in existing firms that produce goods and services.

- Other innovating institutions: In a partnership that began early in the 1900s, two universities, one public (University of California at Berkeley) and the other private (Stanford University) work closely with firms to commercialize innovations. An industrial park was set up in 1951 at Stanford with major corporations like General Electric, IBM, and Hewlett Packard. University, government, and private R&D labs are co-located in the Valley, even including the R&D centre of Walmart, the retail giant.

- Government: Military research in electronics and high-energy physics was funded at the universities and in private firms in the area, starting in the run-up to the Second World War. During the Cold War (from the end of the Second World War until the 1990s), this continued with Lockheed Missiles and Space the largest employer in the Valley. A change in the law in 1980, called the Bayh-Dole Act, enabled universities to gain ownership of their output and commercialize it even if the federal government had helped fund it. This brought private investors into the network.

- Social norms: A social norm for high-risk, high-return behaviour, which some say has its origins in the speculators who flooded into California to mine for gold in the nineteenth century, sustains a culture of serial entrepreneurship. Failed innovators can start again with a new idea. High firm failure rates and other reasons for employee mobility across firms distribute the tacit knowledge acquired in one firm to other firms. Some have concluded that this unintentional sharing of information among firms was key to Silicon Valley’s success.

- Finance: Entrepreneurs at an early stage will pitch their project to venture capital (VC) investors. When the VCs decide to invest and take a substantial ownership stake, usually for a period of 12 to 18 months, it creates strong incentives for the startup to grow rapidly and, if successful, means the VC investor can exit with a high rate of profit. The funding model for startups is a rapid-paced cycle of pitching a new business idea to investors, which is based on the commercialization of an invention, followed by recruiting key employees (often with earnings linked to the value of the firm when it is sold), market growth, and seeking more cash. Founders, investors, and employees all understand that failure is likely. Funders still benefit, because the few successful ventures produce large returns that compensate for many losses.

The German innovation system

Innovation in the US is concentrated in industries whose patents heavily cite scientific articles. This is one indicator of radical innovation. By contrast, the very successful export industries of Germany rely on incremental innovation, where patents are much less intensive in scientific citations and tacit knowledge tends to be more important. Networks are also crucial to the German innovation system but they work differently from those in Silicon Valley. Like Silicon Valley, innovation is concentrated geographically, with centres around Munich and Stuttgart in southwest Germany.

The German system consists of:

Read the introduction to: Peter A Hall and David Soskice. 2001. Varieties of Capitalism: The Institutional Foundations of Comparative Advantage. New York, NY: Oxford University Press.

-

Innovating firms: Incremental innovation takes place in medium-size and large long-lived companies in Germany, and relies on long-term relationships between employers and workers, between firms and banks, and among firms linked through production relationships and ownership and control ties. To succeed in introducing new technology, firms face many coordination problems, which can be solved through cooperative and competitive relationships with employees, other firms, and banks.

- Government: The government supports the training of highly skilled workers through a government-subsidized apprenticeship system, which is supervised by industry associations. This system reduces training costs for firms and ensures high quality training. Apprentices contribute by accepting low training wages. Large firms are required to have elected bodies to represent workers in negotiations with managers. They help to devise ways to exploit all possible mutual gains and to distribute these gains in a way acceptable to all.

- Innovators: Skilled workers are needed for the successful introduction of process and product innovations. To make this possible, young people need to be assured of long-term, high-wage employment before they are willing to commit to multi-year apprenticeships. Similarly, workers engaging in innovation that could result in job cuts need to be assured that they will not lose their jobs. The vocational training scheme addresses these issues in a number of ways. As discussed above, the government sponsors and subsidizes high-quality apprenticeships. Training schemes are also certified. This assures trainees that their skills are valuable outside the firm, improving their reservation position should their job end, and helping to ensure high wages as long as the job continues.

- Social norms: Incremental innovation (for example, in the automobile industry) requires industry-wide standards to make technology transfer easier. Long-term relationships and cross-ownership among firms are essential for facilitating technology transfer, because long-term employment contracts mean that the Silicon Valley-style technology transfer that occurs when workers move from one firm to another is much less common. Similarly, the assurance that firms’ highly trained workers will not be poached is not achieved through laws but by norms that are widely respected by the otherwise highly competitive firms.

- Finance: The system of ownership of large German firms differs sharply from that of US or UK firms. Takeovers are easier in the US or the UK, and allow for rapid changes in the use of the assets of a firm. Because ownership of firms is much more concentrated in Germany, it is virtually impossible for a hostile takeover—that is, one opposed by the management—to occur. Therefore, long-run inter-firm collaboration over technology development is possible, and industry-wide standards are easier to set. The financing of innovation in Germany comes from retained profits (profits not distributed to shareholders) and bank loans. Long-term finance provides reassurance for trainees who invest in acquiring company-specific skills, as well as for other companies investing in related technology developments.

Figure 21.5 compares the two systems. Both are successful, but in different ways. Silicon Valley-based firms dominate important digital technologies (ICT) associated with the latest general-purpose technology, while the German firms making up its distinctive innovation system have managed to sustain a much higher level of well-paid industrial jobs in the face of global competition, compared to the US or any other country outside of East Asia.

| Silicon Valley | German innovation system | |

|---|---|---|

| Innovation | Radical codified, especially in ICT | Incremental tacit, especially in capital goods and transport equipment |

| Innovating firms | Entrepreneurial innovation specialists | Established industrial and other firms |

| Government | Military contracts, higher education | Subsidies for training workers |

| Innovators | Engineers, scientists, universities | Skilled workers and engineers |

| Social norms | Competitive; risk-taking | Cooperative; risk-pooling |

| Finance | Venture capital | Bank loans, retained earnings |

| Property rights | Patents of more importance | Non-patent forms of protection of more importance |

Two innovation systems: Silicon Valley and Germany.

Figure 21.5 Two innovation systems: Silicon Valley and Germany.

The economics of innovation systems

Successful innovation can contribute to rising living standards by expanding the set of products available to consumers, and by reducing the prices of existing products. However, many societies struggle to innovate.

Compare the amount of innovation in capitalist economies to the amount in centrally planned economies of the Soviet Union and its allies during the twentieth century. In a list of 111 major non-military product and process innovations between 1917 and 1998, only one—synthetic rubber—came from Soviet bloc countries. Scholars have suggested that an important factor contributing to the collapse of the Soviet planned economies was the Communist Party’s failure to deliver innovation in consumer goods, which eroded the legitimacy of its rule.11

The successful capitalist innovation systems in Silicon Valley and Germany have two things in common:

- The innovation system is not based on individual creativity: A single firm or an inventor relies on the relationships among all of the actors—owners, employees, governments, and sources of finance. Regions without these support networks are less successful at innovation.

- There is a helping hand as well as an ‘invisible hand’: Successful innovation systems involve profit-seeking competition among individuals and firms, but the government also plays an essential role—military contracts in Silicon Valley and worker training in Germany, for example.

In the next three sections, we explore three aspects of invention and diffusion that make the innovation process a challenge to public policy, and why it has proven so difficult for other localities to copy the Silicon Valley or German innovation systems.

- external effect

- A positive or negative effect of a production, consumption, or other economic decision on another person or people that is not specified as a benefit or liability in a contract. It is called an external effect because the effect in question is outside the contract. Also known as: externality. See also: incomplete contract, market failure, external benefit, external cost.

- public good

- A good for which use by one person does not reduce its availability to others. Also known as: non-rival good. See also: non-excludable public good, artificially scarce good.

- economies of scale

- These occur when doubling all of the inputs to a production process more than doubles the output. The shape of a firm’s long-run average cost curve depends both on returns to scale in production and the effect of scale on the prices it pays for its inputs. Also known as: increasing returns to scale. See also: diseconomies of scale.

These aspects are:

- External effects and the problem of coordination among innovators*: A firm’s successful invention almost always has either positive or negative effects on the value of other firms’ investments in the innovation process. Owners of a firm who are concerned solely about their profits will fail to take into account these external effects.

- Public goods: Innovation can be seen as the production of new knowledge by the use of a combination of old knowledge and creativity. The fact that most forms of knowledge are non-rival—making it available to an additional user does not mean that some current user will be deprived of its use—makes the innovation process one that uses public goods to produce other public goods.

- Economies of scale and winner-take-all competition: Big is beautiful when it comes to the knowledge-based economy. Average costs fall as more units of a good or service are provided, and this means that firms entering a market first often can take the entire market, at least temporarily.

Recall from Unit 12 that these three characteristics are all sources of market failure. Simply letting market competition regulate the process of innovation will generally not result in an efficient outcome. These same three aspects of the innovation process also pose challenges to governments that seek to address these market failures. This is because governments may lack the necessary information (or the motivation) to develop appropriate policies.

We begin with a model of the problem of external effects and the problem of coordination among innovators, simplified to just two firms considering investing in innovations, and a government that may assist in the innovation process.

Exercise 21.3 Comparing innovation systems

In this unit, we compared the Silicon Valley and German innovation systems.

Which of these two systems do you think would be more likely to be introduced and succeed in the country or region in which you are now living? Why or why not? (If you are in Germany, would the Silicon Valley system work where you are? If you are in California, would the German system work there?)

Question 21.2 Choose the correct answer(s)

Which of the following statements is correct regarding the Silicon Valley and German innovation systems?

- The two systems, though very different, are both regarded as very successful. Silicon Valley-based firms dominate important ICT technologies, while the German firms have managed to sustain a much higher level of well-paying industrial jobs despite global competition.

- Whilst this statement is true for Silicon Valley, workers in Germany are trained through multi-year apprenticeships at low wages by the firms.

- As explained in the text.

- The financing of innovation in Germany comes from retained earnings and bank loans, which allows investment in more industry-specific skills.

21.3 External effects: Complements, substitutes, and coordination

- complements

- Two goods for which an increase in the price of one leads to a decrease in the quantity demanded of the other. See also: substitutes.

- substitutes

- Two goods for which an increase in the price of one leads to an increase in the quantity demanded of the other. See also: complements.

Innovations considered by a firm will typically either increase or decrease other firms’ profit levels, and affect those firms’ choices about innovation. Think about just two firms, each considering innovations that are either:

- Complements: The value of one innovation is greater in the presence of the other. Tin cans were invented to store food in 1810 by Peter Durand, a British merchant, and the first canning factory began production in 1813. But the cans were very difficult to open and not widely used in the home until 1858, when Ezra Warner invented a simple can opener.

- Substitutes: The two innovations are valuable alone, but less valuable when some other innovation has already occurred. A good example is the video format war during the 1980s between two competing standards, VHS and Betamax. Videos made using one format could not be played on machines designed to play the other. Either Sony Betamax or JVC’s rival VHS would have been a perfectly good single format for home video recording, but the introduction of both led to a costly rivalry.

In the absence of explicit government policies or private means of coordination among firms, the challenges posed by complementary innovations and substitute innovations are quite different:

- When potential innovations are complements: Innovations sometimes do not occur even when it would have been socially beneficial, and profitable to the firms, if they had both occurred.

- When potential innovations are substitutes: Both innovations sometimes occur, when having only one or the other would be more socially beneficial and profitable to the firms involved. Competition between substitutes may impose a high cost on both innovators.

We can use game theory to understand how two potential innovating firms interact strategically, and show why these contrasting problems arise and why they may be difficult to solve. (You may wish to review the introduction to game theory in Unit 4.)

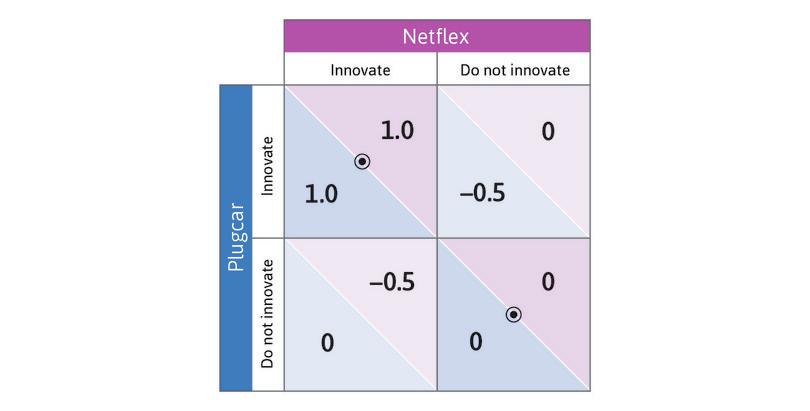

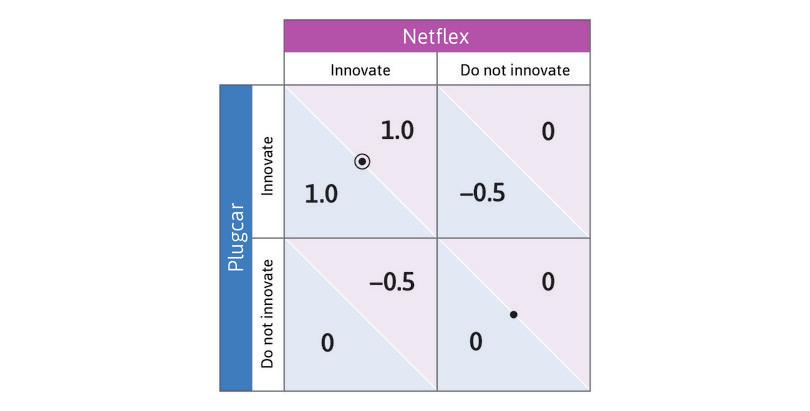

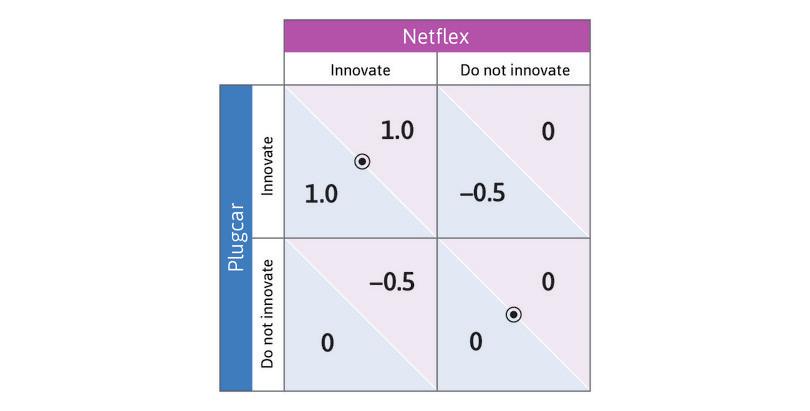

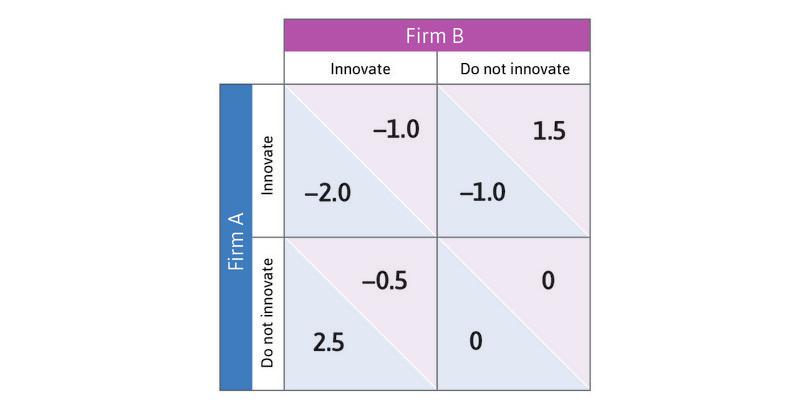

Innovations that are complements

Here we have two hypothetical firms, Plugcar, which is considering developing a novel electric car, and Netflex, which is weighing up the likely profits and costs of investing in a mobile network of battery exchanges. As above, the presence of Netflex makes Plugcar more valuable and vice versa, so they are complements. They will make their decisions (Innovate or Do not innovate) independently, but they know the profits and losses that will result in each of the four possible outcomes. They are given in the payoff matrix below. The row player is Plugcar, and its payoffs come first in each cell; the column player is Netflex, its payoffs are second in each cell. Positive numbers are profits for the company, while negative numbers are losses.

Imagine that you are Plugcar. If you do not innovate you will get zero, whatever Netflex does. If you knew that Netflex was not going to introduce its product, then you surely would not develop the Plugcar. What if Netflex does introduce its product? If you innovate you will get profits of 1. But you also stand to incur losses of 0.5 if Netflex does not innovate.

Unless you are pretty sure that Netflex is going to innovate, you may decide that you have better uses for your funds. If Netflex reasoned the same way, then neither firm might innovate even though they both would have profited from doing so.

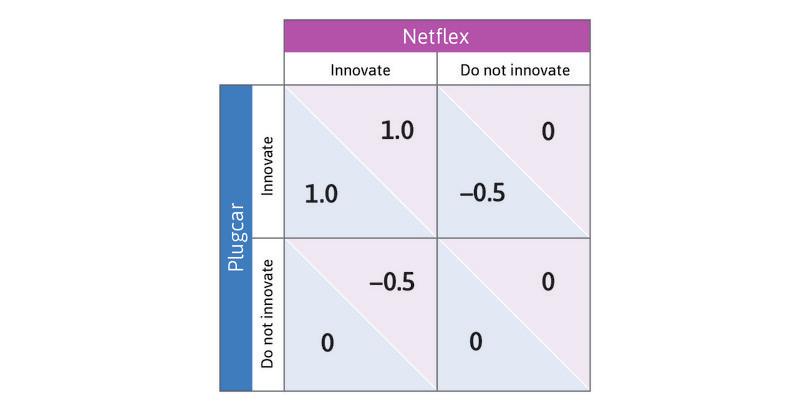

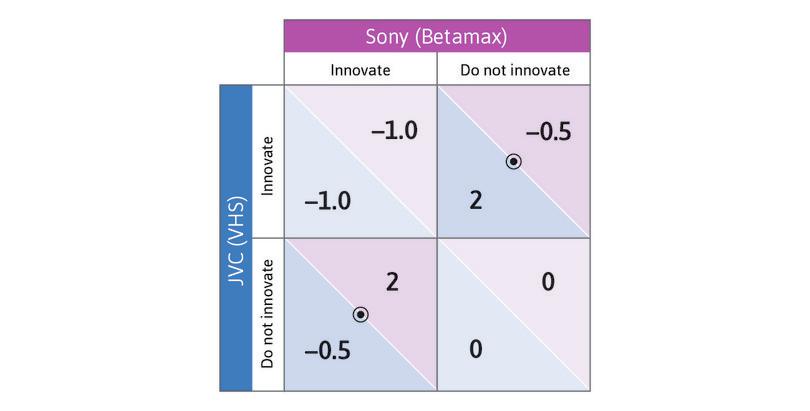

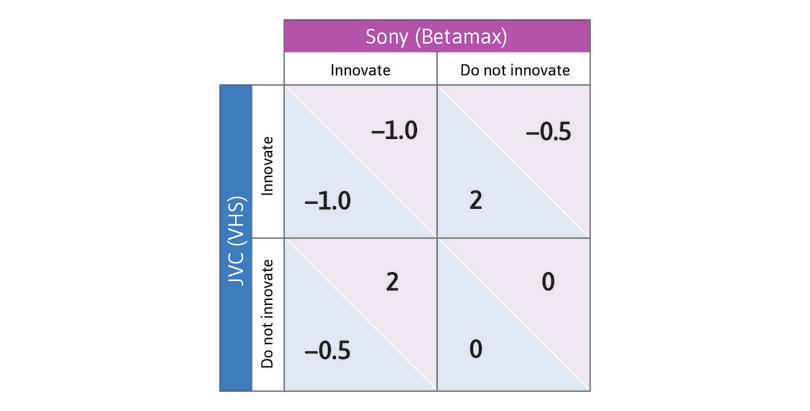

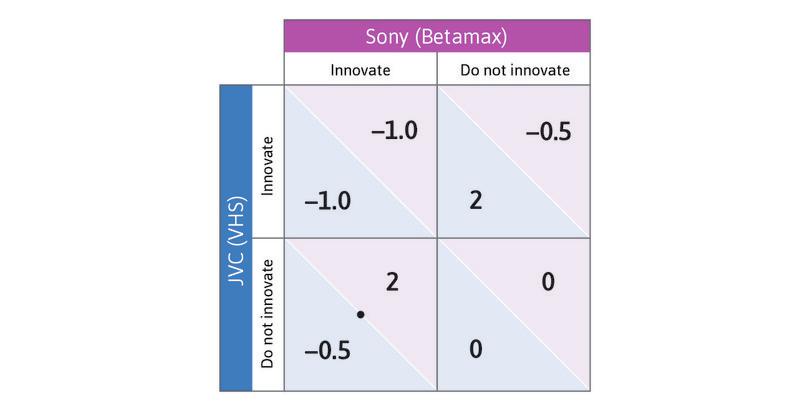

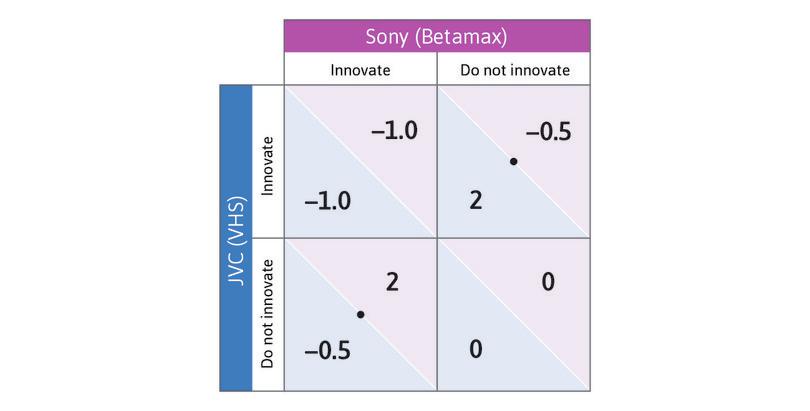

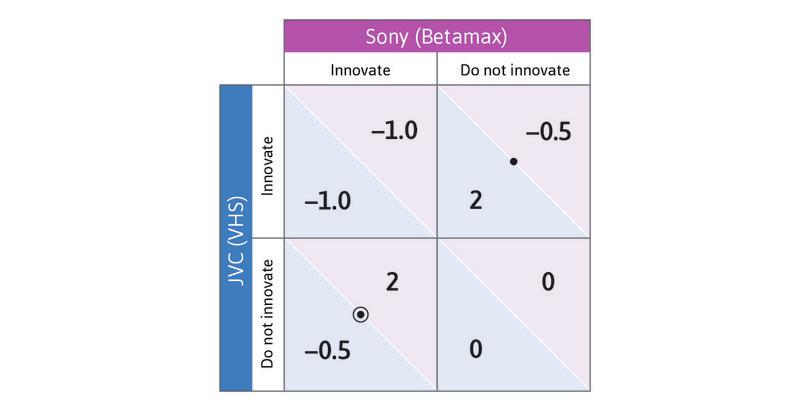

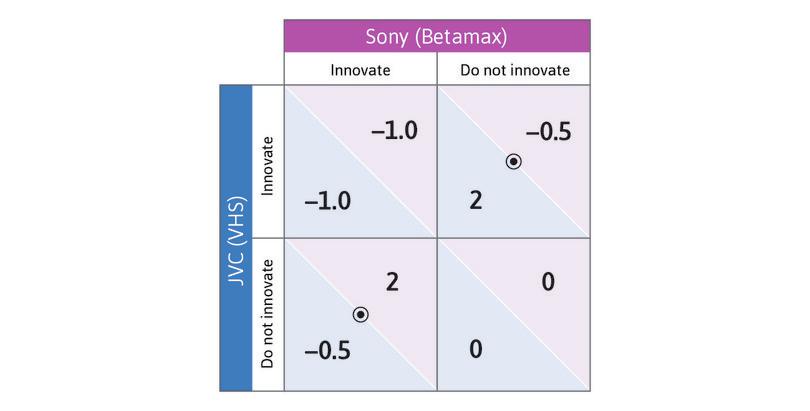

Innovations that are substitutes

When two innovations are substitutes we have the opposite problem. A good example is the video format war during the 1980s between two competing standards, VHS (for ‘video home system’ developed by Victor Company of Japan (JVC)) and Sony’s Betamax format. As discussed above, videos using one format could not be played on machines designed to play the other, so both companies had an interest in making their format the most widely accepted.

We consider two hypothetical firms based on the Sony-JVC case. Here is the payoff matrix facing them. JVC is the row player, and Sony is the column player. As before, the first entry in each cell is the payoff of the row player.

If Sony is sure that JVC will innovate, then it will face a costly battle with big losses if JVC wins. The payoffs in the upper left-hand cell are negative for both firms, because the costs of developing the new product and competing for market share do not offset the uncertain prospect of profits should they win. Of course, if Sony knew that JVC was not going to invest, or if it was sure it would win a not-very-costly battle with its product should both invest, then Sony would definitely invest and enjoy the winner-take-all profits, while inflicting losses on JVC.

The result is that there is sometimes too little innovation for the good of society when ideas are complementary, and too much when the innovations are substitutes.

The role of public policy

Complements

If the payoffs in the matrix were known to everyone, then a wise government would know that the top left (Innovate, Innovate) in Figure 21.6 is the best outcome for society. It could, in the case of complementary innovations, provide both firms with sufficient subsidies so that both would find it profitable to make the investment regardless of what the other firm did. Or, more reasonably, it could help the two firms to cooperate in the innovation process, promising not to prosecute them for any anti-competitive practices if coordinated decision making is prohibited by antitrust or other law.

But using public policy to avoid an unfavourable outcome is a greater challenge than our simple model would suggest. There are likely to be more than two potential innovators, and hence many proposed designs for electric cars and for recharging systems. The government would have to choose the cooperating firms, and the terms under which the cooperation would occur. In this case, companies have incentives to spend resources to influence government decisions (lobbying). As we shall see in Unit 22, there are many reasons why governments may fail to achieve the socially beneficial outcome in cases like this.

Private exchanges might have a role to play here. If the firms themselves have better information than the government, they might engage in private agreements. This is the equivalent to the bargaining among private economic bodies that occurred in Unit 12 as an alternative to government regulation of the use of chemical weedkillers.

Finally, firms with promising complementary innovations might agree to merge so that, as a single company, the problem of coordinating their innovation decisions would be internal to the firm.

Substitutes and standards

The substitutes in Figure 21.7 present similar challenges for government policy. There may be a great many competing substitute innovations. Sony’s Betamax and JVC’s VHS were not the only entrants in the early stages of the formatting wars. Governments may also lack the relevant information, or may be under the influence of one of the contestants.

As we will see later, sometimes one competitor’s technology wins over the other. Eventually, Betamax, for example, died out and VHS became the universal home videotape standard. Sometimes, companies in an industry apply the same standards, because consistency increases the size of the market and benefits all firms. An example is the way the shipping industry implemented the standard for the size of containers they carry, which allowed trucks and ports to become more efficient, and therefore achieve economies of scale.

Often, however, public sector agencies play an important role in encouraging agreement among all the firms in an industry about technical standards. These are usually international bodies, like the International Telecommunications Union or the European Commission. The EU, for example, helped mobile phone companies to agree on the GSM standard for phone handsets and networks, which enabled all the manufacturers and operators to benefit from a rapidly growing European mobile market, and enabled consumers to benefit from the ease of calling other networks and declining prices.

Exercise 21.4 Complements

- List some pairs of innovations that are complements, and some that are substitutes.

- In the game in Figure 21.6, what probability of one firm choosing ‘Innovate’ would make it profitable for the other firm to choose ‘Innovate’? Explain your answer. (Hint: Compare the expected payoffs of choosing either option, given that the probability of the other firm choosing ‘Innovate’ is x. What range of probabilities would give a higher expected payoff from choosing ‘Innovate’?)

Exercise 21.5 Substitutes and complements

- Go back to Figure 4.16a and consider the game between Bettina and Astrid, in which they choose whether to use two different programming languages, C++ and Java. Describe the similarities and differences in the strategies, payoffs, and optimal outcome of Figure 4.16 and the Sony-JVC game depicted here.

- In Figure 21.7, for innovating to be profitable, with what probability should the other firm choose ‘Do not innovate’?

Now suppose that decisions in Figures 21.6 and 21.7 are made sequentially rather than simultaneously. In the case of substitutes (Sony and JVC), imagine that JVC developed its product and put it on the market (or at least convinced Sony that it would definitely do this). In the case of complements (Plugcar and Netflex), assume that Plugcar could convince Netflex that it will definitely bring the new electric car to the market.

- Explain what the outcome in those cases would be if the two firms made their decisions sequentially rather than simultaneously.

Question 21.3 Choose the correct answer(s)

The following matrix shows the payoffs for two firms according to whether they innovate or not. The first number is the payoff for firm A while the second number is for firm B.

Based on this information, which of the following statements is correct?

- The payoff of one’s innovation is decreased by innovation of the other. Therefore the two are substitutes.

- The two Nash equilibria in this game are (Innovate, Do not innovate) and (Do not innovate, Innovate).

- Firm B incurs a large loss if firm A also innovates. It is therefore not certain that firm B would innovate.

- If the probability that Firm B chooses Innovate is x%, then Firm A gets –x + 1.5(1 – x) by choosing Innovate, compared to –0.5x by choosing Not innovate. Firm A prefers to innovate if –x + 1.5(1 – x) > –0.5x, which is true if x < 0.75.

21.4 Economies of scale and winner-take-all competition

Innovation involves developing new knowledge, and putting it to use. Recall that knowledge is unusual in two ways. It is a public good (what one consumes does not subtract from what is available to others) and its production and use are characterized by extraordinary increasing returns to scale. We discussed knowledge as a public good in Unit 12. In this section, we discuss the two ways in which knowledge-intensive innovation creates economies of scale.

The supply side: First copy costs and economies of scale in production

- first copy costs

- The fixed costs of the production of a knowledge-intensive good or service.

The first copy of new knowledge is costly to produce, but virtually costless to make available to others. Because first copy costs are large relative to the costs (variable or marginal) of making additional goods available, information production and distribution is different from any other part of the economy.

- Thriller, by Michael Jackson: This is the best-selling music album in history. It cost $750,000 to produce in 1982 (about twice that amount in 2015 dollars). The marginal cost of producing additional copies is less than $1 for a CD, and almost nothing if it is a download. A CD sells for about $10, and a download for the same amount. The first copy cost of even a modest production by a new band will be at least $10,000, with marginal costs of around $1 for each CD, and zero for a download.

- Textbooks: To develop a new high-quality textbook in the US costs between $1 million and $2 million, to compensate the writers, designers, editors, and others for their work. This is the first copy cost. The cost of producing and distributing the physical books (printing, warehousing, and delivery included) for a successful text are approximately $12 per book. This is its marginal cost. Students all over the world know that introductory course textbooks typically sell for ten times this amount.

- Star Wars: The Force Awakens: the production budget for this film, released in 2015, was $200 million. The development cost for the computer game Star Wars: The Old Republic (2011) was between $150 million and $200 million. These figures do not include the marketing and promotion costs, such as advertising, that should be included in the first copy cost, and may be bigger than the production costs. Now that movies are distributed digitally to cinemas, making a film available costs virtually nothing. The marginal costs for movies or games sold on DVD are around the same as for a CD, and when they are sold as digital downloads, they are zero.

- New drugs: The average first copy cost of a new drug according to a study in the US in 2003 was $403 million. This fact explains the difference in price between drugs that are still under patent, giving the producer a temporary monopoly, and the prices that users pay once the patent has expired so that other producers compete with the originator of the drug. For instance, Omeprazole, a very widely prescribed dyspepsia drug, was patented and launched in 1989, sold under the brand name Prilosec. In the US the patent expired in 2001, and by 2003, 28 tablets of brand-name Prilosec sold for $124, while the equivalent packet of generic Omeprazole cost only $24.12

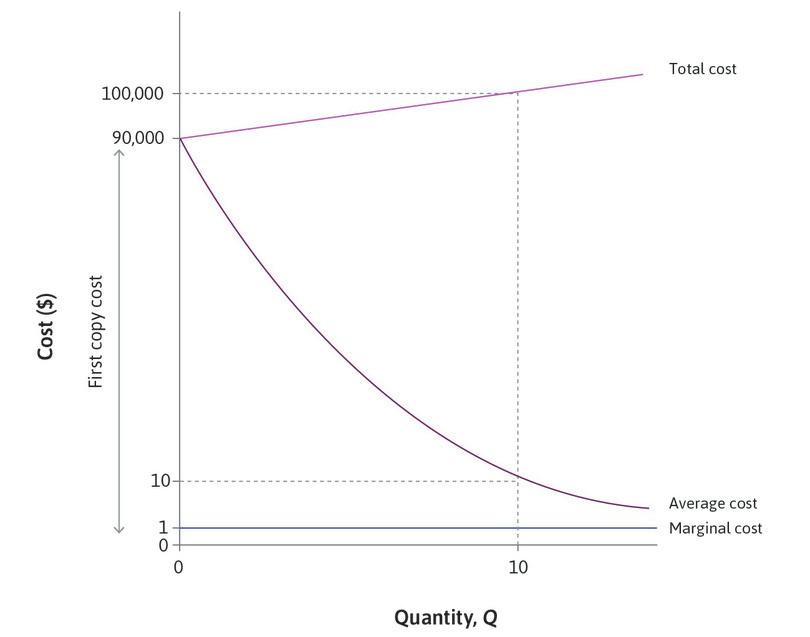

In Unit 7 we studied how a firm sets prices, and how it decides how much to produce. In Figure 21.8, we show a set of cost curves for a firm producing a knowledge-intensive good. The numbers are hypothetical, and they understate the true size of the first copy cost relative to marginal cost. Even so, the vertical axis is still not drawn to scale so we can read the figure.

- Total cost: The curve starts at the first copy cost, and then rises very little with increased production.

- Marginal cost (MC): The curve is low and constant.

- Average cost (AC): The curve (including economic profits and the first copy costs) falls as quantity increases, as the cost of the first copy is spread over larger units of output.

- MC < AC: No matter how many units are produced, the marginal cost will always be less than the average.

A firm producing a knowledge-intensive good that wants to make economic profits will have to cover its first copy cost. To do so, the price will have to be at least as high as the average cost curve and therefore higher than marginal cost.

This means the production of knowledge-intensive goods cannot be described by the competitive markets of Unit 8 in which price equals marginal cost (P = MC), but instead by the model of price-setting firms in Unit 7. In Unit 7, we assumed that P > MC because of limited competition. Here it is an unavoidable consequence of first copy costs, and no matter how many competitors there are, price cannot be competed all the way down to marginal cost.

Earlier in this unit (and in Units 1 and 2), we explain that in the absence of intellectual property rights, competition from followers would eventually eliminate the innovation rents made by first adopters of an improved technology or new product. This is how the diffusion of a new technology happens, and results in lower prices. The same process will take place where first copy costs are important. Other firms will copy the innovator until the economic profits (rents) are eliminated, so that the price being charged offsets the average cost of production, including the first copy cost and the opportunity cost of the capital goods used. But in this situation, the price being charged must be greater than the average cost (due to the first copy costs, as shown in Figure 21.8). Figure 21.9 below illustrates these cases.

| Restricted entry (IPR or other) | Unrestricted entry | |

|---|---|---|

| Declining average costs | Economic profits P > AC > MC |

No economic profits P = AC > MC |

| Non-declining average costs | Economic profits P > MC ⋛ AC |

No economic profits P = MC = AC |

The average cost curve, economic profits, and competition.

Figure 21.9 The average cost curve, economic profits, and competition.

The demand side: Economies of scale through network effects

- network external effects

- An external effect of one person’s action on another, occuring because the two are connected in a network. See also: external effect.

The value of many forms of knowledge increases when more people use it. Because the benefits to users increase as the network of users grows, demand-side increasing returns are sometimes called network external effects. The external effect is that when one more person joins the network, all others benefit.

Languages are a good example. Today, more than one billion people are learning English, which is more than three times as many people who speak English as their first language. The demand for English is not due to the intrinsic superiority of the language or because it is easy to learn (as many of you will know), but simply because so many other people, in many parts of the world, speak it. There are many more people who speak Mandarin (Chinese) and Spanish as a first language, and almost as many Hindi and Arabic speakers, but none of these languages is as useful to communicate globally as is English.

Having a particular games console is better when lots of people have the same one, because developers will produce more games for it. A credit card is more useful when many people have the same card, because lots of shops will accept it as payment.

But have you ever wondered who bought the first telephone, and what they intended to do with it? Or what you could do with the first fax machine?

The technology behind the fax, a device to send images of documents over a telephone line, was first patented by Alexander Bain in 1843—although his image-sending innovation had to use the telegraph, because nobody had invented a telephone yet. A commercial service that could transmit handwritten signatures using the telegraph was available in the 1860s. But the fax remained a niche product until 120 years later when it became so popular that, within the space of 10 years, almost every office installed its own fax machine.

This tells us the first thing we need to know about demand-side economies of scale: there is little incentive to be the first to adopt a technology with this characteristic.

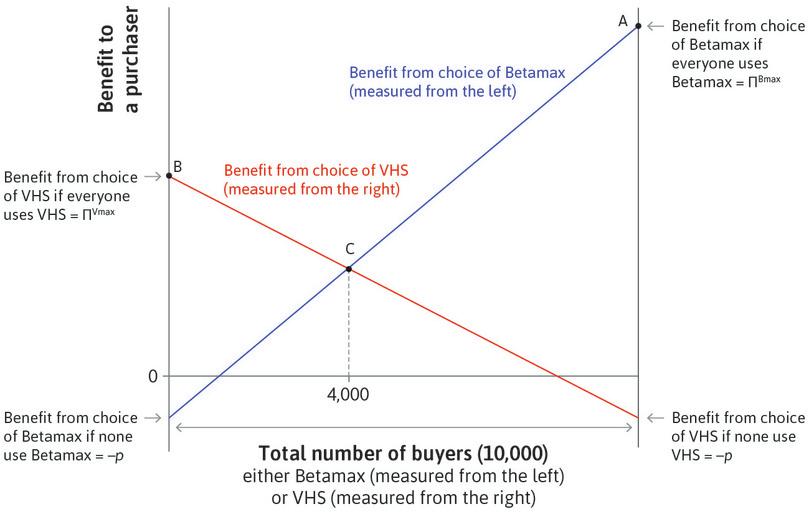

The second thing we need to know is that, if two versions of this type of technology are competing, the one that gains a larger number of adopters at the outset will have an advantage, even if the other one is cheaper or better. To see this, let’s take another look at the video format war between Sony and JVC.

Sony’s Betamax format was superior to JVC’s VHS for its picture and sound quality. But in the early 1980s, Sony made a strategic error by limiting the recording time to 60 minutes. If customers wanted to use their new Sony Betamax to record a feature film, they needed to change the tape in the middle of the recording. By the time Sony had extended its recording length to 120 minutes, there were so many more VHS users that the Betamax format all but disappeared.

- winner-take-all competition

- Firms entering a market first can often dominate the entire market, at least temporarily.

The video formatting war, and its outcome, is an example of winner-take-all competition, in which economies of scale in production or distribution give the firm with the largest share of the market a commanding competitive edge. Winner-take-all competition does not necessarily select the best.

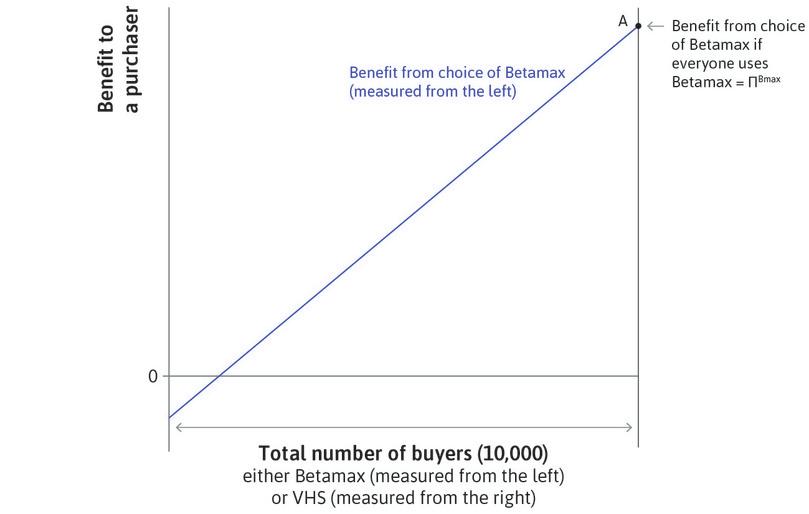

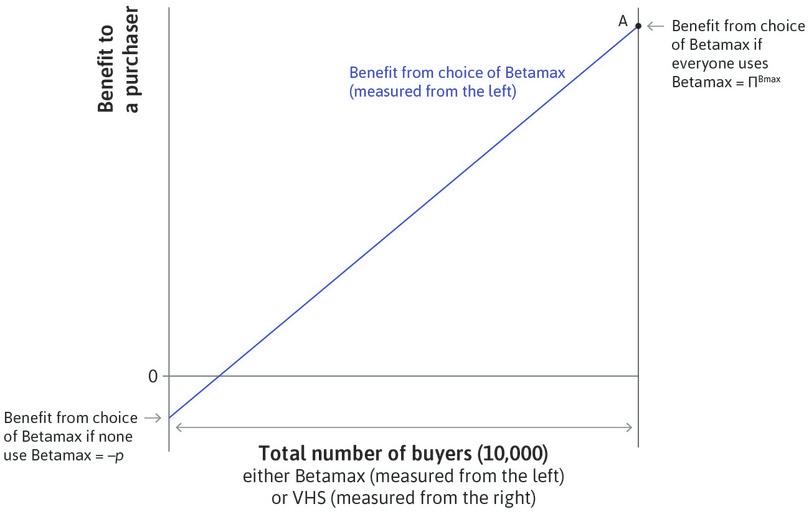

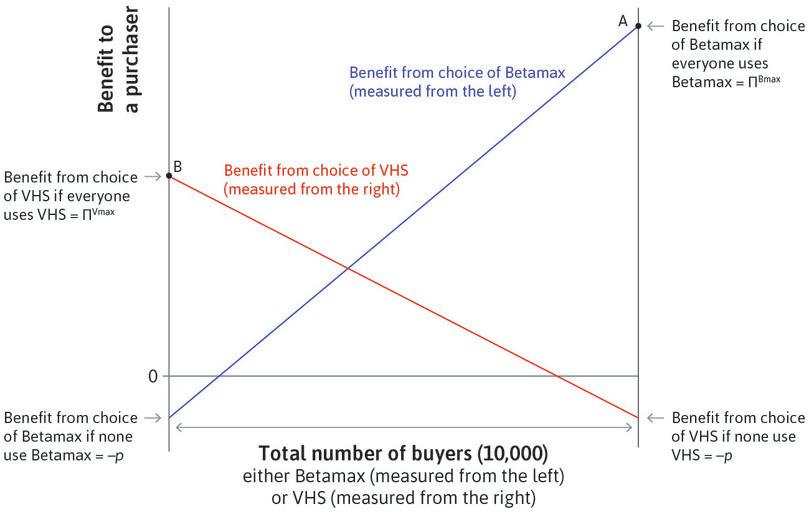

To see how this works, Figure 21.10 depicts competition based on the Sony and JVC case. The length of the horizontal axis is the number of people purchasing either Sony’s Betamax or JVC’s VHS. We assume that the price of the two products is identical.

To simplify our example, assume that the value of using the product for a new user is approximately the number of individuals currently using the product, n, multiplied by an index for the quality of the product, q. The net benefit of purchasing a good is then equal to the benefit from using the good, qn, minus the price that the consumer pays, p. Our simplifying assumptions then allow us to write the net value of buying the product as Π = qn − p. Higher quality products have a higher value of q, so consumers faced with two products with the same number of users and same price will prefer the higher quality good.

The number of individuals buying Betamax is measured from the left to the right, starting at zero and extending potentially all the way to the entire market. The blue line shows the net benefits of using Betamax for consumers. Its equation is ΠB = qBnB − p, where the superscript ‘B’ is for Betamax. If everyone buys Betamax, the value to each purchaser is shown in the figure, ΠBmax, which is equal to qBntotal − p. If no one else buys Betamax, the value to that first purchaser is negative and equal to the price paid, shown by the intercept on the left-hand vertical axis below the horizontal axis.

In the same figure, the net value of JVC’s product VHS is given by the red line whose equation is ΠV = qVnV − p (where the superscript ‘V’ stands for VHS). Because there are only two firms competing, the number buying VHS is just the total size of the market, minus the number buying Betamax.

Let’s assume that the Betamax format is higher quality. Within our model, this means that qB > qV. This implies that if everyone bought Betamax, the net value would be greater than if everyone bought VHS format, that is ΠBmax > ΠVmax. In Figure 21.10, this is illustrated by the fact that the height of the blue Betamax line where it intersects the right-hand axis (everyone using Betamax) is above the intercept of the red VHS line with the left-hand axis (everyone using VHS).

The first thing to notice is that if at a particular moment everyone is buying VHS (point B), then a new buyer will certainly prefer VHS to Betamax. To see this in the diagram, look at the left-hand side and consider a new buyer. For this person, the value of VHS is high (the intercept with the left-hand axis), whereas the value of Betamax is negative. This is because the new user would have to pay the price of the Betamax recorder, but would not get any benefits because there are no other users, and therefore no video content is provided. This is true even though we have assumed that Betamax costs the same as VHS, and that Betamax is the better quality video cassette.

- lock-in

- A consequence of the network external effects that create winner-take-all competition. The competitive process results in an outcome that is difficult to change, even if users of the technology consider an alternative innovation superior.

The second lesson from the figure is that even if many consumers (but fewer than 4,000) were buying Betamax, the new consumer would still prefer VHS (the red line is still above the blue line at that point). For Betamax to break the VHS monopoly, it would have to get at least 4,000 buyers. Then Betamax rather than VHS would offer higher value, and could eventually take the entire market (at point A).

So the winner need not be the better alternative. This is sometimes called lock-in.

But this is not the whole story. The history of innovation in the knowledge economy is full of more complicated stories, in which changes are constantly occurring for many reasons.

For example:

- Browser wars: When the Internet became popular, the market for Internet browsers was dominated by a product called Netscape Navigator. It was displaced by Microsoft Internet Explorer in the ‘browser wars’ of the early 2000s. Internet Explorer, in turn, was later challenged by Mozilla Firefox and Google Chrome.

- Smartphones: At the beginning of 2009, Android smartphones had a market share of 1.6%, Apple’s iPhones had 10.5%, and the market was dominated by a technology called Symbian, with 48.8% share. At the beginning of 2016, 84.1% of smartphones sold were based on Android, Apple’s smartphones had a share of 14.8%, and Symbian smartphones were no longer being manufactured.

- Social networks: In June 2006, 80% of people who used a social network used a site called MySpace. By May 2009, more people used Facebook than MySpace.

Question 21.4 Choose the correct answer(s)

Figure 21.8 shows the cost curves for a firm producing a knowledge-intensive good.

The marginal cost is constant at $1 for all output Q. Based on this information, which of the following statements is correct?

- With positive first copy cost (say F) and constant marginal cost (MC), the average cost (AC) will always be higher than the marginal cost by F/Q, as AC = TC/Q = (F + (MC × Q))/Q = (F/Q) + MC.

- With positive first copy cost (say F) and constant marginal cost (MC), the average cost (AC) will always be higher than the marginal cost by F/Q, as AC = TC/Q = (F + (MC × Q))/Q = (F/Q) + MC. Now AC > MC for all values of Q, so the AC curve will always be downward sloping. Hence the firm’s production will always exhibit economies of scale.

- A firm producing a knowledge-intensive good needs to cover its first copy cost and thus must charge a price greater than its marginal cost. It would be making a loss if the price were below its average cost.

- A small-scale car valeting business would have a very small initial fixed cost–just the cost of car wash equipment–and virtually zero training cost. It is unlikely to benefit from much economies of scale.

21.5 Matching (two-sided) markets

A market is a way of putting together people who might benefit from exchanging a good or service. Often these are potential buyers and sellers of the same commodity, such as milk, and the sides of this market are farmers supplying milk and consumers demanding it. In common usage, a market may also refer to a place such as the Fulton Fish Market that we described in Unit 8, or a place where those selling fresh vegetables, cheese, and baked goods congregate, knowing that they will encounter potential customers. In these markets, buyers do not care about who produced the fish or the milk that they buy, and sellers are similarly not concerned about who is buying, as long as someone buys their products.

Matching (two-sided) markets

People also use the term market to describe a different kind of connection, in which the people on each side of the market care whom they are matched with on the other side. This is what people have in mind when they speak about the ‘marriage market’, for example. Most of us do not get married in the way that we get a carton of milk in the grocery market. The marriage market is about getting married to a person with the combination of characteristics that you find most desirable in a spouse. Markets like these are called matching markets or two-sided markets.

- matching market

- A market that matches members of two distinct groups of people. Each person in the market would benefit from being connected to the right member of the other group. Also known as: two-sided market.

In our ‘Economist in action’ video, Alvin Roth, an economist who specializes in how markets are designed (and who won the Nobel Prize for his work on the subject in 2012), explains how matching markets function.12 13

We have recently seen a proliferation of online platforms that connect individuals in two groups, starting with the launch of consumer-to-consumer trader eBay in 1995. These platforms make up a general-purpose technology that allows the participants to benefit from being networked together, and so are examples of two-sided markets.

Another example is Airbnb, a service that connects travellers looking for short-term apartment rentals with owners seeking to make money by making their home available while they are not living in it. Airbnb is a platform that puts the group of apartment seekers in touch with the group of apartment owners who would like to offer their apartments for rent. Tinder does the same thing for people who want to find a date for the evening. A service called JOE Network puts employers in contact with people who have recently been awarded PhDs in economics.

The CORE Project is itself a matching market, as it provides a digital platform for researchers, teachers and students in economics to connect in ways that are mutually beneficial, although it is not really a market as the services of the researchers of providing the content in the ebook and the ebook itself are provided without pay.

These matching platforms have become an important topic in economics because of the magnitude of the network connections that are now possible. But while connections on this scale are now technically feasible, there is no mechanism that will reliably bring two-sided markets into existence even if they create gains for the participants on both sides.

At an early stage, these markets—meaning the creation of the platform, or the marketplace, or whatever it is that connects people—face a chicken-and-egg problem. Think about Airbnb: it makes money by charging a commission on each deal that is struck. Unless there are a large number of apartment seekers consulting its website, there is no reason for an apartment owner seeking a rental to offer an apartment for rent. Without apartments to rent, Airbnb will not be able to make money, so there would be no incentive to create the platform in the first place.

A model of a two-sided matching market

- strategic complements

- For two activities A and B: the more that A is performed, the greater the benefits of performing B, and the more that B is performed the greater the benefits of performing A.

In economics, these two activities—seeking an apartment by going to Airbnb’s web page, and posting one’s apartment on it—are termed strategic complements. This term means that the more of the first (seeking) that occurs, the more benefit there is to someone who does the second (posting); also, the more posting there is, then the more benefit there is to seeking. This is closely related to the network externalities typical of a new innovation that we discussed in the previous section, where the benefit to using Betamax increased with the number of individuals using that video format. However, in this case, the external benefit depends on how many members of the opposite group are on the platform, rather than just how many people are using the platform in total.

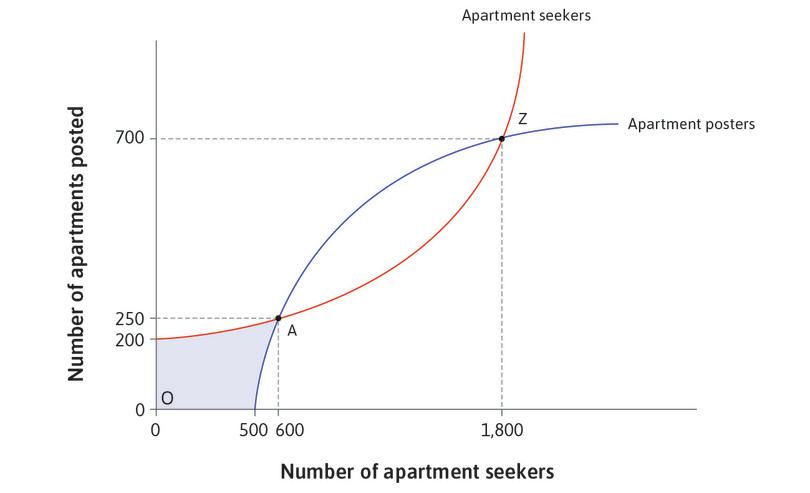

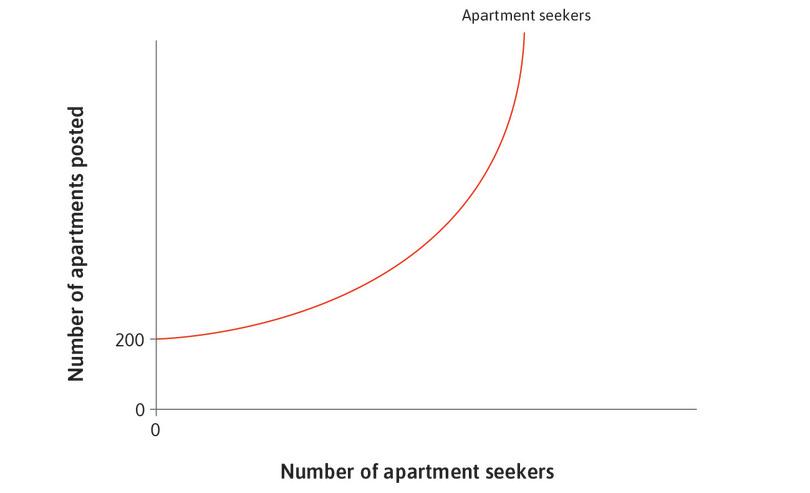

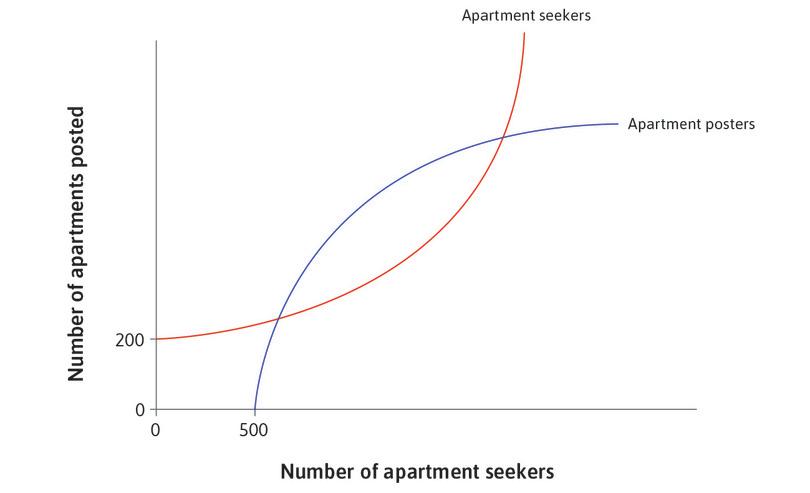

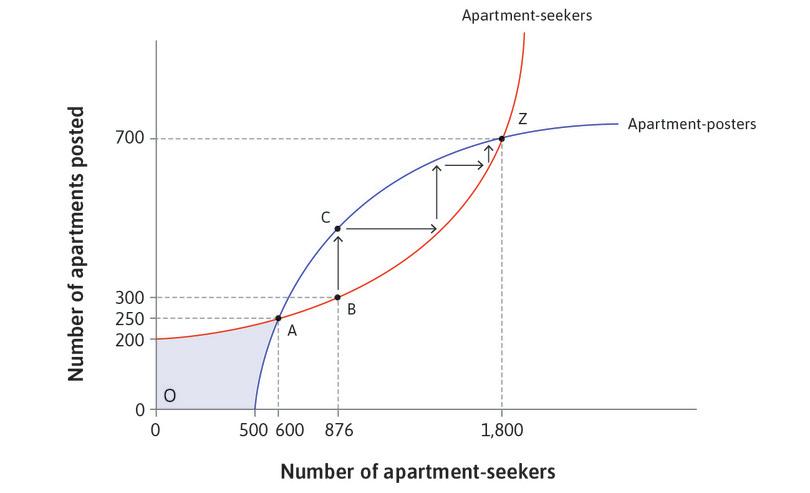

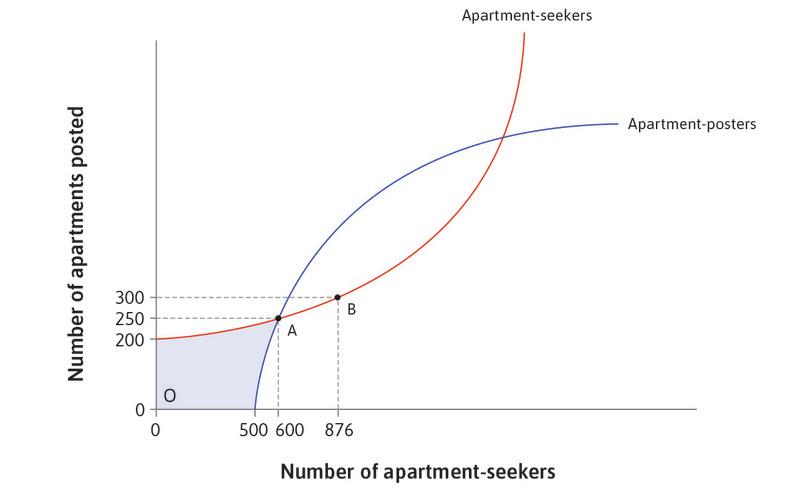

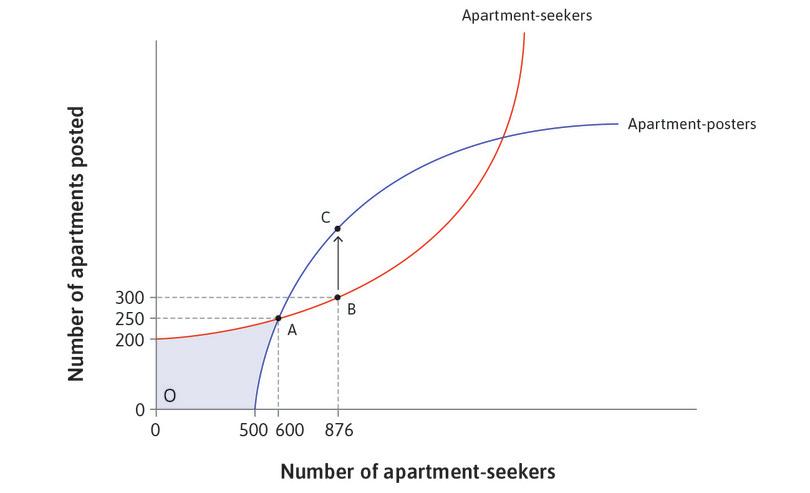

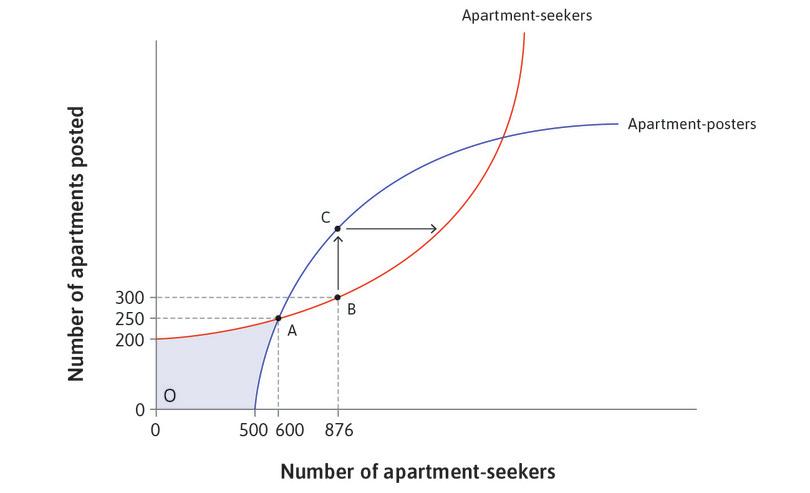

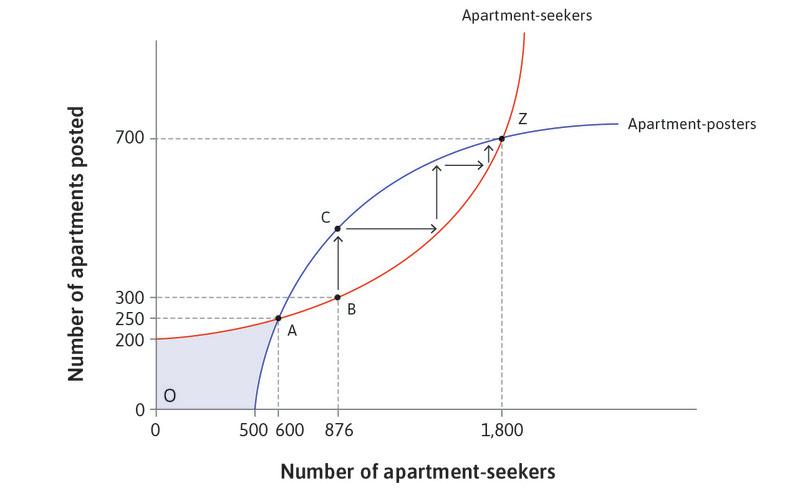

Figure 21.11a illustrates the chicken-and-egg problem. We begin with the number of apartments posted on Airbnb. People post their apartment because they believe that many apartment seekers will see the posting and eventually rent the apartment. If there are few people logging onto the Airbnb site (seeking), then few apartment owners will think it’s worth their effort to post their apartment on the site.

The ‘posters’ curve shows hypothetically how many apartments would be posted in response to each possible number of apartment seekers who consult the site. As illustrated in the figure, unless more than 500 apartment seekers are going to the site, no apartment owner will post their home for rent. To see this, look at where the curve labelled ‘posters’ intercepts the horizontal axis. As the number of apartment seekers (those ‘demanding’ apartments) viewing the site rises beyond 500, an increasing number of owners will post their information. But there is a limit to how many people will want to rent out their home temporarily, so the ‘posters’ curve flattens out as we move to the right.

The situation is similar for those seeking to rent an apartment. The number of people checking the Airbnb site depends on how many apartments are posted there. As long as more than a minimum number of apartments are posted on the site (from the figure, more than 200), then some people will look for an apartment there. This is the intercept of the ‘seeker’s’ curve with the vertical axis. The ‘seekers’ curve shows that the more apartments are posted, the more people will look.

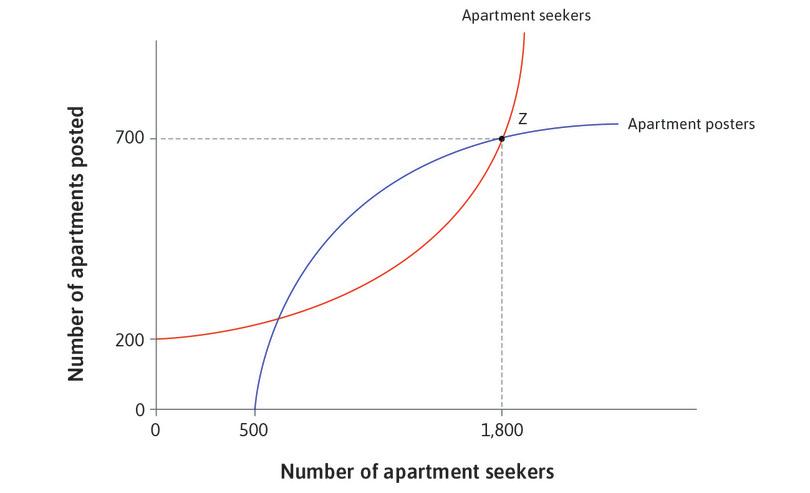

To see how the Airbnb market works, think about point Z in the figure. Z is a mutually consistent outcome in that:

- There are 700 apartments posted, so there will be 1,800 apartment seekers.

- Since there are 1,800 apartment seekers, there will be 700 apartments posted.

This means that the behaviours of the posters and the seekers is mutually consistent at point Z, and so point Z is a Nash equilibrium. If the market is at point Z, with 700 apartments posted and 1,800 apartment seekers, neither the apartment posters or seekers will want to change their behaviour.

But notice that there are two other points that also have this mutual consistency property:

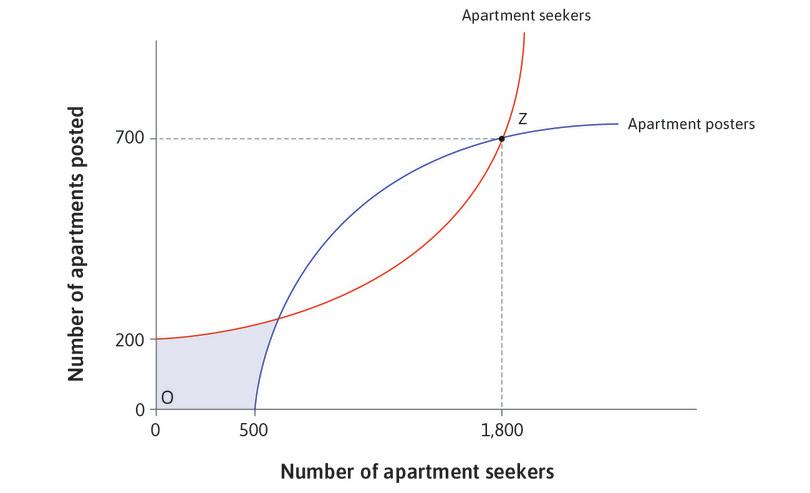

- There is a Nash equilibrium in which there is no Airbnb: At point O, nobody is posting an apartment on Airbnb so there is no incentive for anyone to look at the site, and because nobody is looking at the site there is no incentive for anyone to post their apartment there. This is the chicken-and-egg problem.

- Point A is a mutually consistent outcome, with 250 apartments posted and 600 people seeking apartments: It is unlikely to last, however, for reasons discussed below.

To see what happens in the latter case, suppose that the number of apartment seekers unexpectedly dropped from 600 to 450. The best response for the 250 apartment owners who had previously posted their homes would then be to completely pull out of the market. If all the apartment posters drop out of the market, the remaining 450 seekers will also eventually drop out. So, if we enter the blue zone, a ‘vicious cycle’ of both posters and seekers abandoning the market will ensue and the result will be no market at all, which is depicted on the diagram as point O.

- unstable equilibrium

- An equilibrium such that, if a shock disturbs the equilibrium, there is a subsequent tendency to move even further away from the equilibrium.

- tipping point

- An unstable equilibrium at the boundary between two regions characterized by distinct movements in some variable. If the variable takes a value on one side, the variable moves in one direction; on the other, it moves in the other direction. See also: asset price bubble.

This process of adjustment away from an equilibrium is similar to the example you studied in Unit 11, about house prices and the value of durable assets. Because a small move away from point A leads to a cumulative process leading further away from A, we say that point A is unstable. A situation like point A is sometimes described as a tipping point.

Given the chicken-and-egg problem, how could Airbnb ever come into existence? Point Z is a Nash equilibrium, but how could the market ever get there?

If a sufficient number of seekers (greater than 600) somehow showed up on the site then more than 250 owners would post their apartments on the site. Or if by chance 300 owners posted their apartments, then more than 600 seekers would be motivated to check out the Airbnb site.

Figure 21.11b shows that in these cases, a virtuous cycle of both seekers and posters entering the market will take place and the number of both will grow until there are 700 posters and 1,800 seekers.

The figure explains why we might end up either with no market at all, or with a functioning market that matches some of the 1,800 seekers with the 700 posters. To see that the second is preferable to the first, think about a particular transaction: all of those posting and seeking are doing so voluntarily, so they must all see a personal benefit in doing it. When one of the seekers is paired with a poster, both seeker and renter benefit (otherwise they would not agree). This is true for every market participant. So, having the market must be better than not having it.

The figure also shows that the market can come into existence and persist if we somehow started out with more than 600 seekers and or 250 posters. But that is a big if.

Market failures in matching markets

The economic policy challenge is to find a way to ensure that someone will create the platforms that produce benefits for participants that are sufficient to justify the cost. This is sometimes done by the public sector playing a role in creating the platform, as it did in the case of the Internet, or physical marketplaces in cities and towns. But in many cases (such as Airbnb, Tinder, and many other private platforms), the existence of a two-sided market is the haphazard result of a forward-looking individual having both the idea and the resources to launch a large, risky project.

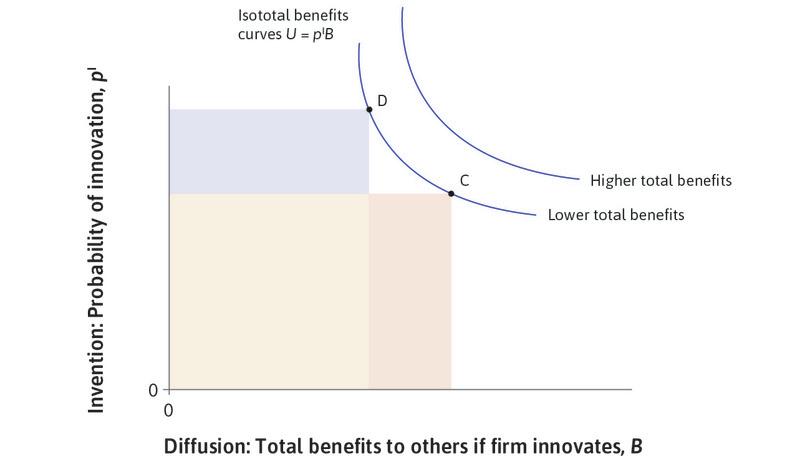

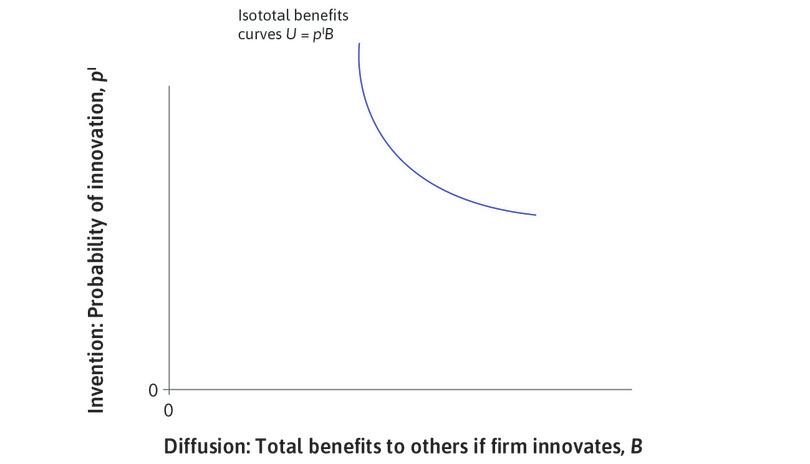

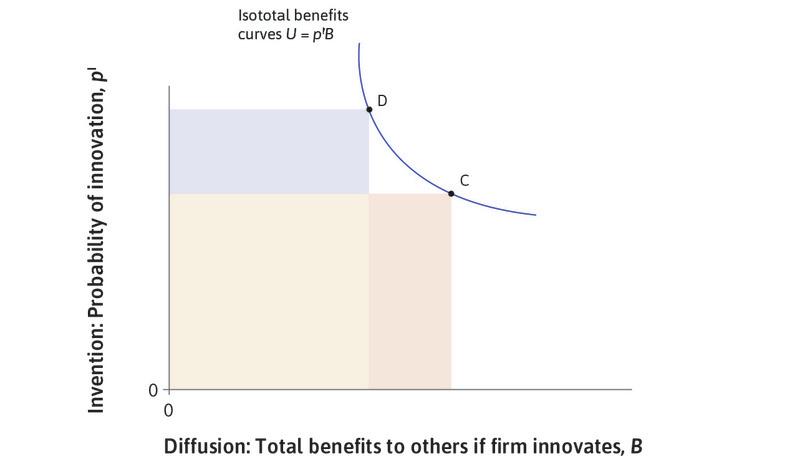

For example, to solve the chicken-and-egg startup problem in the Airbnb market, the originator of the platform could have paid the first 250 posters to post their apartments, giving them an incentive to post on the website even when nobody was consulting the site. That could have kicked off the virtuous cycle of additional seekers and posters joining the market.